46-1063 Emepela Way Unit 6 Kaneohe, HI 96744

Estimated Value: $575,000 - $633,000

2

Beds

1

Bath

717

Sq Ft

$846/Sq Ft

Est. Value

About This Home

This home is located at 46-1063 Emepela Way Unit 6, Kaneohe, HI 96744 and is currently estimated at $606,580, approximately $845 per square foot. 46-1063 Emepela Way Unit 6 is a home located in Honolulu County with nearby schools including Heeia Elementary School, Governor Samuel Wilder King Intermediate School, and Castle High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2020

Sold by

Ajifu Leonard S and Leonard Shoji Ajifu Revocable

Bought by

Ojeda Nicholas Brandon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$491,040

Outstanding Balance

$435,002

Interest Rate

3.4%

Mortgage Type

VA

Estimated Equity

$171,578

Purchase Details

Closed on

Apr 8, 2003

Sold by

Lau Constance Hee and Thompson Charles Nainoa

Bought by

Ajifu Leonard S and Leonard Shoji Ajifu Revocable Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,800

Interest Rate

5.75%

Mortgage Type

Unknown

Purchase Details

Closed on

Jun 10, 1997

Sold by

Ajifu Leonard Shoji

Bought by

Ajifu Leonard S and Leonard Shoji Ajifu Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ojeda Nicholas Brandon | $48,000 | Hta | |

| Ojeda Nicholas Brandon | $48,000 | Hta | |

| Ajifu Leonard S | $59,400 | -- | |

| Ajifu Leonard S | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ojeda Nicholas Brandon | $491,040 | |

| Closed | Ojeda Nicholas Brandon | $491,040 | |

| Previous Owner | Ajifu Leonard S | $145,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,779 | $576,000 | $119,900 | $456,100 |

| 2024 | $1,779 | $628,300 | $112,800 | $515,500 |

| 2023 | $1,395 | $598,500 | $112,800 | $485,700 |

| 2022 | $1,480 | $522,800 | $107,200 | $415,600 |

| 2021 | $1,315 | $475,800 | $104,300 | $371,500 |

| 2020 | $1,951 | $557,300 | $98,700 | $458,600 |

| 2019 | $1,257 | $550,400 | $91,700 | $458,700 |

| 2018 | $1,257 | $479,100 | $66,300 | $412,800 |

| 2017 | $1,084 | $429,700 | $56,400 | $373,300 |

| 2016 | $1,065 | $384,400 | $43,400 | $341,000 |

| 2015 | $1,043 | $378,000 | $41,600 | $336,400 |

| 2014 | $823 | $354,200 | $39,800 | $314,400 |

Source: Public Records

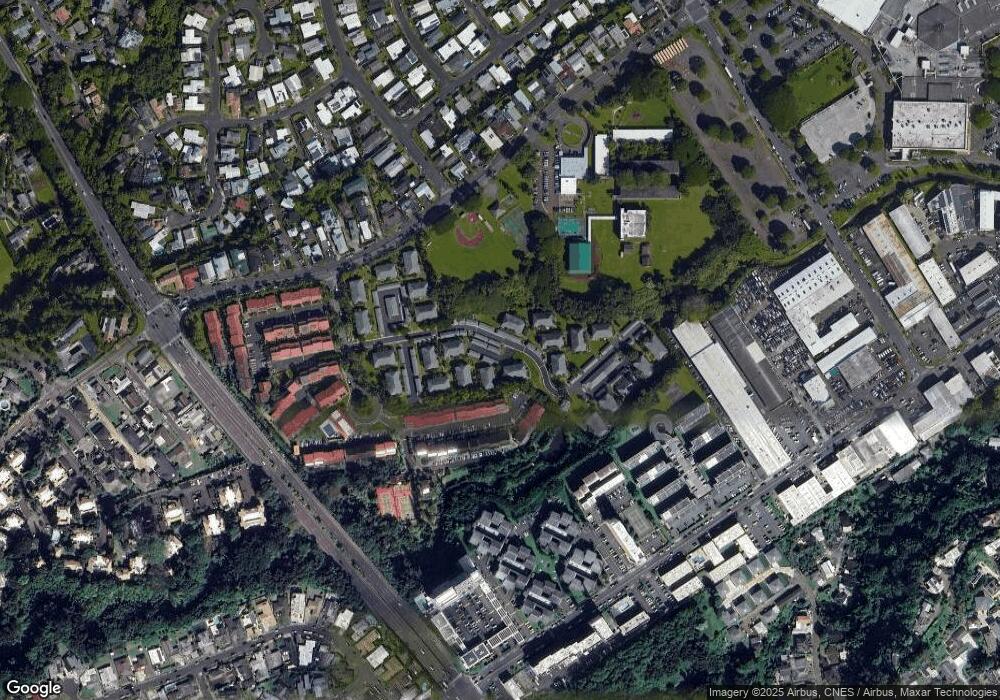

Map

Nearby Homes

- 46-78 Emepela Place Unit K104

- 46-078 Emepela Place Unit M102

- 46-078 Emepela Place Unit K102

- 46-63 Emepela Place Unit U206

- 46-63 Emepela Place Unit P205

- 46-1006 Emepela Way Unit 24

- 46-1002 Emepela Way Unit 25R

- 46-269 Kahuhipa St Unit D305

- 46-283 Kahuhipa St Unit C602

- 46-255 Kahuhipa St Unit A201

- 46-255 Kahuhipa St Unit A1004

- 46-261 Kahuhipa St Unit 203

- 46-261 Kahuhipa St Unit 101

- 46-263 Kahuhipa St Unit B311

- 46-263 Kahuhipa St Unit B107

- 46-232 Kahuhipa St Unit B205

- 46-232 Kahuhipa St Unit F204

- 46-232 Kahuhipa St Unit D202

- 46-270 Kahuhipa St Unit A619

- 46-270 Kahuhipa St Unit A419

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6T

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6A

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6

- 46-1061 Emepela Way Unit 5

- 46-1061 Emepela Way Unit S

- 46-1061 Emepela Way Unit 5

- 46-1061 Emepela Way Unit 5

- 46-1061 Emepela Way Unit 5

- 46-1061 Emepela Way Unit 5

- 46-1061 Emepela Way Unit 5

- 46-1061 Emepela Way Unit 5

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1