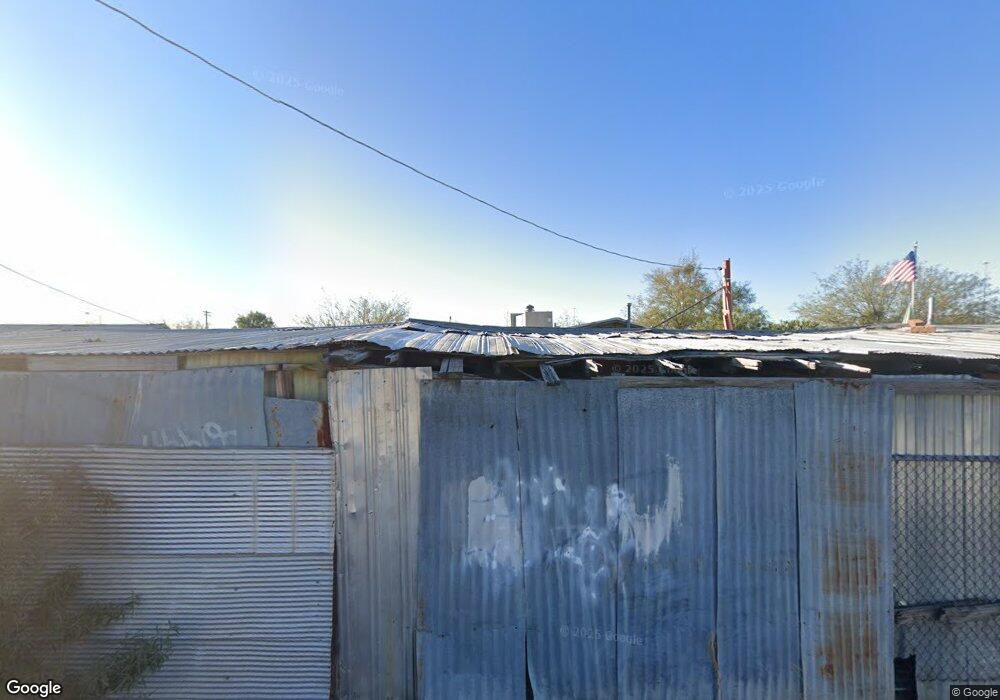

446 W 30th St Tucson, AZ 85713

Estimated Value: $242,129 - $283,000

Studio

1

Bath

1,745

Sq Ft

$156/Sq Ft

Est. Value

About This Home

This home is located at 446 W 30th St, Tucson, AZ 85713 and is currently estimated at $271,782, approximately $155 per square foot. 446 W 30th St is a home located in Pima County with nearby schools including Ochoa Elementary School, Tucson High Magnet School, and Las Puertas Community School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 31, 2013

Sold by

Diaz George D

Bought by

Diaz Bertha D

Current Estimated Value

Purchase Details

Closed on

Jun 27, 2011

Sold by

Diaz Bertha D

Bought by

Diaz Geogre D

Purchase Details

Closed on

Apr 5, 2000

Sold by

Kinas Deanne

Bought by

Kinas David A

Purchase Details

Closed on

Nov 13, 1998

Sold by

Gutierrez Jose L

Bought by

Three Brothers Development Corp

Purchase Details

Closed on

May 7, 1997

Sold by

Gonzales Richard L

Bought by

Gonzales Lorraine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$31,400

Interest Rate

8.15%

Purchase Details

Closed on

Jan 28, 1997

Sold by

City Central Development Corp

Bought by

438 E Prince Road Associates

Purchase Details

Closed on

Jun 28, 1995

Sold by

Lackey Dathel J

Bought by

Lackey William S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Diaz Bertha D | -- | None Available | |

| Diaz Bertha D | -- | None Available | |

| Diaz Geogre D | -- | None Available | |

| Kinas David A | -- | -- | |

| Kinas David A | -- | -- | |

| Deed & Note Traders Llc | -- | -- | |

| Three Brothers Development Corp | -- | -- | |

| Gonzales Lorraine A | -- | -- | |

| Gutierrez Jose L | -- | -- | |

| 438 E Prince Road Associates | $550,000 | -- | |

| City Central Development Corp | -- | -- | |

| Lackey William S | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gutierrez Jose L | $31,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $1,067 | $8,440 | -- | -- |

| 2025 | $1,067 | $8,038 | -- | -- |

| 2024 | $836 | $7,655 | -- | -- |

| 2023 | $781 | $7,291 | $0 | $0 |

| 2022 | $765 | $6,944 | $0 | $0 |

| 2021 | $780 | $2,251 | $0 | $0 |

| 2020 | $269 | $6,298 | $0 | $0 |

| 2019 | $250 | $6,209 | $0 | $0 |

| 2018 | $224 | $5,713 | $0 | $0 |

| 2017 | $231 | $5,713 | $0 | $0 |

| 2016 | $211 | $5,463 | $0 | $0 |

| 2015 | $186 | $5,203 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 533 W San Xavier St

- 420 W 26th St

- 231 W 26th St

- 118 W 32nd St

- 224 W 34th St

- 1704 S 7th Ave

- 411 W 35th St

- 31 W 32nd St

- 2238 S 6th Ave

- 324 W 23rd St

- 1205 S Herndon Ave

- 514 W 38th St

- 518 W 38th St

- 524 W 38th St

- 215 E 26th St

- 1275 S Via Estrella Blanca

- 1136 S 7th Ave

- 320 E 29th St

- 1304 S 5th Ave

- 2001 S 3rd Ave