4452 Forest Glen Ave NW Unit 19 Massillon, OH 44647

Amherst Heights-Clearview NeighborhoodEstimated Value: $209,421 - $274,000

2

Beds

2

Baths

1,438

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 4452 Forest Glen Ave NW Unit 19, Massillon, OH 44647 and is currently estimated at $247,355, approximately $172 per square foot. 4452 Forest Glen Ave NW Unit 19 is a home located in Stark County with nearby schools including Sauder Elementary School, Jackson Memorial Middle School, and Jackson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2023

Sold by

Valentine Cynthia J

Bought by

Cynthia Valentine Revocable Trust and Valentine

Current Estimated Value

Purchase Details

Closed on

Oct 6, 2017

Sold by

Self Robert B and Self Dolores A

Bought by

Valentine Cynthia J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

4.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Mar 15, 2006

Sold by

Regal Construction Co

Bought by

Self Robert B and Self Dolores A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Interest Rate

6%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

May 10, 2005

Sold by

Forest Trail Properties Inc

Bought by

Regal Construction Co

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$331,500

Interest Rate

6.05%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cynthia Valentine Revocable Trust | -- | None Listed On Document | |

| Valentine Cynthia J | $160,000 | None Available | |

| Self Robert B | $148,200 | None Available | |

| Regal Construction Co | $75,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Valentine Cynthia J | $120,000 | |

| Previous Owner | Self Robert B | $115,000 | |

| Previous Owner | Regal Construction Co | $331,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $68,010 | $17,150 | $50,860 |

| 2024 | -- | $68,010 | $17,150 | $50,860 |

| 2023 | $2,645 | $53,130 | $12,110 | $41,020 |

| 2022 | $2,634 | $53,130 | $12,110 | $41,020 |

| 2021 | $2,634 | $53,130 | $12,110 | $41,020 |

| 2020 | $2,675 | $49,530 | $10,750 | $38,780 |

| 2019 | $2,583 | $49,530 | $10,750 | $38,780 |

| 2018 | $2,596 | $49,530 | $10,750 | $38,780 |

| 2017 | $1,999 | $45,010 | $11,900 | $33,110 |

| 2016 | $1,886 | $42,740 | $11,900 | $30,840 |

| 2015 | $1,909 | $42,740 | $11,900 | $30,840 |

| 2014 | $1,634 | $36,550 | $9,560 | $26,990 |

| 2013 | $806 | $36,550 | $9,560 | $26,990 |

Source: Public Records

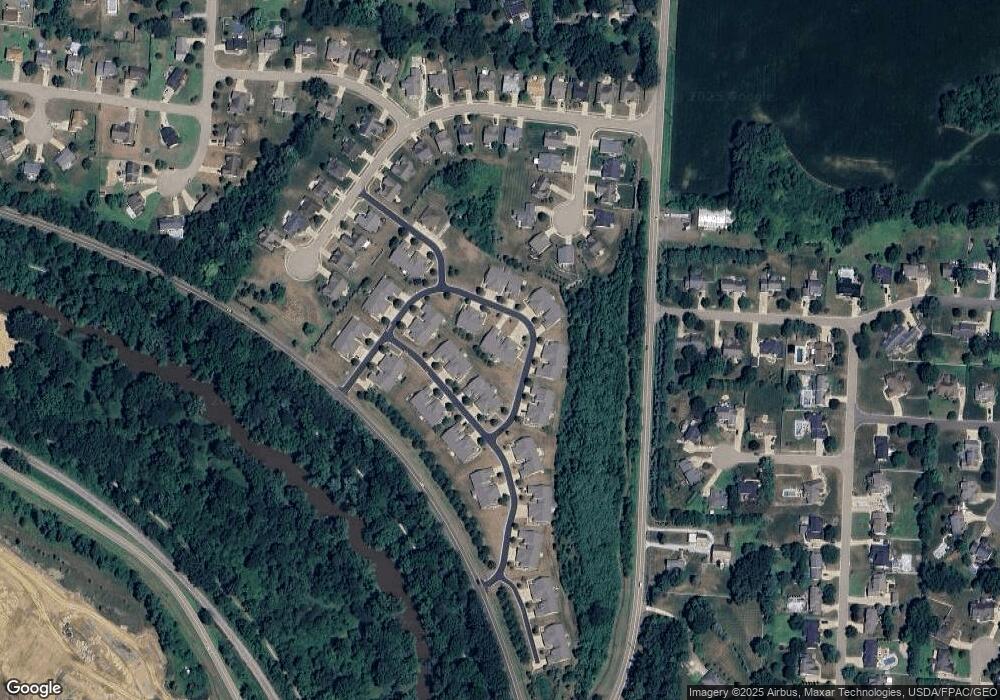

Map

Nearby Homes

- 4338 Greenway Trail St NW Unit 36

- 4374 Forest Glen Ave NW Unit 8

- 4428 Trail Head Cir NW

- 8839 Candleberry St NW

- 9077 Traphagen St NW

- 4792 Revere Ave NW

- 4561 Rohrdale Ave NW

- 8673 Dublin Ridge Cir NW Unit 4A

- 4804 Ranier Ave NW

- 8572 Yorkshire St NW

- 8484 Traphagen St NW

- 8798 Stoneshire St NW

- 5221 Revere Ave NW

- 5265 Pin Oak Ave NW

- 8555 Esquire St NW

- 8722 Glenarden Cir NW

- 0 Crystal Lake Ave NW

- 8251 Audubon St NW

- 8325 Condor Cir NW

- 8625 Milmont St NW

- 4454 Forest Glen Ave NW Unit 20

- 4450 Forest Glen Ave NW Unit 18

- 4432 Forest Glen Ave NW Unit 17

- 4358 Greenway Trail St NW Unit 35

- 4487 Forest Glen Ave NW Unit 29

- 4485 Forest Glen Ave NW Unit 28

- 4360 Greenway Trail St NW Unit 34

- 4430 Forest Glen Ave NW Unit 16

- 4483 Forest Glen Ave NW Unit 27

- 4362 Greenway Trail St NW Unit 33

- 19 Trail Head Cir NW

- 20 Trail Head Cir NW

- 4441 Forest Glen Ave NW Unit 22

- 4465 Forest Glen Ave NW Unit 36

- 4463 Forest Glen Ave NW Unit 25

- 4334 Greenway Trail St NW Unit 38

- 4505 Forest Glen Ave NW Unit 30

- 4461 Forest Glen Ave NW Unit 24

- 4443 Forest Glen Ave NW Unit 23

- 4336 Greenway Trail St NW Unit 37