4621 S Granite Ave Unit F2 Tulsa, OK 74135

Stevenson NeighborhoodEstimated Value: $189,000 - $208,758

3

Beds

3

Baths

1,540

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 4621 S Granite Ave Unit F2, Tulsa, OK 74135 and is currently estimated at $198,690, approximately $129 per square foot. 4621 S Granite Ave Unit F2 is a home located in Tulsa County with nearby schools including Key Elementary School, Memorial Middle School, and Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 7, 2024

Sold by

Edward Pilstrom Lance

Bought by

Nations Joseph L

Current Estimated Value

Purchase Details

Closed on

Nov 18, 2022

Sold by

Kaminos Llc

Bought by

Nations Joseph L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

7.08%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 9, 2022

Sold by

Rodriguez Derincon Rosalba and Rodriguez Saul

Bought by

Kaminos Llc

Purchase Details

Closed on

Aug 10, 2022

Sold by

Jones Diana L

Bought by

Derincon Rosalba Rodriguez and Hudgins Kimberly

Purchase Details

Closed on

Sep 15, 2004

Sold by

Reynolds Glenn Z and Reynolds Patsy R

Bought by

May Miriam Layne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,200

Interest Rate

5.95%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 1, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nations Joseph L | -- | None Listed On Document | |

| Nations Joseph L | $175,000 | Integrity Title & Closing | |

| Kaminos Llc | -- | -- | |

| Derincon Rosalba Rodriguez | $156,000 | Integrity Title & Closing | |

| May Miriam Layne | $79,000 | Scott Title & Escrow Co Inc | |

| -- | $53,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Nations Joseph L | $140,000 | |

| Previous Owner | May Miriam Layne | $63,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,443 | $19,250 | $1,617 | $17,633 |

| 2023 | $2,443 | $19,250 | $1,617 | $17,633 |

| 2022 | $1,451 | $10,880 | $1,481 | $9,399 |

| 2021 | $1,437 | $10,880 | $1,481 | $9,399 |

| 2020 | $1,417 | $10,880 | $1,481 | $9,399 |

| 2019 | $1,491 | $10,880 | $1,481 | $9,399 |

| 2018 | $1,494 | $10,880 | $1,481 | $9,399 |

| 2017 | $1,491 | $11,880 | $1,617 | $10,263 |

| 2016 | $1,432 | $11,670 | $1,588 | $10,082 |

| 2015 | $1,389 | $11,330 | $1,617 | $9,713 |

| 2014 | $1,376 | $11,330 | $1,617 | $9,713 |

Source: Public Records

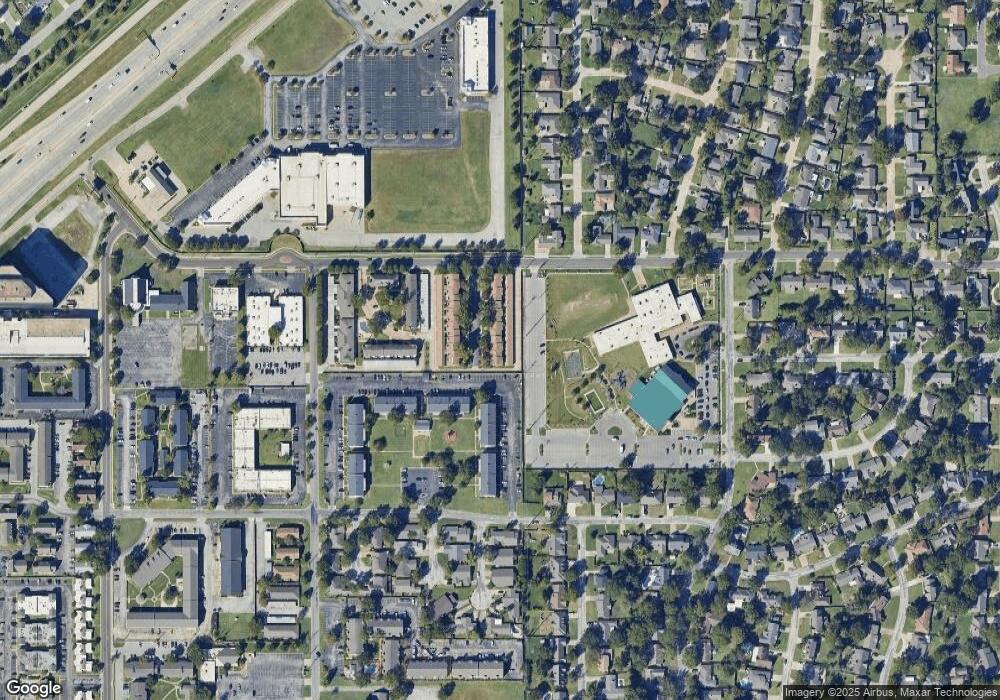

Map

Nearby Homes

- 5538 E 46th St Unit 9

- 5518 E 46th St Unit 5518

- 5342 E 47th Place Unit 1

- 4533 S Hudson Place

- 4760 S Irvington Ave

- 4771 S Hudson Place

- 4730 S Joplin Ave

- 5915 E 47th Place

- 5511 E 51st St Unit 3A

- 4749 S Irvington Place

- 4723 S Joplin Ave

- 5722 E 43rd St

- 5923 E 48th St

- 5934 E 48th St

- 5858 E 50th St

- 4672 S Norwood Ave

- 4665 S Norwood Ave

- 4803 E 46th St

- 4620 S Winston Ave

- 5220 S Joplin Ave

- 4621 S Granite Ave

- 4621 S Granite Ave Unit 4621

- 4623 S Granite Ave

- 4623 S Granite Ave Unit F-3

- 4619 S Granite Ave

- 4617 S Granite Ave

- 4625 S Granite Ave

- 4615 S Granite Ave

- 4613 S Granite Ave

- 4611 S Granite Ave

- 4611 S Granite Ave Unit 4611

- 4611 S Granite Ave Unit E2

- 4609 S Granite Ave

- 4620 S Granite Ave

- 4624 S Granite Ave

- 4624 S Granite Ave Unit 2A

- 4618 S Granite Ave Unit B1

- 4626 S Granite Ave

- 4622 S Granite Ave Unit A3

- 4616 S Granite Ave Unit B2