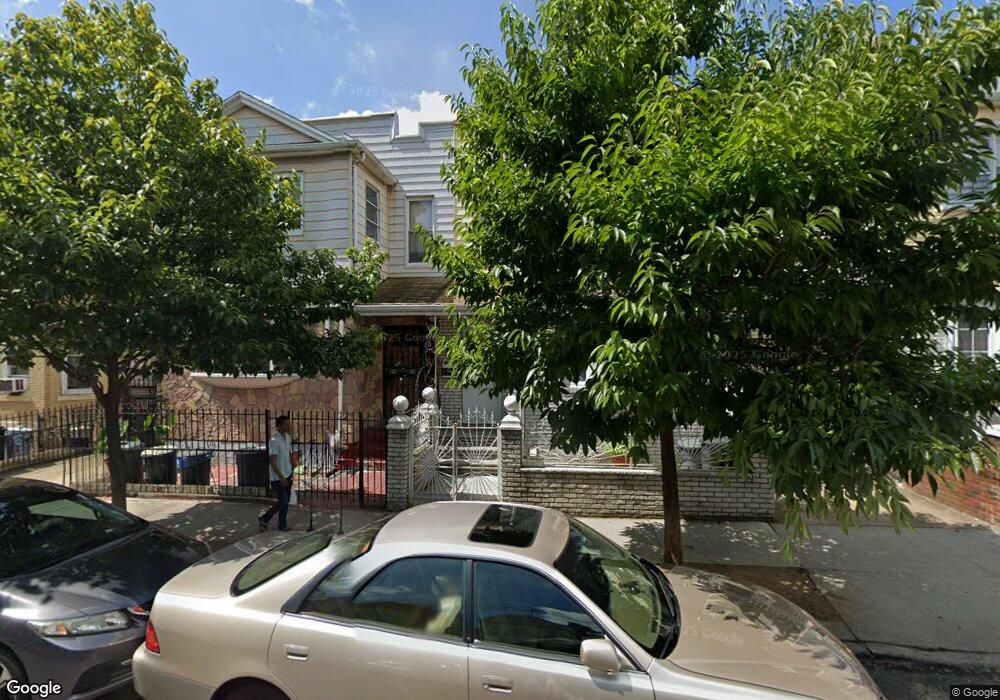

444 Drew St Brooklyn, NY 11208

East New York NeighborhoodEstimated Value: $731,900 - $1,154,000

Studio

--

Bath

2,096

Sq Ft

$467/Sq Ft

Est. Value

About This Home

This home is located at 444 Drew St, Brooklyn, NY 11208 and is currently estimated at $979,475, approximately $467 per square foot. 444 Drew St is a home located in Kings County with nearby schools including P.S. 214 - Michael Friedsam, Cypress Hills Ascend Charter Lower School, and Divine Mercy Catholic Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2019

Sold by

Ahmed Isteaque and Hossain Alamgir

Bought by

Hossain Enayet

Current Estimated Value

Purchase Details

Closed on

Jul 7, 2017

Sold by

Lopez Elizabeth

Bought by

Ahmed Isteaque and Hossain Alamgir

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$575,000

Outstanding Balance

$475,270

Interest Rate

3.88%

Mortgage Type

New Conventional

Estimated Equity

$504,205

Purchase Details

Closed on

May 25, 2006

Sold by

Gallardo George and Yactayo Edwin

Bought by

Lopez Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$430,500

Interest Rate

6.6%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hossain Enayet | -- | -- | |

| Hossain Enayet | -- | -- | |

| Ahmed Isteaque | $750,000 | -- | |

| Ahmed Isteaque | $750,000 | -- | |

| Lopez Elizabeth | $615,000 | -- | |

| Lopez Elizabeth | $615,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ahmed Isteaque | $575,000 | |

| Closed | Ahmed Isteaque | $575,000 | |

| Previous Owner | Lopez Elizabeth | $430,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,803 | $50,220 | $13,200 | $37,020 |

| 2024 | $6,803 | $46,680 | $13,200 | $33,480 |

| 2023 | $6,770 | $45,480 | $13,200 | $32,280 |

| 2022 | $6,279 | $49,800 | $13,200 | $36,600 |

| 2021 | $6,619 | $43,500 | $13,200 | $30,300 |

| 2020 | $3,130 | $40,740 | $13,200 | $27,540 |

| 2019 | $5,904 | $40,740 | $13,200 | $27,540 |

| 2018 | $5,663 | $27,780 | $8,961 | $18,819 |

| 2017 | $5,343 | $26,209 | $9,345 | $16,864 |

| 2016 | $5,239 | $26,209 | $10,223 | $15,986 |

| 2015 | $2,982 | $24,931 | $12,996 | $11,935 |

| 2014 | $2,982 | $23,520 | $14,700 | $8,820 |

Source: Public Records

Map

Nearby Homes

- 142 Forbell St

- 97-52 75th St

- 97-52 75th St Unit B1

- 95-22 75th St

- 392 Eldert Ln

- 7518 95th Ave

- 371 Grant Ave

- 1168 Glenmore Ave

- 105-18 77th St

- 557 Drew St

- 357 Grant Ave

- 568 Drew St

- 94-13 Forbell St

- 10124 78th St

- 233 Sheridan Ave

- 367 Lincoln Ave

- 9406 76th St

- 18 Sheridan Ave

- 331 Lincoln Ave

- 699 N Conduit Blvd