Estimated Value: $174,000 - $229,000

3

Beds

1

Bath

1,056

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 4627 E 460, Pryor, OK 74361 and is currently estimated at $189,383, approximately $179 per square foot. 4627 E 460 is a home located in Mayes County with nearby schools including Pryor Middle School and Pryor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 18, 2019

Sold by

Tilley Judy E

Bought by

Tilley Judy E and The Judy E Tilley Trust

Current Estimated Value

Purchase Details

Closed on

Sep 2, 2008

Sold by

Secretary Of Housing And Urban Developme

Bought by

Gilchrist Arthur

Purchase Details

Closed on

Aug 9, 2006

Sold by

Monahan F Scott and Monahan Tammy L

Bought by

Martin Ronald R and Martin Agnes B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,852

Interest Rate

6.78%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 15, 1998

Sold by

Bayless Alfred

Bought by

Monahan F Scott

Purchase Details

Closed on

Dec 17, 1997

Sold by

Jackson Arthur P and Jackson

Bought by

Bayless Alfred

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tilley Judy E | -- | None Available | |

| Gilchrist Arthur | -- | None Available | |

| Martin Ronald R | $82,500 | Mayes County Abstract Compan | |

| Monahan F Scott | $40,000 | -- | |

| Bayless Alfred | $25,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Martin Ronald R | $81,852 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $983 | $11,636 | $3,011 | $8,625 |

| 2023 | $936 | $10,554 | $2,716 | $7,838 |

| 2022 | $840 | $10,051 | $2,529 | $7,522 |

| 2021 | $808 | $9,573 | $2,517 | $7,056 |

| 2020 | $755 | $9,117 | $2,426 | $6,691 |

| 2019 | $741 | $8,683 | $2,034 | $6,649 |

| 2018 | $719 | $8,467 | $2,034 | $6,433 |

| 2017 | $646 | $8,183 | $2,071 | $6,112 |

| 2016 | $621 | $7,794 | $1,908 | $5,886 |

| 2015 | $551 | $7,794 | $1,908 | $5,886 |

| 2014 | $551 | $7,794 | $1,908 | $5,886 |

Source: Public Records

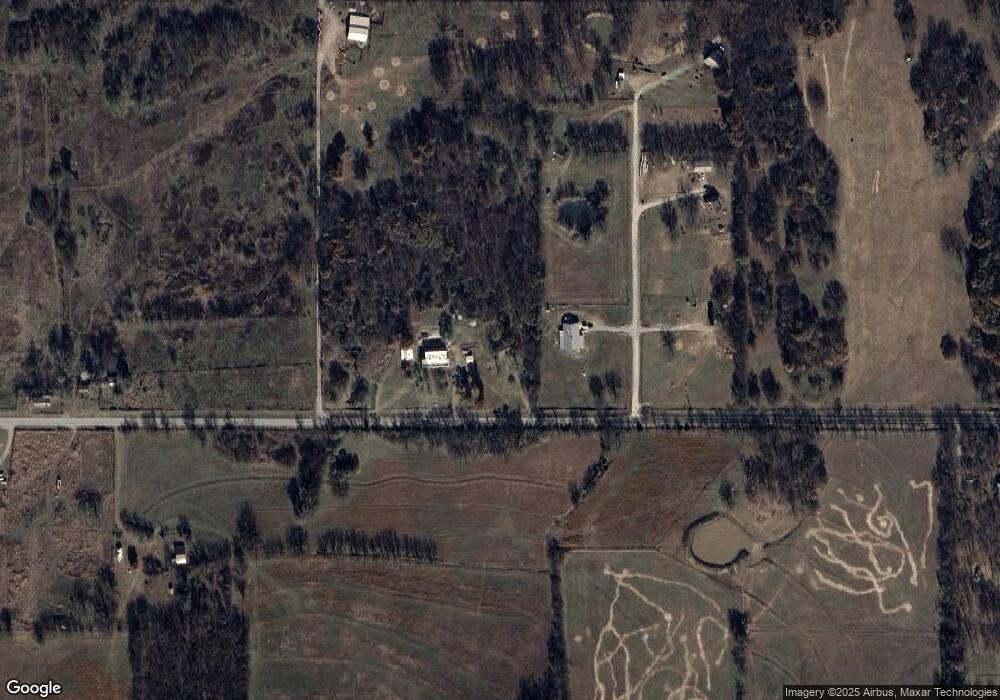

Map

Nearby Homes

- 3188 N 4403 Ln

- 2128 E 4675

- 0 N 4390 Rd Unit 2550978

- 560 N 4395

- 4592 E 480

- 4590 E 480

- 3152 E 4675 Rd

- 3901 E 440 Rd

- 900 N 4389 Ln

- 5931 N 440 Rd

- 2801 E 480

- 18 W Elm

- 302 Mountain Top Rd

- 33 E Center St

- 34 Hickory Ln

- 306 Mountain Top

- 5558 N 441 Rd

- 0 N 440 Rd Unit 2605157

- 0 N 440 Rd Unit 26-312

- 116 Eagleview

Your Personal Tour Guide

Ask me questions while you tour the home.