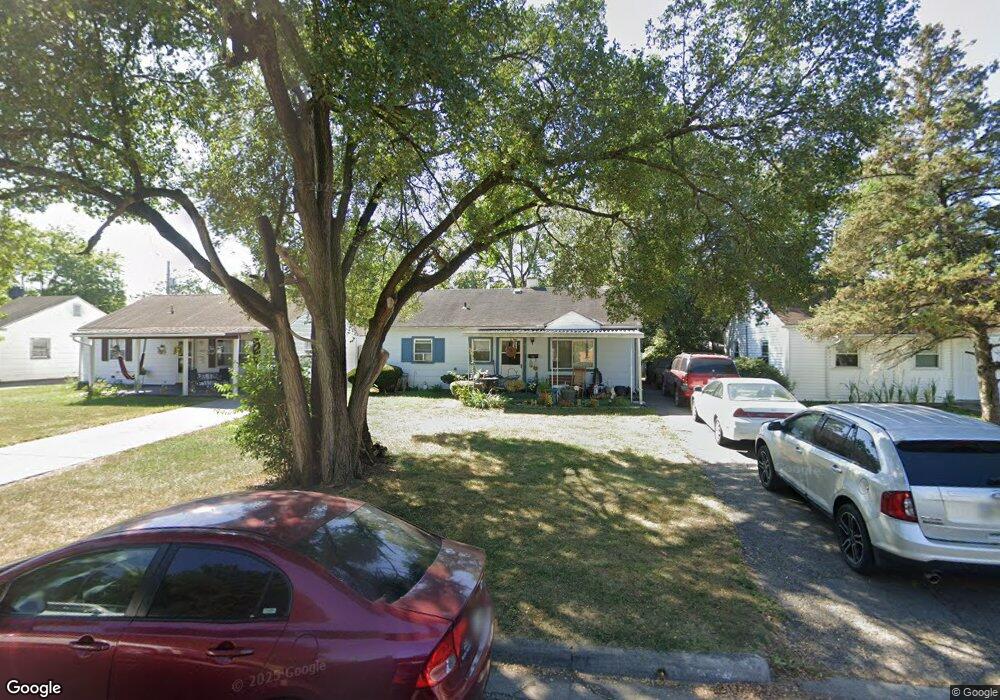

4557 Saint Francis Ln Columbus, OH 43213

Estimated Value: $157,000 - $187,000

3

Beds

1

Bath

875

Sq Ft

$197/Sq Ft

Est. Value

About This Home

This home is located at 4557 Saint Francis Ln, Columbus, OH 43213 and is currently estimated at $172,309, approximately $196 per square foot. 4557 Saint Francis Ln is a home located in Franklin County with nearby schools including Etna Road Elementary School, Beechwood Elementary School, and Rosemore Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2006

Sold by

Koepplin Martha and Koepplin Norman R

Bought by

Hoy Connie R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$32,750

Interest Rate

6.85%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 14, 2006

Sold by

Hoy Connie

Bought by

Koepplin Martha

Purchase Details

Closed on

Oct 14, 2005

Sold by

Koepplin Norman R and Koepplin Martha W

Bought by

Hoy Connie

Purchase Details

Closed on

Jul 10, 1997

Sold by

Koepplin Norman R and Koepplin Martha W

Bought by

Koepplin Norman R and Koepplin Martha W

Purchase Details

Closed on

Jul 11, 1990

Purchase Details

Closed on

Nov 20, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hoy Connie R | -- | Title First | |

| Koepplin Martha | -- | None Available | |

| Hoy Connie | -- | -- | |

| Koepplin Norman R | -- | -- | |

| Koepplin Norman R | -- | -- | |

| -- | -- | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Hoy Connie R | $32,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,471 | $43,440 | $13,090 | $30,350 |

| 2023 | $1,487 | $43,435 | $13,090 | $30,345 |

| 2022 | $1,598 | $27,970 | $5,040 | $22,930 |

| 2021 | $1,500 | $27,970 | $5,040 | $22,930 |

| 2020 | $1,485 | $27,970 | $5,040 | $22,930 |

| 2019 | $1,396 | $22,860 | $4,030 | $18,830 |

| 2018 | $1,266 | $22,860 | $4,030 | $18,830 |

| 2017 | $1,224 | $22,860 | $4,030 | $18,830 |

| 2016 | $1,100 | $16,840 | $4,100 | $12,740 |

| 2015 | $1,109 | $16,840 | $4,100 | $12,740 |

| 2014 | $1,110 | $16,840 | $4,100 | $12,740 |

| 2013 | $586 | $18,690 | $4,550 | $14,140 |

Source: Public Records

Map

Nearby Homes

- 4489 Saint Margaret Ln

- 4368 Broadhurst Dr

- 4232 Mayflower Blvd

- 451 Beaver Ave

- 353 Shell Ct E

- 571 S Hamilton Rd

- 4148 Elbern Ave

- 424 Cumberland Dr

- 469 Cumberland Dr

- 322 Fairway Cir

- 579 Westphal Ave

- 4780 Etna Rd Unit 782

- 4653 Kae Ave

- 91 Robinwood Ave

- 547 Country Club Rd

- 4662 Jae Ave

- 110 Ironclad Dr Unit 9

- 3814 Elbern Ave

- 185 Prairiecreek Way Unit 185

- 798 S Yearling Rd

- 4549 Saint Francis Ln

- 4563 Saint Francis Ln

- 4543 Saint Francis Ln

- 4569 Saint Francis Ln

- 4558 Norton Ln

- 4564 Norton Ln

- 4552 Norton Ln

- 4546 Norton Ln

- 4572 Norton Ln

- 4537 Saint Francis Ln

- 4575 Saint Francis Ln

- 4575 St Francis Ln

- 4564 Saint Francis Ln

- 4556 Saint Francis Ln

- 4572 Saint Francis Ln

- 4540 Norton Ln

- 4580 Norton Ln

- 4548 Saint Francis Ln

- 4583 Saint Francis Ln

- 4529 Saint Francis Ln