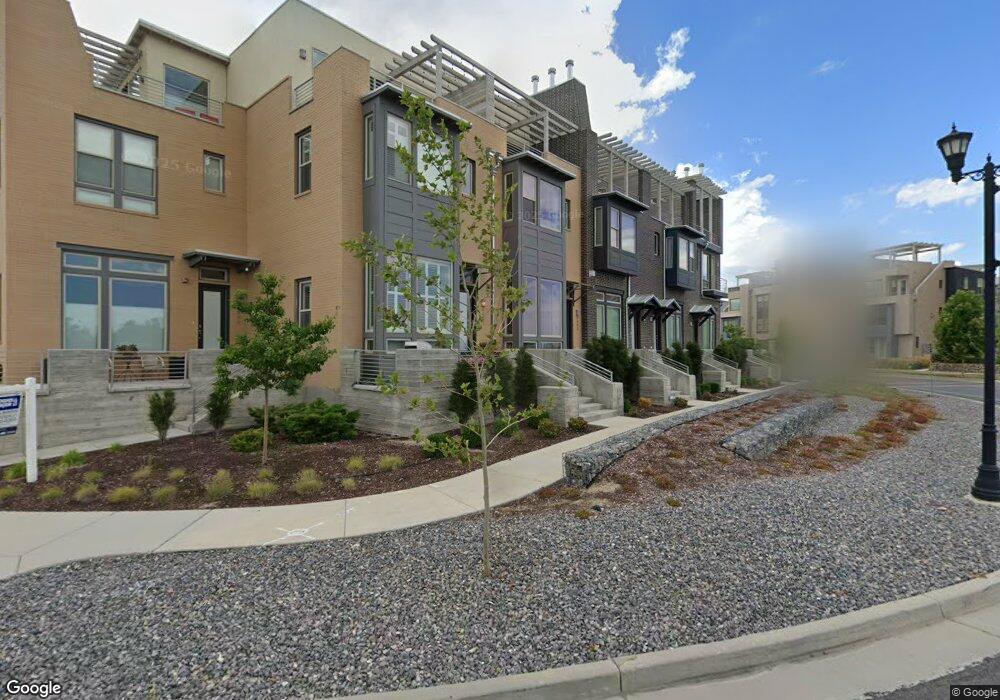

4493 W Daybreak Rim Way South Jordan, UT 84009

Daybreak NeighborhoodEstimated Value: $553,834 - $622,000

3

Beds

3

Baths

2,263

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 4493 W Daybreak Rim Way, South Jordan, UT 84009 and is currently estimated at $581,959, approximately $257 per square foot. 4493 W Daybreak Rim Way is a home located in Salt Lake County with nearby schools including Daybreak Elementary School, Mountain Creek Middle School, and Herriman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2022

Sold by

Constance Susan Whiting Revocable Trust

Bought by

Belnap Andrew and Belnap Alexandra Anderson

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$426,000

Outstanding Balance

$403,771

Interest Rate

5%

Mortgage Type

New Conventional

Estimated Equity

$178,188

Purchase Details

Closed on

Mar 11, 2019

Sold by

Whiting Clark E and Whiting Susan C

Bought by

Revoca Whiting Constance Susan and Constance Susan Whiting Revocable Trust

Purchase Details

Closed on

Sep 15, 2016

Sold by

Sego Daybreak 6 Lc

Bought by

Whiting Clark E and Susan Whiting C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$295,911

Interest Rate

3.45%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 18, 2015

Sold by

Daybreak Development Llc

Bought by

Sego Daybreak 6 Lc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Belnap Andrew | -- | Title One Title | |

| Belnap Andrew | -- | Title One Title | |

| Revoca Whiting Constance Susan | -- | None Available | |

| Whiting Clark E | -- | Keystone Title Ins Am Fork | |

| Sego Daybreak 6 Lc | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Belnap Andrew | $426,000 | |

| Closed | Belnap Andrew | $426,000 | |

| Previous Owner | Whiting Clark E | $295,911 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,803 | $529,100 | $48,200 | $480,900 |

| 2024 | $2,803 | $532,200 | $44,300 | $487,900 |

| 2023 | $2,803 | $521,800 | $43,000 | $478,800 |

| 2022 | $2,992 | $525,300 | $42,200 | $483,100 |

| 2021 | $2,355 | $379,400 | $34,300 | $345,100 |

| 2020 | $2,264 | $341,900 | $32,300 | $309,600 |

| 2019 | $2,243 | $333,000 | $32,300 | $300,700 |

| 2018 | $2,129 | $314,500 | $33,000 | $281,500 |

| 2017 | $1,977 | $286,100 | $33,000 | $253,100 |

| 2016 | $474 | $34,800 | $34,800 | $0 |

| 2015 | $474 | $34,800 | $34,800 | $0 |

Source: Public Records

Map

Nearby Homes

- 4563 W Daybreak Rim Way

- 4584 W Daybreak Rim Way

- 4592 W Scissor Way

- 11211 S Clear Blue Dr

- 11076 S Paddle Board Way

- 11347 S Kestrel Rise Rd

- 11064 S Paddle Board Way

- 4555 W Open Hill Dr

- 11213 S Kestrel Rise Rd

- 4536 W Silent Rain Dr

- 11048 S Paddle Board Way Unit 3-332

- 11043 S Lake Island Dr Unit 3-377

- Ashland Plan at Cascade Village - Augustine

- Avenel Plan at Cascade Village - Augustine

- Camden Plan at Cascade Village - Augustine

- Sonoma Plan at Cascade Village - Augustine

- 11037 S Lake Island Dr Unit 3-378

- 11078 Topview Rd

- 11171 S Kestrel Rise Rd

- 10993 Lake Island Dr Unit 310

- 4493 W Daybreak Rim Way Unit 307

- 4497 W Daybreak Rim Way

- 4491 W Daybreak Rim Way

- 4499 W Daybreak Rim Way

- 4499 W Daybreak Rim Way Unit 305

- 4496 W Kestrel Ridge Rd Unit 309

- 4496 W Kestrel Ridge Rd

- 4501 W Daybreak Rim Way

- 4509 W Daybreak Rim Way

- 4509 W Daybreak Rim Way Unit 303

- 11279 S High Crest Ln

- 11283 S High Crest Ln

- 11283 S High Crest Ln Unit 321

- 11281 S High Crest Ln Unit 322

- 11281 S High Crest Ln

- 4502 W Kestrel Ridge Rd

- 11277 S High Crest Ln

- 11277 S High Crest Ln Unit 324

- 4517 W Daybreak Rim Way Unit 302

- 4504 W Kestrel Ridge Rd