Estimated Value: $594,444 - $645,000

4

Beds

3

Baths

2,582

Sq Ft

$241/Sq Ft

Est. Value

About This Home

This home is located at 449 Emory Oak St, Ocoee, FL 34761 and is currently estimated at $621,111, approximately $240 per square foot. 449 Emory Oak St is a home located in Orange County with nearby schools including Westbrooke Elementary School, Sunridge Middle School, and West Orange High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2020

Sold by

Wiseheart Robert C and Wiseheart Charlotte C

Bought by

Alderman Mary Beth and Hassanali Kevin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,750

Outstanding Balance

$342,373

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$278,738

Purchase Details

Closed on

Sep 6, 1997

Sold by

Lennar Homes Inc

Bought by

Wisehart Robert C and Wisehart Charlotte C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$14,900

Interest Rate

7.43%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alderman Mary Beth | $405,000 | Treasure Title | |

| Wisehart Robert C | $189,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alderman Mary Beth | $384,750 | |

| Previous Owner | Wisehart Robert C | $200,363 | |

| Previous Owner | Wisehart Robert C | $202,500 | |

| Previous Owner | Wisehart Robert C | $14,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,760 | $353,728 | -- | -- |

| 2024 | $5,217 | $343,759 | -- | -- |

| 2023 | $5,217 | $324,341 | $0 | $0 |

| 2022 | $5,060 | $314,894 | $0 | $0 |

| 2021 | $5,014 | $305,722 | $0 | $0 |

| 2020 | $4,218 | $265,965 | $0 | $0 |

| 2019 | $4,371 | $259,985 | $0 | $0 |

| 2018 | $4,373 | $255,137 | $0 | $0 |

| 2017 | $4,352 | $283,729 | $60,000 | $223,729 |

| 2016 | $4,370 | $278,216 | $60,000 | $218,216 |

| 2015 | $4,446 | $268,617 | $60,000 | $208,617 |

| 2014 | $4,414 | $257,648 | $60,000 | $197,648 |

Source: Public Records

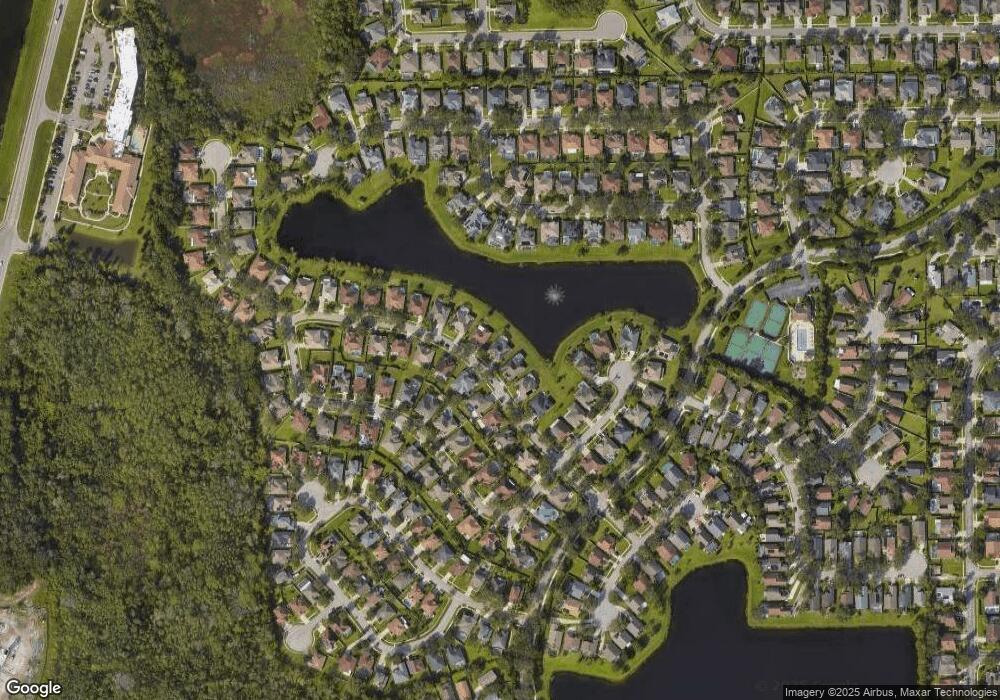

Map

Nearby Homes

- 2316 Blackjack Oak St

- 2254 Blackjack Oak St

- 660 Chester Pines Ct Unit 3

- 418 Covered Bridge Dr Unit 1

- 44 Heather Green Ct

- 815 Grovesmere Loop

- 586 Huntington Pines Dr

- 214 Highbrooke Blvd

- 841 Grovesmere Loop

- 457 Mickleton Loop

- 469 Mickleton Loop

- 934 Roberson Rd

- 814 Windergrove Ct

- 272 Longhirst Loop

- 11410 Rapallo Ln

- 237 White Dogwood Ln

- 1812 Leather Fern Dr

- 2080 Bent Grass Ave

- 2022 Bent Grass Ave

- 11714 Delwick Dr

- 461 Emory Oak St

- 473 Emory Oak St

- 425 Emory Oak St

- 454 Emory Oak St

- 468 Emory Oak St

- 434 Emory Oak St

- 485 Emory Oak St

- 413 Emory Oak St

- 422 Emory Oak St

- 486 Emory Oak St

- 2293 Blackjack Oak St

- 2297 Blackjack Oak St

- 497 Emory Oak St

- 2288 Post Oak Ct

- 410 Emory Oak St

- 2306 Post Oak Ct

- 498 Emory Oak St

- 2276 Post Oak Ct

- 2320 Post Oak Ct

Your Personal Tour Guide

Ask me questions while you tour the home.