451 Primrose Ln East Liverpool, OH 43920

Estimated Value: $217,000 - $253,408

3

Beds

2

Baths

1,612

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 451 Primrose Ln, East Liverpool, OH 43920 and is currently estimated at $235,352, approximately $146 per square foot. 451 Primrose Ln is a home located in Columbiana County with nearby schools including Westgate Middle School, North Elementary School, and East Liverpool High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 2016

Sold by

Weyand Christina R and Douds Christina R

Bought by

Weyand Christina R and Weyand John L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,516

Outstanding Balance

$89,868

Interest Rate

3.75%

Mortgage Type

FHA

Estimated Equity

$145,484

Purchase Details

Closed on

Apr 13, 2006

Sold by

Jones Ruth E and Case #05Cv266

Bought by

Deutsche Bank National Trust Co and Morgan Stanley Abs Capital 1 Inc Trust 2

Purchase Details

Closed on

Aug 10, 1998

Sold by

Jones Richard E

Bought by

Jones Jay L and Jones Ruth E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

7.07%

Purchase Details

Closed on

Jan 30, 1996

Sold by

Adkins Jerry F

Bought by

Richard E Jones

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,200

Interest Rate

7.19%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weyand Christina R | -- | None Available | |

| Deutsche Bank National Trust Co | $100,000 | None Available | |

| Jones Jay L | $95,900 | -- | |

| Richard E Jones | $98,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Weyand Christina R | $110,516 | |

| Previous Owner | Jones Jay L | $90,000 | |

| Previous Owner | Richard E Jones | $88,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,754 | $67,340 | $8,190 | $59,150 |

| 2023 | $2,755 | $67,340 | $8,190 | $59,150 |

| 2022 | $2,756 | $67,340 | $8,190 | $59,150 |

| 2021 | $2,312 | $53,940 | $8,300 | $45,640 |

| 2020 | $2,257 | $52,580 | $8,300 | $44,280 |

| 2019 | $2,256 | $52,580 | $8,300 | $44,280 |

| 2018 | $2,182 | $47,780 | $7,530 | $40,250 |

| 2017 | $2,301 | $47,780 | $7,530 | $40,250 |

| 2016 | $2,210 | $44,280 | $7,980 | $36,300 |

| 2015 | $2,210 | $44,280 | $7,980 | $36,300 |

| 2014 | $2,046 | $44,280 | $7,980 | $36,300 |

Source: Public Records

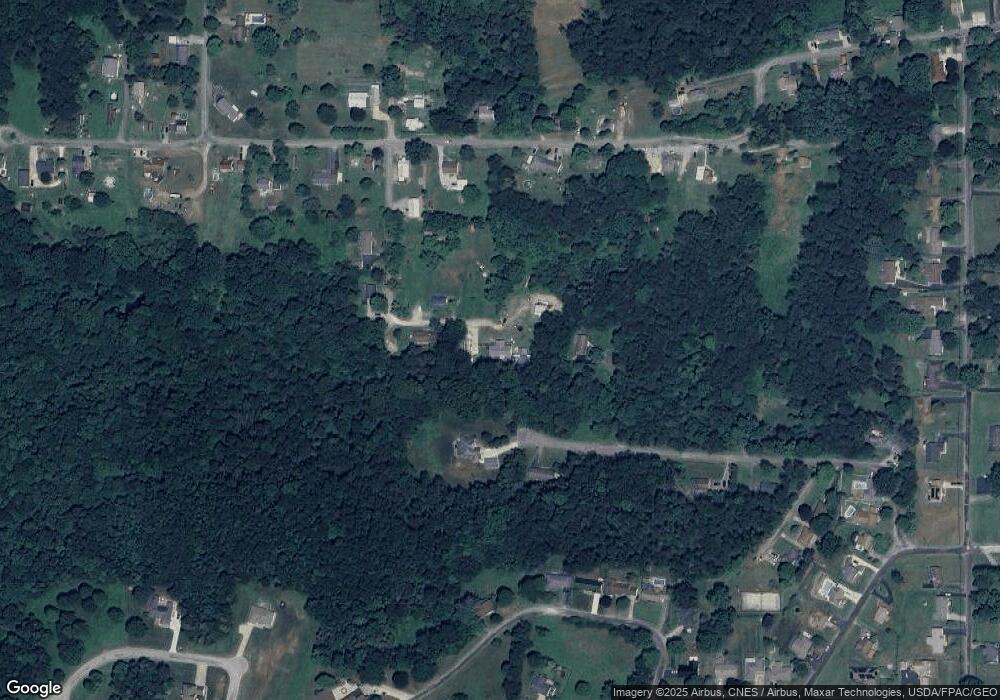

Map

Nearby Homes

- 3150 Forest Hills Dr

- 3140 Forest Hills Dr

- 3170 Hampton Ct

- 3158 Forest Hills Dr

- 3164 Forest Hills Dr

- 3135 Forest Hills Dr

- 3165 Forest Hills Dr

- 3173 Forest Hills Dr

- 3178 Forest Hills Dr

- 48712 Bloomfield Ave

- 3177 Forest Hills Dr

- 3186 Forest Hills Dr

- 3105 Forest Hills Dr

- 3194 Forest Hills Dr

- 3244 Saint Clair Ave

- 3124 Gilson Ave

- 147 Huntington Ct

- 141 Huntington Ct

- 140 Huntington Ct

- 138 Huntington Ct

- 417 Primrose Ln

- 487 Pleasant St

- 400 Pleasant St

- 48709 Belmont Ave

- 422 Pleasant St

- 16995 Cincinnati Ave

- 16971 Cincinnati Ave

- 48753 Belmont Ave

- 48703 Belmont Ave

- 48731 Belmont Ave

- 48801 Belmont Ave

- 48839 Belmont Ave

- 48699 Belmont Ave

- 401 Watterson St

- 48667 Belmont Ave

- 48812 Belmont Ave

- 48768 Belmont Ave

- 3135 Hampton Ct

- 48744 Belmont Ave

- 530 Pleasant St