4540 Shannon Ct Suwanee, GA 30024

Estimated Value: $550,000 - $604,895

3

Beds

2

Baths

1,958

Sq Ft

$300/Sq Ft

Est. Value

About This Home

This home is located at 4540 Shannon Ct, Suwanee, GA 30024 and is currently estimated at $586,724, approximately $299 per square foot. 4540 Shannon Ct is a home located in Forsyth County with nearby schools including Sharon Elementary School, Riverwatch Middle School, and Lambert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2022

Sold by

Crane Royce I

Bought by

Royce & Marilyn Crane Joint Living Trust

Current Estimated Value

Purchase Details

Closed on

May 12, 2005

Sold by

Maier David J and Maier Paula

Bought by

Crane Royce L and Crane Marilyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

5.8%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Feb 29, 2000

Sold by

Miller Robert J and Miller Maureen N

Bought by

Maier David J and Maier Paula G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,400

Interest Rate

8.29%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Royce & Marilyn Crane Joint Living Trust | -- | W Frank Ward Pc | |

| Crane Royce L | $235,000 | -- | |

| Maier David J | $188,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Crane Royce L | $150,000 | |

| Previous Owner | Maier David J | $150,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $738 | $264,724 | $78,000 | $186,724 |

| 2024 | $738 | $254,672 | $68,000 | $186,672 |

| 2023 | $651 | $234,256 | $60,000 | $174,256 |

| 2022 | $713 | $147,504 | $36,000 | $111,504 |

| 2021 | $682 | $147,504 | $36,000 | $111,504 |

| 2020 | $691 | $156,932 | $36,000 | $120,932 |

| 2019 | $688 | $147,804 | $36,000 | $111,804 |

| 2018 | $705 | $141,952 | $36,000 | $105,952 |

| 2017 | $705 | $132,160 | $36,000 | $96,160 |

| 2016 | $697 | $126,160 | $30,000 | $96,160 |

| 2015 | $665 | $103,720 | $24,000 | $79,720 |

| 2014 | $611 | $92,112 | $24,000 | $68,112 |

Source: Public Records

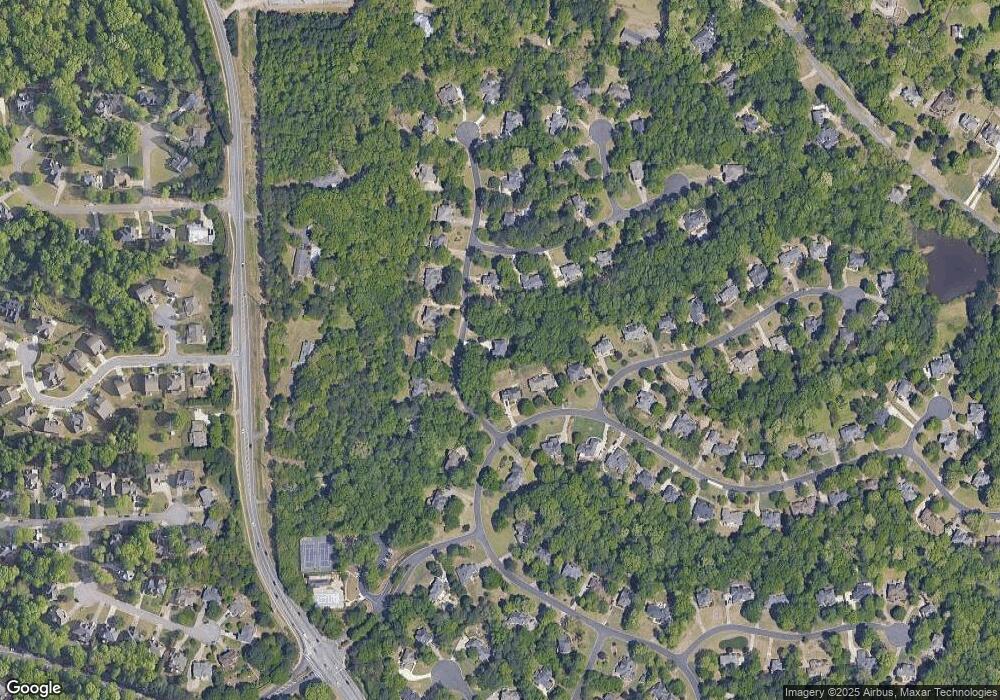

Map

Nearby Homes

- 00 Old Atlanta Lot Rd

- 373 Via Secco Ln

- 4785 Scotney Ct

- 4715 Scotney Ct

- 3945 Preston Oak Ln

- 1310 Settles Rd

- 5055 Mallory Ct

- 4760 Fontwell Ct Unit 5

- 915 Taylor Pkwy

- 6640 Bridlewood Way

- 6625 Chambrel Way

- 1140 Easy St

- 4840 Yorkshire Ln

- 1112 Bartlett Trace

- 1104 Bartlett Trace

- 1101 Bartlett Trace

- 5365 Winding Ln

- 7025 Blackthorn Ln

- 4790 Ashwell Ln

- 4815 Ashwell Ln Unit 2

- 4505 Waterford Dr Unit 34

- 4505 Waterford Dr

- 4515 Waterford Dr

- 4550 Shannon Ct

- 4640 Glencullen Ct

- 4605 Saint Kevin Ct

- 4535 Shannon Ct Unit 1072

- 4535 Shannon Ct

- 4545 Shannon Ct

- 4650 Glencullen Ct

- 4615 Saint Kevin Ct

- 4525 Shannon Ct

- 4510 Waterford Dr

- 4425 Waterford Dr

- 4610 Shannon Ct

- 4515 Shannon Ct

- 4565 Shannon Ct

- 4625 Saint Kevin Ct

- 4660 Glencullen Ct

- 4430 Waterford Dr