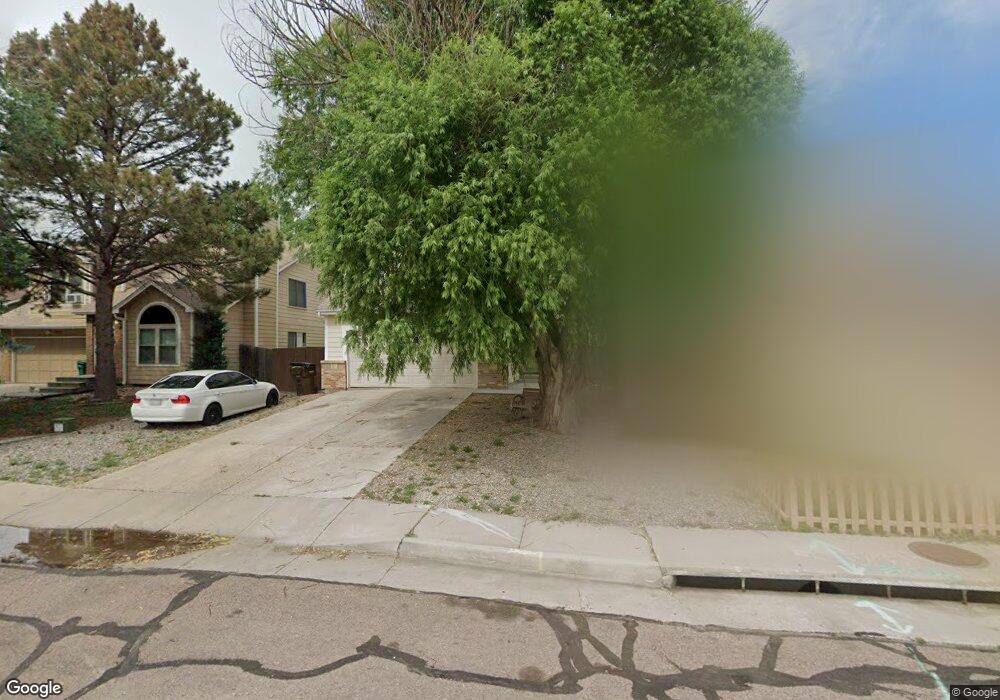

4428 Bramble Ln Colorado Springs, CO 80925

Colorado Centre NeighborhoodEstimated Value: $391,000 - $405,000

3

Beds

3

Baths

1,744

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 4428 Bramble Ln, Colorado Springs, CO 80925 and is currently estimated at $398,911, approximately $228 per square foot. 4428 Bramble Ln is a home located in El Paso County with nearby schools including Martin Luther King Jr. Elementary School, Watson Junior High School, and Widefield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 2, 2004

Sold by

Delmago Mica J

Bought by

Delmago Richard J and Delmago Ellen M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,900

Outstanding Balance

$52,766

Interest Rate

5.78%

Mortgage Type

New Conventional

Estimated Equity

$346,145

Purchase Details

Closed on

Jun 15, 2000

Sold by

Dona George G

Bought by

Delmargo Richard J and Delmargo Ellen M

Purchase Details

Closed on

Feb 24, 1998

Sold by

Mccorvey Roderick N

Bought by

Dona George G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,360

Interest Rate

6.91%

Mortgage Type

VA

Purchase Details

Closed on

Jun 28, 1995

Sold by

U S Home Corp

Bought by

Mccorvey Roderick N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,088

Interest Rate

7.87%

Mortgage Type

VA

Purchase Details

Closed on

Jul 1, 1988

Bought by

Delmargo Richard J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Delmago Richard J | -- | Unified Title Co Inc | |

| Delmargo Richard J | $135,000 | -- | |

| Dona George G | $118,000 | Security Title | |

| Mccorvey Roderick N | $107,930 | -- | |

| Delmargo Richard J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Delmago Richard J | $112,900 | |

| Previous Owner | Dona George G | $120,360 | |

| Previous Owner | Mccorvey Roderick N | $110,088 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,010 | $28,160 | -- | -- |

| 2024 | $1,869 | $28,950 | $5,090 | $23,860 |

| 2023 | $1,869 | $28,950 | $5,090 | $23,860 |

| 2022 | $1,575 | $20,340 | $3,500 | $16,840 |

| 2021 | $1,696 | $20,920 | $3,600 | $17,320 |

| 2020 | $1,411 | $15,880 | $3,150 | $12,730 |

| 2019 | $1,404 | $15,880 | $3,150 | $12,730 |

| 2018 | $1,255 | $13,440 | $2,020 | $11,420 |

| 2017 | $1,267 | $13,440 | $2,020 | $11,420 |

| 2016 | $1,051 | $13,380 | $1,990 | $11,390 |

| 2015 | $1,076 | $13,380 | $1,990 | $11,390 |

| 2014 | $961 | $12,040 | $1,990 | $10,050 |

Source: Public Records

Map

Nearby Homes

- 4512 Bramble Ln

- 4404 Bramble Ln

- 9208 Granger Ln

- 4548 Bramble Ln

- 4421 Horizonpoint Dr

- 4332 Levi Ln

- 4380 Gunbarrel Dr

- 4386 Gunbarrel Dr

- 9384 Pony Gulch Way

- 9558 Yukon Way

- 9328 Chieftan Dr

- 4555 Settlement Way

- 9630 Yukon Way

- 4806 Truscott Rd

- Cimarron | Residence 39102 Plan at Bradley Heights

- Ontario | Residence 39205 Plan at Bradley Heights

- Livingston | Residence 39103 Plan at Bradley Heights

- Powell | Residence 39206 Plan at Bradley Heights

- Frisco | Residence 39204 Plan at Bradley Heights

- Arcadia Plan at Meadoworks - Trinity Series

- 4424 Bramble Ln

- 4432 Bramble Ln

- 4420 Bramble Ln

- 4436 Bramble Ln

- 4416 Bramble Ln

- 4425 Bramble Ln

- 4440 Bramble Ln

- 4433 Bramble Ln

- 4417 Bramble Ln

- 4412 Bramble Ln

- 9116 Granger Ln

- 4444 Bramble Ln

- 9117 Granger Ln

- 4445 Bramble Ln

- 4413 Bramble Ln

- 4408 Bramble Ln

- 4428 Anvil Dr

- 4504 Bramble Ln

- 4432 Anvil Dr

- 4416 Anvil Dr