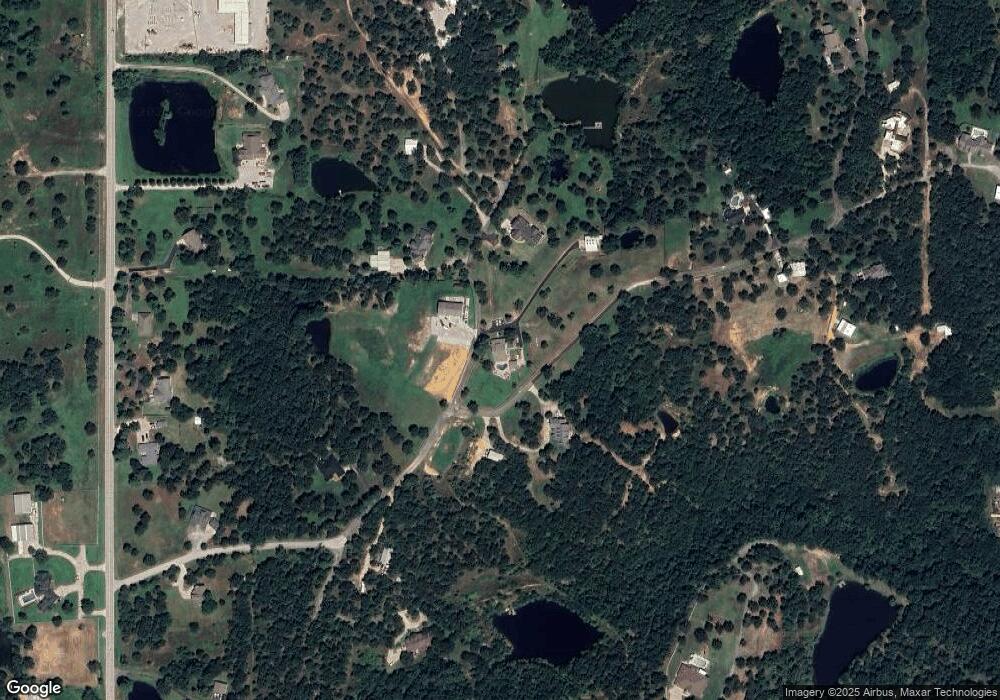

4518 Edgewood Sapulpa, OK 74066

4

Beds

3

Baths

3,168

Sq Ft

9.99

Acres

About This Home

This home is located at 4518 Edgewood, Sapulpa, OK 74066. 4518 Edgewood is a home located in Creek County with nearby schools including Sapulpa Middle School, Sapulpa Junior High School, and Sapulpa High School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History Compared to Growth

Map

Nearby Homes

- 421 Summercrest Ct

- 461 Cross Timbers Blvd

- 11163 S 55th West Ave

- 605 Cross Timbers Blvd

- 609 Cross Timbers Blvd

- 4367 Lakeside Dr

- 540 Creekside Dr

- 590 Creekside Dr

- 0 Lakeside Dr

- 527 Pioneer Rd

- 11602 S 30th West Ave

- 626 Countrywood Way

- 5231 W Hilton Rd

- 10732 S 33rd West Ave

- 5672 W Hilton Rd

- 404 Hickory Hill Rd

- 504 Hickory Hill Rd

- 10910 S Olmsted St

- 10417 S 33rd West Ave

- 3003 Laurel Oaks Rd

- 4518 Edgewood

- 0 Edgewood Dr Unit 706747

- 0 Edgewood Dr Unit 1932673

- 0 Edgewood Dr Unit 1932668

- 4519 Edgewood

- 4525 Edgewood

- 4728 Edgewood

- 4915 Edgewood Dr

- 4520 Edgewood

- 4523 Edgewood

- 4727 Edgewood

- 11239 S 49th West Ave

- 11263 S 49th West Ave

- 11325 S 49th West Ave

- 11355 S 49th West Ave

- 11235 S 49th West Ave

- 11235 S 49th Ave W

- 11317 S 49th West Ave

- 11449 S 49th West Ave

- 11405 S 49th West Ave