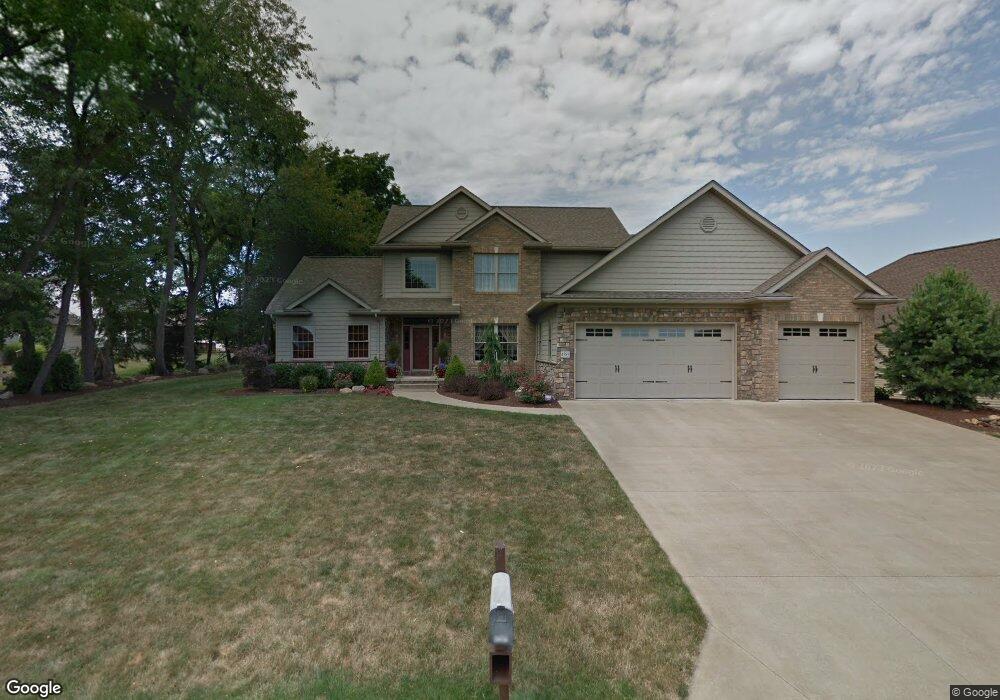

4585 Ranier Ave NW Massillon, OH 44646

Amherst Heights-Clearview NeighborhoodEstimated Value: $473,000 - $556,000

3

Beds

3

Baths

2,181

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 4585 Ranier Ave NW, Massillon, OH 44646 and is currently estimated at $496,483, approximately $227 per square foot. 4585 Ranier Ave NW is a home located in Stark County with nearby schools including Sauder Elementary School, Jackson Memorial Middle School, and Jackson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2019

Sold by

Crisp Gary A and Crisp Gina

Bought by

Walters Katlynn S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,000

Outstanding Balance

$207,186

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$289,297

Purchase Details

Closed on

Oct 2, 2017

Sold by

Ramold Gerald C and Ramold Carrie Ann

Bought by

Crisp Gary A and Crisp Gina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$271,600

Interest Rate

3.89%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 30, 2008

Sold by

Oakes Galen M and Oakes Beulah L

Bought by

Ramold Gerald C and Ramold Carrie Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Interest Rate

6.5%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Walters Katlynn S | $335,000 | None Available | |

| Crisp Gary A | $339,500 | None Available | |

| Ramold Gerald C | $64,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Walters Katlynn S | $235,000 | |

| Previous Owner | Crisp Gary A | $271,600 | |

| Previous Owner | Ramold Gerald C | $204,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $148,020 | $31,290 | $116,730 |

| 2024 | -- | $148,020 | $31,290 | $116,730 |

| 2023 | $6,161 | $123,420 | $28,950 | $94,470 |

| 2022 | $6,130 | $123,420 | $28,950 | $94,470 |

| 2021 | $6,154 | $123,420 | $28,950 | $94,470 |

| 2020 | $5,664 | $104,380 | $24,960 | $79,420 |

| 2019 | $5,456 | $104,380 | $24,960 | $79,420 |

| 2018 | $5,483 | $104,380 | $24,960 | $79,420 |

| 2017 | $5,109 | $92,510 | $23,100 | $69,410 |

| 2016 | $5,190 | $93,350 | $23,100 | $70,250 |

| 2015 | $5,253 | $93,350 | $23,100 | $70,250 |

| 2014 | $1,015 | $85,230 | $21,070 | $64,160 |

| 2013 | $2,467 | $85,230 | $21,070 | $64,160 |

Source: Public Records

Map

Nearby Homes

- 4456 Red Panda Cir NW

- 8459 Audubon St NW

- 4804 Ranier Ave NW

- 8325 Condor Cir NW

- 8572 Yorkshire St NW

- 8251 Audubon St NW

- 8673 Dublin Ridge Cir NW Unit 4A

- 8555 Esquire St NW

- 8309 Gentry St NW

- 8798 Stoneshire St NW

- 4213 Columbia Ave NW

- 4195 Columbia Ave NW

- 4792 Revere Ave NW

- 7978 Parkford St NW

- 8484 Traphagen St NW

- 5271 Lake Vista Cir NW

- 4428 Trail Head Cir NW

- 4338 Greenway Trail St NW Unit 36

- 4374 Forest Glen Ave NW Unit 8

- 0 Cambridge St NW

- 4607 Ranier Ave NW

- 8465 Noble Loon St NW

- 8487 Noble Loon St NW

- 8436 Windy Hill Cir NW

- 8437 Noble Loon St NW

- 8437 Windy Hill Cir NW

- 8505 Noble Loon St NW

- 8424 Windy Hill Cir NW

- 4643 Ranier Ave NW

- 8415 Noble Loon St NW

- 8523 Noble Loon St NW

- 8464 Noble Loon St NW

- 8420 Windy Hill Cir NW

- 8486 Noble Loon St NW

- 8425 Windy Hill Cir NW

- 4520 Ranier Ave NW

- 4659 Ranier Ave NW

- 8452 Wooded Point Cir NW

- 8504 Noble Loon St NW

- 8397 Noble Loon St NW