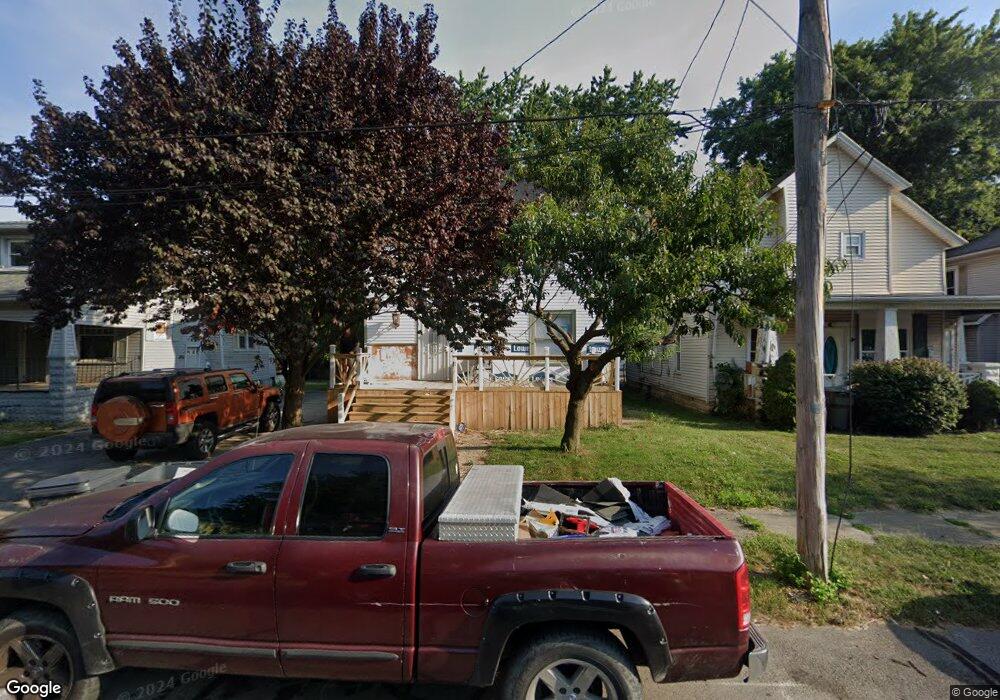

445 E Albert St Lima, OH 45804

Fifth Ward NeighborhoodEstimated Value: $43,000 - $69,132

4

Beds

1

Bath

1,768

Sq Ft

$34/Sq Ft

Est. Value

About This Home

This home is located at 445 E Albert St, Lima, OH 45804 and is currently estimated at $60,033, approximately $33 per square foot. 445 E Albert St is a home located in Allen County with nearby schools including Freedom Elementary School, Lima North Middle School, and Lima West Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2024

Sold by

Grant Don Na Demea

Bought by

Tarrant Ashely N

Current Estimated Value

Purchase Details

Closed on

Dec 21, 2022

Sold by

Grace Tlc Inc

Bought by

Grant Don Na Demea

Purchase Details

Closed on

Jul 9, 2009

Sold by

Mckim Spencer M and Mckim Ashlee B

Bought by

Grace Tlc Inc

Purchase Details

Closed on

Jan 8, 2006

Sold by

Secretary Of Va

Bought by

Graham Ashlee B and Lorge Spencer M

Purchase Details

Closed on

Sep 1, 1975

Bought by

Carder Carl J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tarrant Ashely N | $10,000 | None Listed On Document | |

| Grant Don Na Demea | $48,900 | -- | |

| Grace Tlc Inc | -- | Attorney | |

| Graham Ashlee B | $6,300 | None Available | |

| Carder Carl J | $17,500 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $295 | $6,480 | $950 | $5,530 |

| 2023 | $315 | $6,160 | $910 | $5,250 |

| 2022 | $1,603 | $6,160 | $910 | $5,250 |

| 2021 | $330 | $6,160 | $910 | $5,250 |

| 2020 | $348 | $5,850 | $880 | $4,970 |

| 2019 | $348 | $5,850 | $880 | $4,970 |

| 2018 | $347 | $5,850 | $880 | $4,970 |

| 2017 | $349 | $5,850 | $880 | $4,970 |

| 2016 | $354 | $5,850 | $880 | $4,970 |

| 2015 | $384 | $5,850 | $880 | $4,970 |

| 2014 | $384 | $6,380 | $950 | $5,430 |

| 2013 | $375 | $6,380 | $950 | $5,430 |

Source: Public Records

Map

Nearby Homes

- 439 E Albert St

- 706 E Kibby St

- 0 E Vine St

- 721 E Albert St

- 546 Orena Ave

- 00 E Albert St

- 0 E Albert St

- 520 Orena Ave

- 638 Harrison Ave

- 725 E Vine St

- 712 S Elizabeth St

- 801 E Vine St

- 812 E Vine St

- 610 Linden St

- 915 Michael Ave

- 312 W Vine St

- 817 E Eureka St

- 963 Greenlawn Ave

- 145 S Pine St

- 1008 Fairview Ave