4643 S Crystal Way Unit F182 Aurora, CO 80015

Estimated Value: $318,952 - $339,000

2

Beds

3

Baths

1,108

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 4643 S Crystal Way Unit F182, Aurora, CO 80015 and is currently estimated at $325,988, approximately $294 per square foot. 4643 S Crystal Way Unit F182 is a home located in Arapahoe County with nearby schools including Sagebrush Elementary School, Laredo Middle School, and Smoky Hill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 10, 2016

Sold by

Javaherian Steven

Bought by

Bumpas Joseph A

Current Estimated Value

Purchase Details

Closed on

Aug 17, 2006

Sold by

Rhodes Sharon K

Bought by

Javaherian Steven

Purchase Details

Closed on

Feb 2, 1993

Sold by

Independence One Mortgage Corp

Bought by

Rhodes Sharon K

Purchase Details

Closed on

Mar 6, 1992

Sold by

Secretary Of Housing & Urban Dev

Bought by

Independence One Mortgage Corp

Purchase Details

Closed on

Jan 21, 1992

Sold by

Wright Mark Anthony

Bought by

Secretary Of Housing & Urban Dev

Purchase Details

Closed on

Oct 29, 1986

Sold by

Conversion Arapco

Bought by

Wright Mark Anthony

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bumpas Joseph A | $189,000 | Fidelity National Title Ins | |

| Javaherian Steven | $121,000 | Fahtco | |

| Rhodes Sharon K | -- | -- | |

| Independence One Mortgage Corp | -- | -- | |

| Secretary Of Housing & Urban Dev | -- | -- | |

| Wright Mark Anthony | -- | -- | |

| Conversion Arapco | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,436 | $20,630 | -- | -- |

| 2023 | $1,436 | $20,630 | $0 | $0 |

| 2022 | $1,316 | $18,049 | $0 | $0 |

| 2021 | $1,324 | $18,049 | $0 | $0 |

| 2020 | $1,125 | $15,558 | $0 | $0 |

| 2019 | $1,085 | $15,558 | $0 | $0 |

| 2018 | $1,024 | $13,795 | $0 | $0 |

| 2017 | $1,009 | $13,795 | $0 | $0 |

| 2016 | $822 | $10,547 | $0 | $0 |

| 2015 | $782 | $10,547 | $0 | $0 |

| 2014 | $551 | $6,575 | $0 | $0 |

| 2013 | -- | $7,690 | $0 | $0 |

Source: Public Records

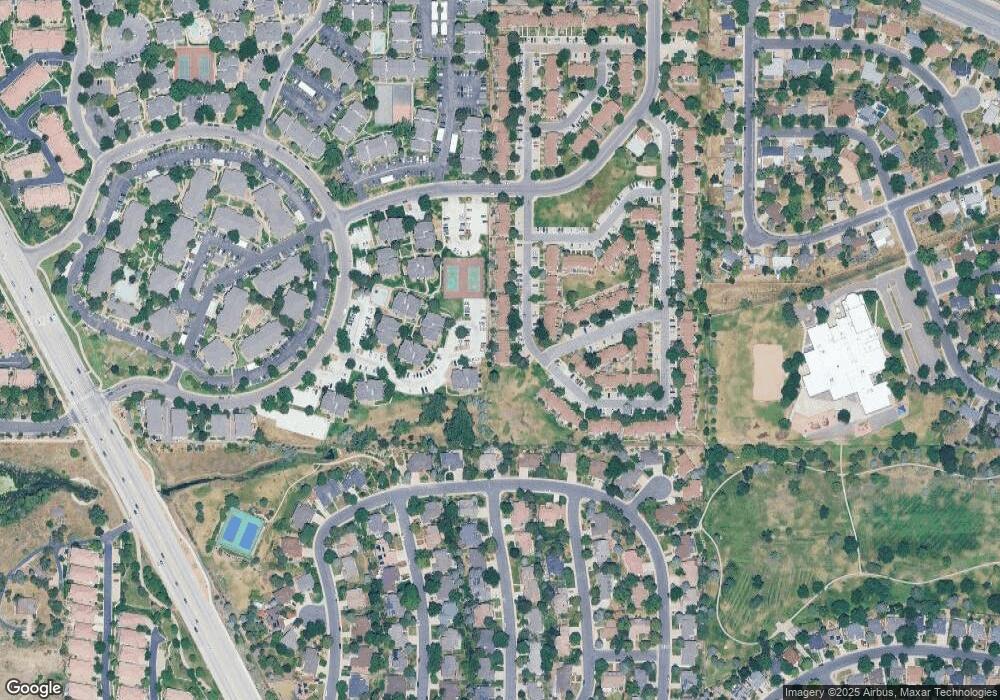

Map

Nearby Homes

- 4643 S Crystal Way Unit D184

- 14180 E Temple Dr Unit R03

- 14100 E Temple Dr Unit 5

- 4823 S Crystal St

- 4656 S Dillon Ct Unit D

- 4852 S Carson St

- 14572 E Tufts Ave

- 4971 S Parker Rd

- 4501 S Crystal Way Unit C303

- 14086 E Stanford Cir Unit F07

- 4933 S Carson St Unit 208

- 4933 S Carson St Unit 211

- 14503 E Wagontrail Dr

- 4538 S Atchison Way

- 13982 E Stanford Cir Unit N02

- 14207 E Grand Dr Unit 79

- 14296 E Whitaker Place Unit 110

- 14739 E Wagontrail Place

- 4973 S Dillon St Unit 135

- 14032 E Chenango Dr

- 4643 S Crystal Way Unit A187

- 4643 S Crystal Way Unit B186

- 4643 S Crystal Way Unit C185

- 4643 S Crystal Way Unit E183

- 4633 S Crystal Way Unit A193

- 4633 S Crystal Way Unit B192

- 4633 S Crystal Way Unit C191

- 4633 S Crystal Way Unit D190

- 4633 S Crystal Way Unit F188

- 4623 S Crystal Way Unit A201

- 4623 S Crystal Way Unit B200

- 4623 S Crystal Way Unit C199

- 4623 S Crystal Way Unit D198

- 4623 S Crystal Way Unit E197

- 4623 S Crystal Way Unit F196

- 4623 S Crystal Way Unit G195

- 4623 S Crystal Way Unit H194

- 4623 S Crystal Way

- 4623 S Crystal Way Unit GG195

- 4644 S Crystal Way Unit F181