4640 Smothers Rd Westerville, OH 43081

Genoa NeighborhoodEstimated Value: $880,000 - $1,094,758

4

Beds

4

Baths

3,502

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 4640 Smothers Rd, Westerville, OH 43081 and is currently estimated at $998,440, approximately $285 per square foot. 4640 Smothers Rd is a home located in Delaware County with nearby schools including Mark Twain Elementary School, Walnut Springs Middle School, and Westerville-North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2007

Sold by

Mckahan William E

Bought by

Rennie Jackson E and Rennie Lori A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$398,000

Outstanding Balance

$250,021

Interest Rate

6.33%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$748,419

Purchase Details

Closed on

May 7, 2004

Sold by

Mckahan Marianne

Bought by

Mckahan Ii William E

Purchase Details

Closed on

Apr 2, 2003

Sold by

Mckahan William E

Bought by

Mckahan Marianne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,000

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 30, 2001

Sold by

Spahn Mitchell W

Bought by

Mckahan William E and Mckahan Marianne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,500

Interest Rate

7.02%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 25, 1998

Sold by

Walt Morrow Builders Inc

Bought by

Spahn Mitchell W and Spahn Sheryl M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$397,520

Interest Rate

7.15%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 2, 1997

Sold by

Bay Ridge Assoc

Bought by

Walt Morrow Builder Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$371,175

Interest Rate

8.05%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rennie Jackson E | $498,000 | Talon Group | |

| Mckahan Ii William E | -- | -- | |

| Mckahan Marianne | -- | Title First Agency Inc | |

| Mckahan William E | $530,000 | -- | |

| Spahn Mitchell W | $496,900 | -- | |

| Walt Morrow Builder Inc | $90,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rennie Jackson E | $398,000 | |

| Closed | Mckahan Marianne | $435,000 | |

| Closed | Mckahan William E | $450,500 | |

| Previous Owner | Spahn Mitchell W | $397,520 | |

| Previous Owner | Walt Morrow Builder Inc | $371,175 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $14,845 | $285,890 | $84,250 | $201,640 |

| 2023 | $14,552 | $285,890 | $84,250 | $201,640 |

| 2022 | $13,735 | $207,660 | $62,270 | $145,390 |

| 2021 | $13,872 | $207,660 | $62,270 | $145,390 |

| 2020 | $13,956 | $207,660 | $62,270 | $145,390 |

| 2019 | $12,645 | $180,570 | $54,150 | $126,420 |

| 2018 | $12,261 | $180,570 | $54,150 | $126,420 |

| 2017 | $12,787 | $187,260 | $54,150 | $133,110 |

| 2016 | $13,672 | $187,260 | $54,150 | $133,110 |

| 2015 | $13,563 | $187,260 | $54,150 | $133,110 |

| 2014 | $13,400 | $187,260 | $54,150 | $133,110 |

| 2013 | $13,319 | $187,260 | $54,150 | $133,110 |

Source: Public Records

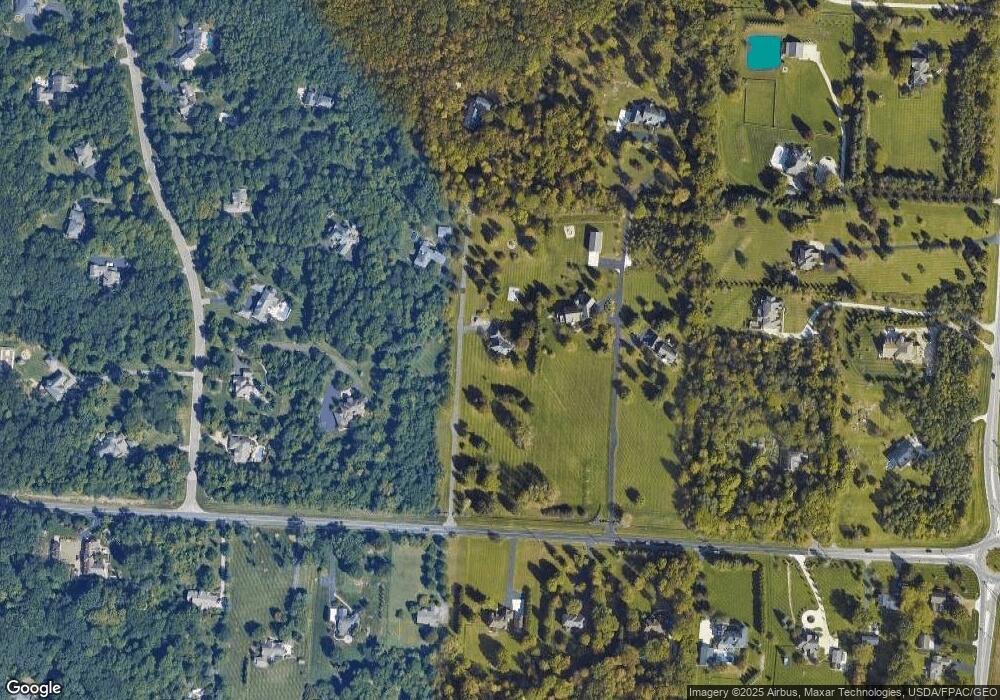

Map

Nearby Homes

- 4485 Smothers Rd

- 9119 Robinhood Cir

- 6999 Red Bank Rd

- 5360 Smothers Rd

- 6699 Cold Mountain Dr

- 4930 E Walnut St

- 4948 E Walnut St

- 6643 Cold Mountain Dr

- 6643 Bowery Peak Ln

- 6590 Bowery Peak Ln

- 6611 Lake of the Woods Point

- 5132 E Walnut St

- 1155 Ashford Ct

- 6477 Drasco Dr

- 5143 E Walnut St

- 1182 Lake Point

- 6452 Rockhold Dr

- 9200 Knoll Dr

- 11050 Fancher Rd Unit Lot 103

- 11050 Fancher Rd Unit 287

- 4692 Smothers Rd

- 4632 Smothers Rd

- 4700 Smothers Rd

- 7895 Silver Lake Ct

- 7845 Silver Lake Ct

- 4636 Smothers Rd

- 7925 Silver Lake Ct

- 7869 Silver Lake Ct

- 4585 Smothers Rd

- 7860 Red Bank Rd

- 4555 Smothers Rd

- 4615 Smothers Rd

- 4696 Smothers Rd

- 7969 Silver Lake Ct

- 7817 Silver Lake Ct

- 4780 Smothers Rd

- 7789 Silver Lake Ct

- 4653 Smothers Rd

- 4517 Smothers Rd

- 7830 Red Bank Rd