4471 Greystone Village Dr Unit 8C Columbus, OH 43228

Riverbend NeighborhoodEstimated Value: $174,000 - $183,934

2

Beds

2

Baths

900

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 4471 Greystone Village Dr Unit 8C, Columbus, OH 43228 and is currently estimated at $180,734, approximately $200 per square foot. 4471 Greystone Village Dr Unit 8C is a home located in Franklin County with nearby schools including West Franklin Elementary School, Franklin Woods Intermediate School, and Finland Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 18, 2017

Sold by

Ewing Charles and Ewing Rosemary

Bought by

Ewing James A

Current Estimated Value

Purchase Details

Closed on

Oct 13, 2010

Sold by

Booth Joyce Anne

Bought by

Ewing Charles and Ewing Rosemary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,800

Outstanding Balance

$37,310

Interest Rate

4.26%

Mortgage Type

New Conventional

Estimated Equity

$143,424

Purchase Details

Closed on

Dec 2, 2009

Sold by

Jewell Deborah Lynn and Jewell Rolland

Bought by

Booth Joyce Anne

Purchase Details

Closed on

May 30, 2000

Sold by

Marron Sandra L and Behringer Mildred J

Bought by

Booth Joyce Anne and Jewell Deborah Lynn

Purchase Details

Closed on

Jan 31, 1994

Bought by

Schultz Sandra L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ewing James A | -- | None Available | |

| Ewing Charles | $71,000 | Harrison T | |

| Booth Joyce Anne | $41,300 | Attorney | |

| Booth Joyce Anne | $73,500 | Chicago Title | |

| Schultz Sandra L | $61,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ewing Charles | $56,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,728 | $47,390 | $10,500 | $36,890 |

| 2023 | $1,697 | $47,390 | $10,500 | $36,890 |

| 2022 | $1,463 | $29,970 | $3,680 | $26,290 |

| 2021 | $1,492 | $29,970 | $3,680 | $26,290 |

| 2020 | $1,484 | $29,970 | $3,680 | $26,290 |

| 2019 | $1,528 | $27,240 | $3,330 | $23,910 |

| 2018 | $1,396 | $27,240 | $3,330 | $23,910 |

| 2017 | $1,392 | $27,240 | $3,330 | $23,910 |

| 2016 | $1,270 | $20,410 | $2,700 | $17,710 |

| 2015 | $1,270 | $20,410 | $2,700 | $17,710 |

| 2014 | $1,271 | $20,410 | $2,700 | $17,710 |

| 2013 | $741 | $23,975 | $3,150 | $20,825 |

Source: Public Records

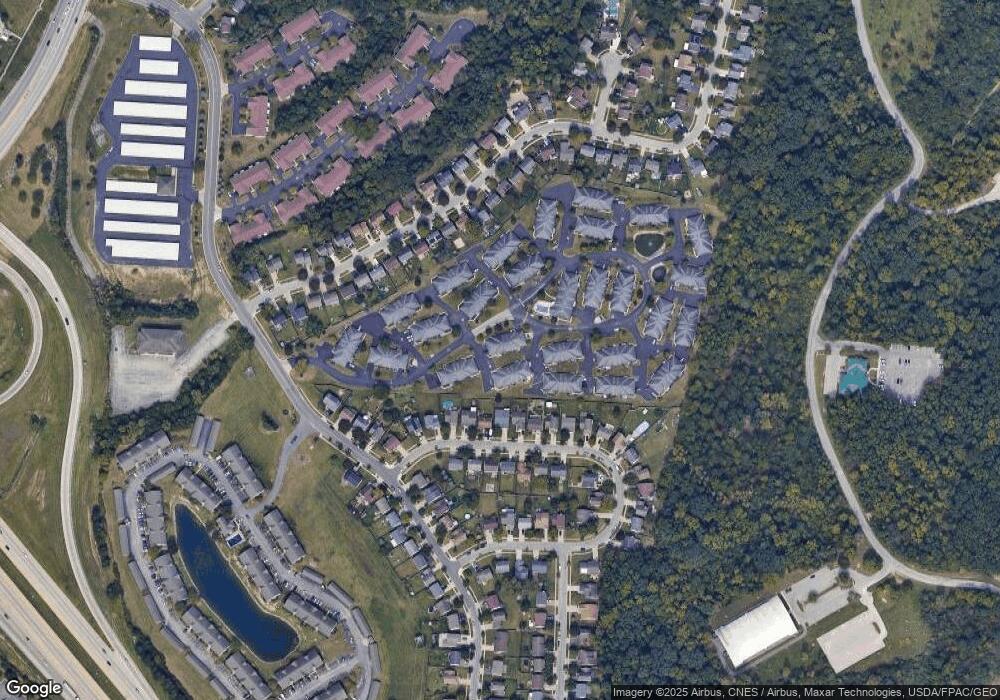

Map

Nearby Homes

- 4363 Village Park Dr

- 4512 White Leaf Way Unit 4512

- 4655 Parkwick Dr

- 4501 White Leaf Way

- 4459 Amwood St

- 4518 Hall Rd

- 1751 Carrigallen Ln

- 1668 Kildare Place

- 4650 Parrau Dr Unit 67E

- 1842 Bashan Dr Unit 75F

- 4686 Parrau Dr Unit 64A

- 1865 Bashan Dr Unit 78E

- 4708 Parrau Dr Unit 60D

- 1911 Kyger Dr Unit 57E

- 979 Tenbrook Place

- 1935 Kyger Dr Unit 28E

- 4691 Athalia Dr Unit 23C

- 1989 Berrancher Dr Unit 1989

- 3881 Lexmont Rd S

- 3941 Ardath Rd

- 4469 Greystone Village Dr Unit 8B

- 4467 Greystone Village Dr Unit 8A

- 4475 Greystone Village Dr Unit 9A

- 4447 Hammerton Dr

- 4447 Hammerton Dr Unit 9-D

- 4451 Hammerton Dr Unit 8D

- 4477 Greystone Village Dr Unit 9B

- 4483 Greystone Village Dr Unit 7B

- 4481 Greystone Village Dr Unit 7A

- 4445 Hammerton Dr

- 4445 Hammerton Dr Unit 9-C

- 4466 Greystone Village Dr

- 4466 Greystone Village Dr Unit 6C

- 4433 Hammerton Dr Unit 10C

- 4464 Greystone Village Dr Unit 6B

- 4485 Greystone Village Dr Unit 7C

- 4435 Hammerton Dr Unit 10D

- 4468 Greystone Village Dr Unit 6D

- 4487 Greystone Village Dr Unit 7D

- 4439 Hammerton Dr Unit 11C