4622 Claremore Chase Fort Wayne, IN 46845

Estimated Value: $568,000 - $606,000

5

Beds

4

Baths

3,986

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 4622 Claremore Chase, Fort Wayne, IN 46845 and is currently estimated at $581,358, approximately $145 per square foot. 4622 Claremore Chase is a home located in Allen County with nearby schools including Cedar Canyon Elementary School, Maple Creek Middle School, and Carroll High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2020

Sold by

Murray Daniel J and Murray Martha M

Bought by

Martha M Murray Revocable Trus

Current Estimated Value

Purchase Details

Closed on

Jul 17, 2020

Sold by

Murray Daniel J and Murray Martha M

Bought by

Murray Martha M and Martha M Murray Revocable Trus

Purchase Details

Closed on

Feb 15, 2002

Sold by

Windsor Inc

Bought by

Murray Daniel J and Murray Martha M

Purchase Details

Closed on

Oct 24, 2001

Sold by

Npt Development Corp

Bought by

Somerset Land Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$889,821

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Murray Martha M | -- | None Available | |

| Murray Daniel J | -- | -- | |

| Somerset Land Development Llc | -- | Three Rivers Title Company I | |

| Martha M Murray Revocable Trus | -- | None Listed On Document |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Somerset Land Development Llc | $889,821 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,079 | $525,700 | $57,600 | $468,100 |

| 2023 | $4,079 | $510,800 | $57,600 | $453,200 |

| 2022 | $3,634 | $447,100 | $57,600 | $389,500 |

| 2021 | $3,407 | $400,400 | $57,600 | $342,800 |

| 2020 | $3,312 | $379,900 | $57,600 | $322,300 |

| 2019 | $3,406 | $378,200 | $57,600 | $320,600 |

| 2018 | $2,910 | $325,200 | $57,600 | $267,600 |

| 2017 | $2,935 | $312,000 | $57,600 | $254,400 |

| 2016 | $3,058 | $314,600 | $57,600 | $257,000 |

| 2014 | $2,939 | $293,900 | $57,600 | $236,300 |

| 2013 | $2,969 | $296,900 | $67,900 | $229,000 |

Source: Public Records

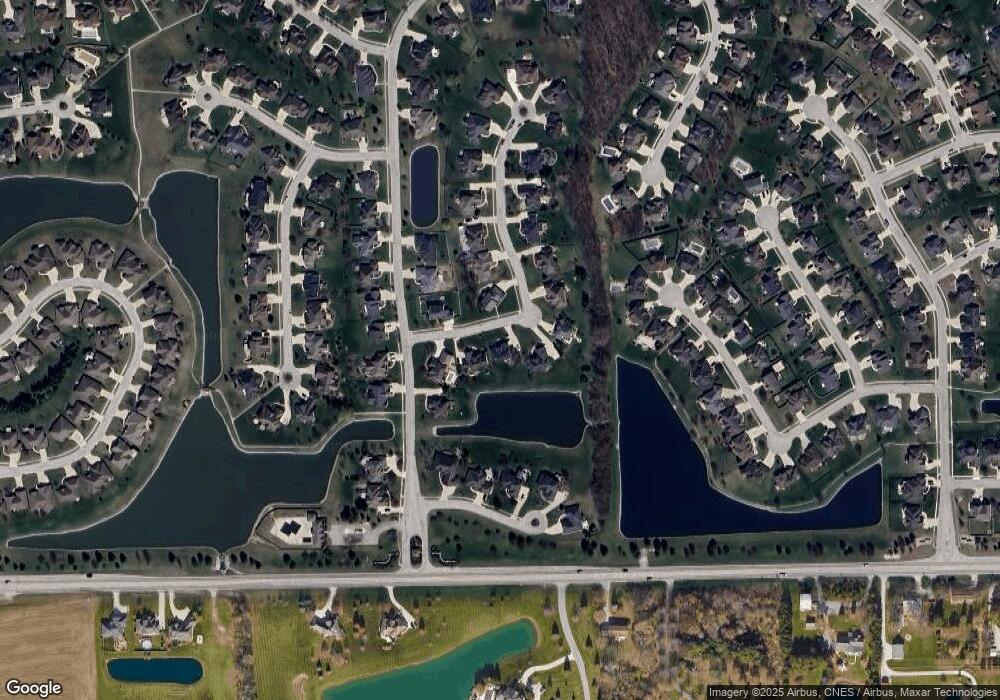

Map

Nearby Homes

- 13004 Garnet Hill

- 12825 Tuscany Way

- 4326 Hatcher Pass

- 5203 Brunello Terrace

- 5236 Argiano Crossing

- 13306 Sangiovese Place

- 4221 Cordell Cove

- 5432 Argiano Crossing

- 4421 Norarrow Dr

- 4121 Norarrow Dr

- 4321 Norarrow Dr

- 13525 Tonkel Rd

- 11427 Red Fern Place

- 13335 Passerine Blvd

- 161 Tumbling Stone Ct

- 12985 Passerine Blvd

- 13108 Passerine Blvd

- 13991 Elderflower Cove

- 5118 Hursh Rd

- 6030 Arvada Way

- 4630 Claremore Chase

- 12915 Garnett Hill

- 12906 Garnett Hill

- 12832 Sutters Pkwy

- 12818 Sutters Pkwy

- 12914 Garnett Hill

- 4607 Claremore Chase

- 12923 Garnett Hill

- 12922 Garnett Hill

- 12916 Sutters Pkwy

- 4609 Shelter Cove

- 4617 Shelter Cove

- 12931 Garnett Hill

- 4601 Shelter Cove

- 12919 Palazzo Blvd

- 12835 Sutters Pkwy

- 12930 Garnett Hill

- 12924 Sutters Pkwy

- 4625 Shelter Cove

- 12821 Sutters Pkwy