46-1065 Emepela Way Unit 1 Kaneohe, HI 96744

Estimated Value: $535,000 - $690,351

2

Beds

2

Baths

810

Sq Ft

$774/Sq Ft

Est. Value

About This Home

This home is located at 46-1065 Emepela Way Unit 1, Kaneohe, HI 96744 and is currently estimated at $626,588, approximately $773 per square foot. 46-1065 Emepela Way Unit 1 is a home located in Honolulu County with nearby schools including Heeia Elementary School, Governor Samuel Wilder King Intermediate School, and Castle High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 13, 2015

Sold by

Valencia Bennett Zakaria and Siatini Valencia Neilani Merina

Bought by

Miyakawa Kazuya

Current Estimated Value

Purchase Details

Closed on

Jul 22, 2009

Sold by

Lihalakha Albert Mumasi

Bought by

Valencia Bennett Zakaria and Siatini Neilani Merina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,637

Interest Rate

5.31%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 21, 2005

Sold by

Plotts Diane Joyce and Kihune Robert Kalani Uichi

Bought by

Lihalakha Albert Mumasi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,600

Interest Rate

6.45%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miyakawa Kazuya | $415,000 | First American | |

| Miyakawa Kazuya | $415,000 | First American | |

| Valencia Bennett Zakaria | $295,000 | Fam | |

| Lihalakha Albert Mumasi | $67,000 | Tg |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Valencia Bennett Zakaria | $269,637 | |

| Previous Owner | Lihalakha Albert Mumasi | $297,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,485 | $656,500 | $135,400 | $521,100 |

| 2024 | $2,485 | $709,900 | $127,400 | $582,500 |

| 2023 | $2,364 | $675,500 | $127,400 | $548,100 |

| 2022 | $2,008 | $573,600 | $121,100 | $452,500 |

| 2021 | $1,840 | $525,800 | $117,900 | $407,900 |

| 2020 | $2,140 | $611,500 | $111,500 | $500,000 |

| 2019 | $2,137 | $610,600 | $103,500 | $507,100 |

| 2018 | $1,845 | $527,200 | $74,900 | $452,300 |

| 2017 | $1,674 | $478,300 | $63,700 | $414,600 |

| 2016 | $1,548 | $442,300 | $49,000 | $393,300 |

| 2015 | $1,183 | $418,000 | $47,000 | $371,000 |

| 2014 | $922 | $393,600 | $44,900 | $348,700 |

Source: Public Records

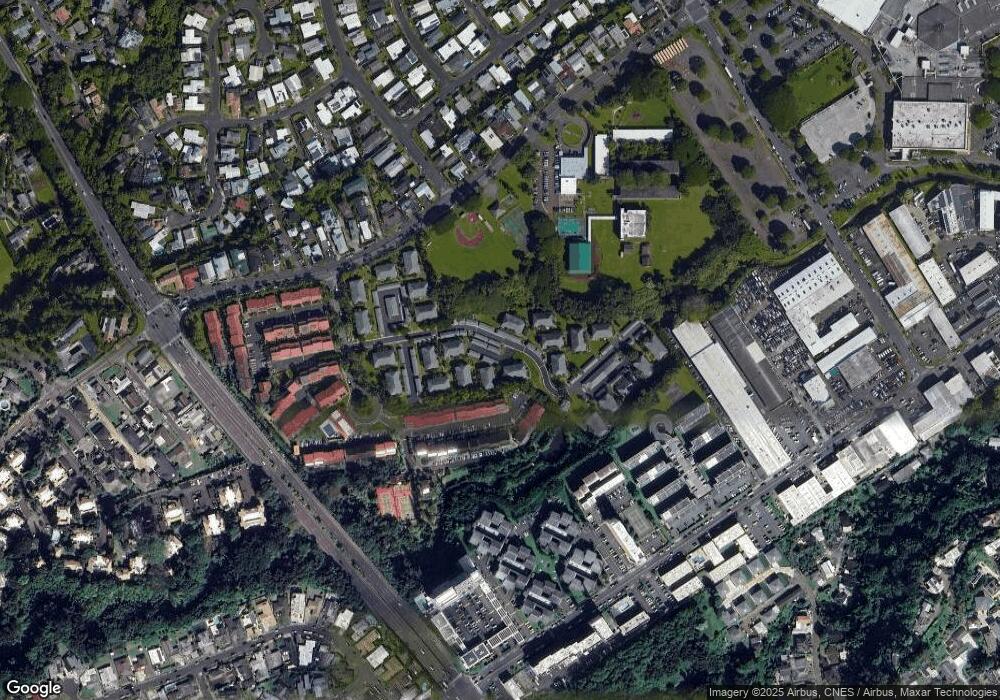

Map

Nearby Homes

- 46-63 Emepela Place Unit U206

- 46-63 Emepela Place Unit P205

- 46-78 Emepela Place Unit K104

- 46-078 Emepela Place Unit M102

- 46-078 Emepela Place Unit K102

- 46-1006 Emepela Way Unit 24

- 46-1002 Emepela Way Unit 25R

- 46-269 Kahuhipa St Unit D305

- 46-283 Kahuhipa St Unit C602

- 46-261 Kahuhipa St Unit 203

- 46-261 Kahuhipa St Unit 101

- 46-255 Kahuhipa St Unit A201

- 46-255 Kahuhipa St Unit A1004

- 46-263 Kahuhipa St Unit B311

- 46-263 Kahuhipa St Unit B107

- 46-270 Kahuhipa St Unit A619

- 46-270 Kahuhipa St Unit A419

- 46-232 Kahuhipa St Unit B205

- 46-232 Kahuhipa St Unit F204

- 46-232 Kahuhipa St Unit D202

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1D

- 46-1065 Emepela Way Unit 1

- 46-1065 Emepela Way Unit 1

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6T

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6A

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6

- 46-1063 Emepela Way Unit 6

- 46-1067 Emepela Way Unit 2B

- 46-1067 Emepela Way Unit 2

- 46-1067 Emepela Way Unit 2

- 46-1067 Emepela Way Unit 2

- 46-1067 Emepela Way Unit 2