455 W 39th St Shadyside, OH 43947

Estimated Value: $100,000 - $222,000

4

Beds

2

Baths

1,944

Sq Ft

$85/Sq Ft

Est. Value

About This Home

This home is located at 455 W 39th St, Shadyside, OH 43947 and is currently estimated at $164,377, approximately $84 per square foot. 455 W 39th St is a home located in Belmont County with nearby schools including Jefferson Avenue Elementary School, Leona Avenue Middle School, and Shadyside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2011

Sold by

Helms Ronald G and Helms Tamara L

Bought by

Magyar Joseph B

Current Estimated Value

Purchase Details

Closed on

Jul 29, 2010

Sold by

Bise Denise L and Bise David S

Bought by

Helms Ronald G and Helms Tamara L

Purchase Details

Closed on

Jun 26, 2009

Sold by

Farrell Linda

Bought by

Bise Denise L

Purchase Details

Closed on

Dec 23, 1995

Sold by

Palmer Dennis Robert Eta

Bought by

Farrell Linda

Purchase Details

Closed on

Sep 28, 1995

Sold by

Farrell Linda

Bought by

Palmer Dennis Robert

Purchase Details

Closed on

Sep 1, 1994

Sold by

Palmer Dennis Robert

Bought by

Palmer Dennis Robert Eta

Purchase Details

Closed on

Jan 1, 1986

Sold by

Palmer Nancy L

Bought by

Palmer Nancy L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Magyar Joseph B | $15,000 | Attorney | |

| Helms Ronald G | $12,500 | Attorney | |

| Bise Denise L | -- | Attorney | |

| Farrell Linda | -- | -- | |

| Palmer Dennis Robert | $13,500 | -- | |

| Palmer Dennis Robert Eta | -- | -- | |

| Palmer Nancy L | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,727 | $42,150 | $4,910 | $37,240 |

| 2023 | $1,291 | $28,450 | $4,900 | $23,550 |

| 2022 | $1,290 | $28,452 | $4,904 | $23,548 |

| 2021 | $1,284 | $28,452 | $4,904 | $23,548 |

| 2020 | $1,120 | $24,320 | $4,190 | $20,130 |

| 2019 | $1,123 | $24,320 | $4,190 | $20,130 |

| 2018 | $1,020 | $24,320 | $4,190 | $20,130 |

| 2017 | $957 | $18,940 | $3,220 | $15,720 |

| 2016 | $962 | $18,940 | $3,220 | $15,720 |

| 2015 | $965 | $18,940 | $3,220 | $15,720 |

| 2014 | $1,033 | $19,830 | $2,930 | $16,900 |

| 2013 | $812 | $18,380 | $2,930 | $15,450 |

Source: Public Records

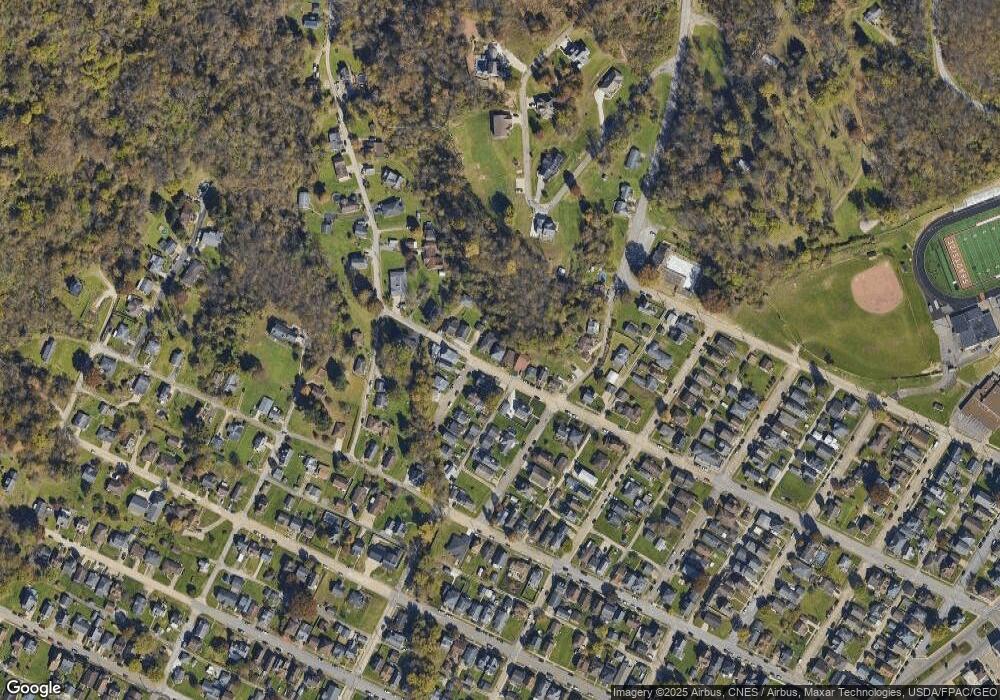

Map

Nearby Homes

- 473 W 39th St

- 3927 Daisyview St

- 3971 Grandview Ave

- 105 W 40th St

- 271-REAR W 43rd St

- 3970 Central Ave

- 411 W 45th St

- 560 W 44th St

- 466 W 45th St

- 4410 Lincoln Ave

- 3841 Highland Ave

- 52 E 37th St

- 3608 Lincoln Ave

- 3480 Central Ave

- 0 Wegee Ln

- 4470 Grand Ave

- 3810 Grand Ave

- 3450 Elk Ave

- 56612 McGee Rd

- 27 16th St

- 449 W 39th St

- 447 W 39th St

- 469 W 39th St

- 469 W 39th St

- 405 W 39th St

- 403 W 39th St

- 3900 Jamison Ave

- 3920 Jamison Ave

- 477 W 39th St

- 400 W 39th St

- 401 W 39th St

- 3901 Jamison Ave

- 3909 Jamison Ave

- 3909 Jamison Ave

- 3919 Jamison Ave

- 3823 Florence Ave

- 3947 Florence Ave

- 3947 Florence Ave

- 3924 Jamison Ave

- 3817 Florence Ave