458 Landing Blvd Inverness, FL 34450

Estimated Value: $152,512 - $168,000

2

Beds

2

Baths

959

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 458 Landing Blvd, Inverness, FL 34450 and is currently estimated at $159,628, approximately $166 per square foot. 458 Landing Blvd is a home located in Citrus County with nearby schools including Inverness Primary School, Inverness Middle School, and Citrus High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2005

Sold by

Jacobs Eugene and Jacobs Susan P

Bought by

Shamah Joshua V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,180

Outstanding Balance

$50,255

Interest Rate

6.04%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$109,373

Purchase Details

Closed on

Sep 30, 2004

Sold by

Rife Jeffrey and Rife Kim M

Bought by

Jacobs Eugene and Jacobs Susan P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,000

Interest Rate

5.75%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 20, 2003

Sold by

Brogna Paul and Brogna Marion

Bought by

Rife Jeffrey D and Rife Kim M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$53,122

Interest Rate

5.93%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 1, 1987

Bought by

Shamah Joshua V

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shamah Joshua V | $103,000 | Dba Crystal River Title | |

| Jacobs Eugene | $67,500 | Dba Crystal River Title | |

| Rife Jeffrey D | $53,000 | American Title Services Of C | |

| Shamah Joshua V | $45,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shamah Joshua V | $91,180 | |

| Previous Owner | Jacobs Eugene | $54,000 | |

| Previous Owner | Rife Jeffrey D | $53,122 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $495 | $48,743 | -- | -- |

| 2023 | $495 | $47,323 | $0 | $0 |

| 2022 | $453 | $45,945 | $0 | $0 |

| 2021 | $421 | $44,607 | $0 | $0 |

| 2020 | $414 | $71,112 | $3,000 | $68,112 |

| 2019 | $402 | $62,208 | $3,460 | $58,748 |

| 2018 | $391 | $57,806 | $3,460 | $54,346 |

| 2017 | $373 | $41,332 | $3,460 | $37,872 |

| 2016 | $355 | $40,482 | $3,460 | $37,022 |

| 2015 | $347 | $40,201 | $3,460 | $36,741 |

| 2014 | $356 | $39,882 | $3,772 | $36,110 |

Source: Public Records

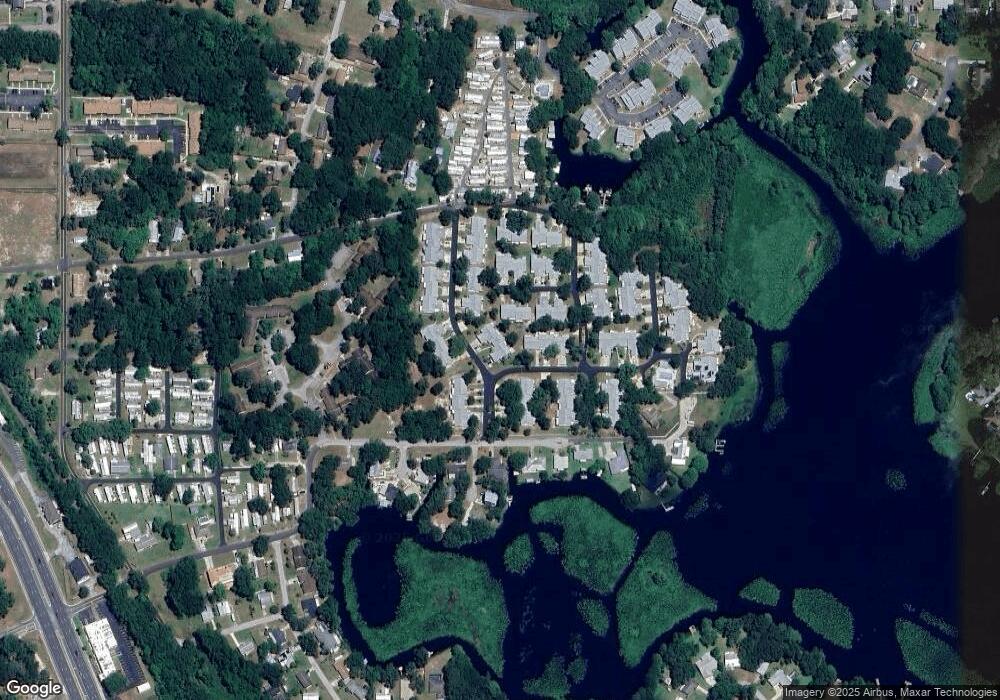

Map

Nearby Homes

- 475 Landing Blvd

- 1423 Longboat Point

- 1220 Mossy Oak Dr

- 1302 Cypress Cove Ct

- 1212 Cypress Cove Ct

- 1288 Cypress Cove Ct

- 1006 Leroy Bellamy Rd

- 1336 Cypress Cove Ct

- 415 Abel Point

- 1308 Lakeshore Dr

- 1104 Lake Shore Dr

- 1505 Lakeview Dr

- 1406 Eden Dr

- 1885 S Westlake Dr

- 1880 S Westlake Dr

- 722 Nola St

- 2001 Us Highway 41 S

- 1316 Eden Dr

- 729 Longfellow Terrace

- 1980 S Tsala Terrace

- 456 Landing Blvd

- 460 Landing Blvd

- 454 Landing Blvd

- 452 Landing Blvd

- 1301 Longboat Point

- 1303 Longboat Point

- 1200 Tamiami Ln

- 1202 Tamiami Ln

- 470 Landing Blvd

- 442 Landing Blvd

- 1204 Tamiami Ln

- 1305 Longboat Point

- 472 Landing Blvd

- 1206 Tamiami Ln

- 440 Landing Blvd

- 469 Landing Blvd

- 459 Landing Blvd

- 1307 Longboat Point

- 457 Landing Blvd

- 474 Landing Blvd