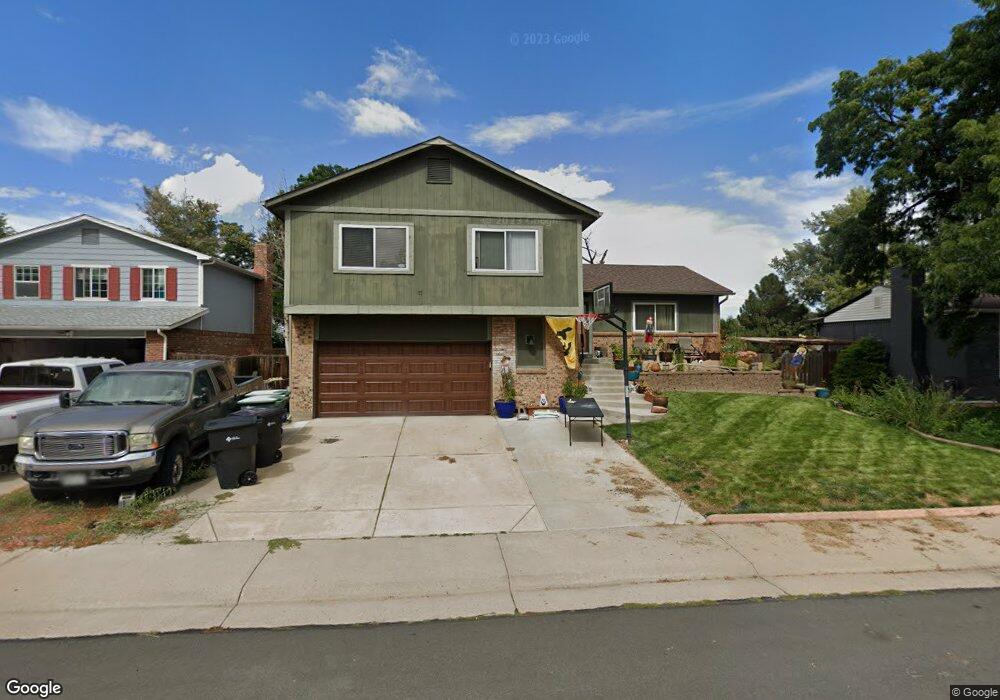

4533 E 121st Way Thornton, CO 80241

Northaven NeighborhoodEstimated Value: $511,000 - $532,000

4

Beds

3

Baths

2,555

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 4533 E 121st Way, Thornton, CO 80241 and is currently estimated at $518,536, approximately $202 per square foot. 4533 E 121st Way is a home located in Adams County with nearby schools including Skyview Elementary School, Shadow Ridge Middle School, and Horizon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2009

Sold by

Jpmorgan Chase Bank National Association

Bought by

Clarke Brandon Scott and Myers Lindsie Sue

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,830

Outstanding Balance

$107,860

Interest Rate

4.97%

Mortgage Type

FHA

Estimated Equity

$410,676

Purchase Details

Closed on

Mar 19, 2009

Sold by

Vogler Gary L and Vogler Loretta E

Bought by

Jpmorgan Chase Bank National Association

Purchase Details

Closed on

Sep 26, 2002

Sold by

Hassel Mark H and Hassel Lisa G

Bought by

Vogler Gary L and Vogler Loretta E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,350

Interest Rate

5.12%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 7, 1993

Sold by

Salazar John R and Salazar Donna L

Bought by

Hassel Mark H and Hassel Lisa C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clarke Brandon Scott | $175,000 | Fahtco | |

| Jpmorgan Chase Bank National Association | -- | None Available | |

| Vogler Gary L | $231,000 | Land Title Guarantee Company | |

| Hassel Mark H | $118,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clarke Brandon Scott | $171,830 | |

| Previous Owner | Vogler Gary L | $196,350 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,494 | $33,460 | $6,530 | $26,930 |

| 2024 | $3,494 | $30,750 | $6,000 | $24,750 |

| 2023 | $3,459 | $37,480 | $5,820 | $31,660 |

| 2022 | $2,952 | $26,800 | $5,980 | $20,820 |

| 2021 | $3,050 | $26,800 | $5,980 | $20,820 |

| 2020 | $2,898 | $25,980 | $6,150 | $19,830 |

| 2019 | $2,904 | $25,980 | $6,150 | $19,830 |

| 2018 | $2,582 | $22,440 | $6,700 | $15,740 |

| 2017 | $2,348 | $22,440 | $6,700 | $15,740 |

| 2016 | $1,796 | $16,710 | $3,340 | $13,370 |

| 2015 | $1,793 | $16,710 | $3,340 | $13,370 |

| 2014 | $1,710 | $15,490 | $2,710 | $12,780 |

Source: Public Records

Map

Nearby Homes

- 12152 Dahlia Dr

- 12187 Fairfax St

- 12129 Forest St

- 12099 Forest St

- 5080 E 120th Place

- 5160 E 120th Place

- 4939 E 124th Way

- 4904 E 125th Ave

- 5211 E 119th Ct

- 11981 Bellaire St Unit D

- 11961 Bellaire St Unit C

- 12312 Colorado Blvd Unit 10

- 12433 Bellaire Dr

- 5243 E 119th Way

- 12332 Colorado Blvd Unit 30

- 3991 E 121st Ave

- 12506 Forest Dr

- 12562 Forest St

- 4220 E 119th Place Unit B

- 12625 Fairfax St

- 4543 E 121st Way

- 4523 E 121st Way

- 4530 E 122nd Ct

- 4540 E 122nd Ct

- 4553 E 121st Way

- 4503 E 121st Way

- 4532 E 121st Way

- 4542 E 121st Way

- 4522 E 121st Way

- 4550 E 122nd Ct

- 4510 E 122nd Ct

- 4552 E 121st Way

- 4502 E 121st Way

- 4531 E 121st Place

- 4541 E 121st Place

- 12190 Cherry St

- 4521 E 121st Place

- 4535 E 122nd Ct

- 12180 Cherry St

- 4461 E 121st Way

Your Personal Tour Guide

Ask me questions while you tour the home.