Estimated Value: $60,000 - $123,000

3

Beds

2

Baths

1,752

Sq Ft

$53/Sq Ft

Est. Value

About This Home

This home is located at 459 Julian Ave, Lima, OH 45801 and is currently estimated at $93,000, approximately $53 per square foot. 459 Julian Ave is a home located in Allen County with nearby schools including Independence Elementary School, Lima North Middle School, and Lima West Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2025

Sold by

Honey Run Investments Llc

Bought by

Meeks Legacy Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,250

Outstanding Balance

$236,250

Interest Rate

6.72%

Mortgage Type

Credit Line Revolving

Estimated Equity

-$143,250

Purchase Details

Closed on

Oct 22, 2021

Sold by

Lepiota Rentals Ltd

Bought by

Honey Runivestments Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$530,000

Interest Rate

3.01%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

May 14, 1993

Sold by

Holman Robert L

Bought by

Bishop Charles W and Carol Ann

Purchase Details

Closed on

Jul 1, 1978

Bought by

Holman Robert L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meeks Legacy Llc | $315,000 | None Listed On Document | |

| Honey Runivestments Llc | $76,000 | None Available | |

| Honey Run Investments Llc | $76,000 | None Listed On Document | |

| Bishop Charles W | $33,000 | -- | |

| Holman Robert L | $25,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meeks Legacy Llc | $236,250 | |

| Previous Owner | Honey Run Investments Llc | $530,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $674 | $17,330 | $3,640 | $13,690 |

| 2023 | $614 | $13,650 | $2,870 | $10,780 |

| 2022 | $616 | $13,650 | $2,870 | $10,780 |

| 2021 | $651 | $13,650 | $2,870 | $10,780 |

| 2020 | $760 | $14,350 | $2,800 | $11,550 |

| 2019 | $760 | $14,350 | $2,800 | $11,550 |

| 2018 | $752 | $14,350 | $2,800 | $11,550 |

| 2017 | $762 | $14,350 | $2,800 | $11,550 |

| 2016 | $773 | $14,350 | $2,800 | $11,550 |

| 2015 | $891 | $14,350 | $2,800 | $11,550 |

| 2014 | $891 | $16,490 | $2,730 | $13,760 |

| 2013 | $868 | $16,490 | $2,730 | $13,760 |

Source: Public Records

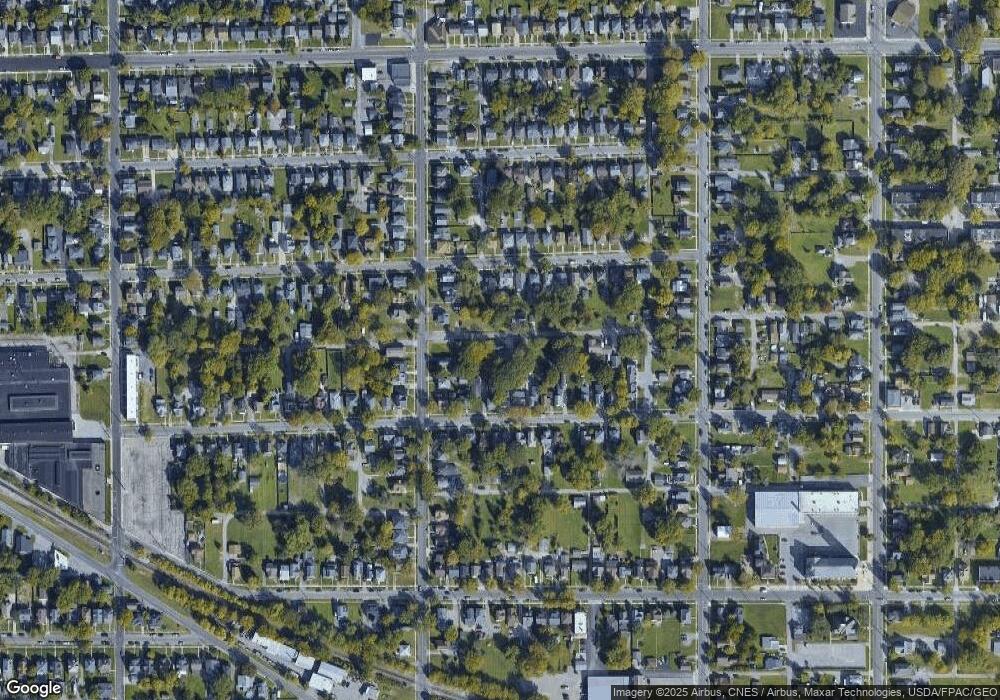

Map

Nearby Homes

- 416 Hazel Ave

- 435 Marian Ave

- 5 Unit Package

- 555 Haller St

- 816 N Baxter St

- 745 Richie Ave

- 431 N Metcalf St

- 627 Brice Ave

- 735 Brice Ave

- 934 N Metcalf St

- 841 N Baxter St

- 631 Hazel Ave

- 753 Brice Ave

- 774 W Wayne St

- 406 Ewing Ave

- 514 & 516 N Elizabeth St

- 325 N McDonel St

- 703 N Collett St

- 316 Ewing Ave

- 615 N Collett St

Your Personal Tour Guide

Ask me questions while you tour the home.