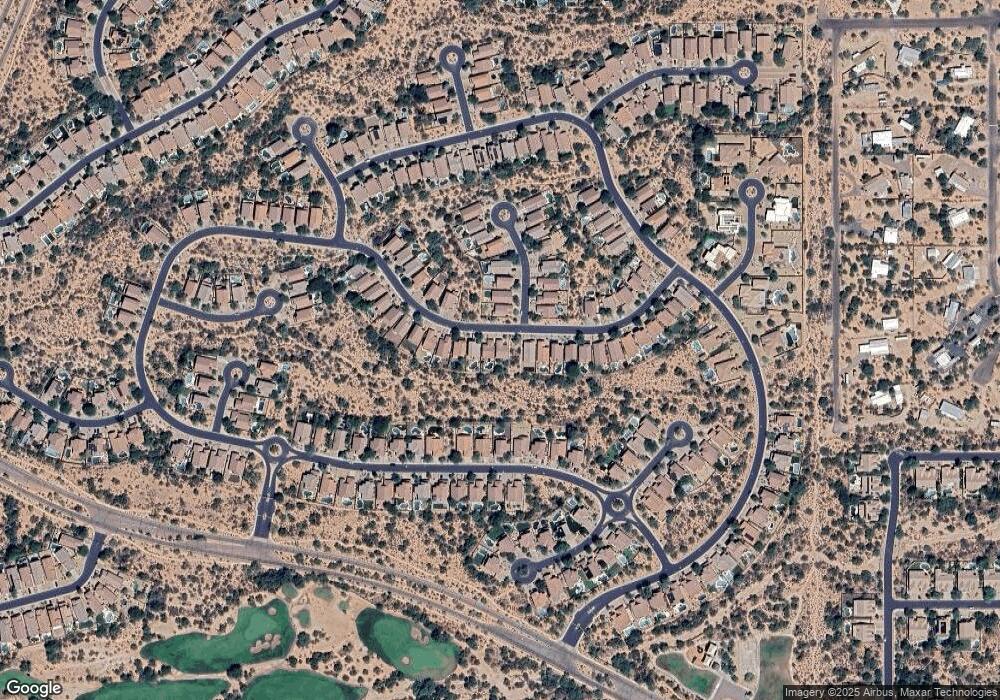

4649 E Matt Dillon Trail Cave Creek, AZ 85331

Desert View NeighborhoodEstimated Value: $412,297 - $551,000

3

Beds

2

Baths

1,314

Sq Ft

$382/Sq Ft

Est. Value

About This Home

This home is located at 4649 E Matt Dillon Trail, Cave Creek, AZ 85331 and is currently estimated at $501,324, approximately $381 per square foot. 4649 E Matt Dillon Trail is a home located in Maricopa County with nearby schools including Lone Mountain Elementary School, Cactus Shadows High School, and Sonoran Trails Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2009

Sold by

Bates Michele

Bought by

Hynes Vivian Marian

Current Estimated Value

Purchase Details

Closed on

Dec 5, 2001

Sold by

Delong Gregory J and Delong Judith A

Bought by

Bates Michele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,200

Interest Rate

7.01%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 14, 2000

Sold by

Shea Homes Arizona Ltd Partnership

Bought by

Delong Gregory J and Delong Judith A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,170

Interest Rate

7.89%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hynes Vivian Marian | $195,000 | Fidelity Natl Title Ins Co | |

| Bates Michele | $179,000 | Stewart Title & Trust | |

| Delong Gregory J | $161,474 | First American Title | |

| Shea Homes Arizona Ltd Partnership | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bates Michele | $143,200 | |

| Previous Owner | Delong Gregory J | $129,170 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,520 | $25,655 | -- | -- |

| 2024 | $1,417 | $24,433 | -- | -- |

| 2023 | $1,417 | $33,320 | $6,660 | $26,660 |

| 2022 | $1,378 | $25,300 | $5,060 | $20,240 |

| 2021 | $1,468 | $23,800 | $4,760 | $19,040 |

| 2020 | $1,434 | $21,800 | $4,360 | $17,440 |

| 2019 | $1,383 | $21,170 | $4,230 | $16,940 |

| 2018 | $1,330 | $20,170 | $4,030 | $16,140 |

| 2017 | $1,281 | $19,330 | $3,860 | $15,470 |

| 2016 | $1,259 | $19,110 | $3,820 | $15,290 |

| 2015 | $1,139 | $18,020 | $3,600 | $14,420 |

Source: Public Records

Map

Nearby Homes

- 4657 E Matt Dillon Trail

- 33460 N 47th Way

- 33235 N Symer Dr

- 4558 E Coyote Wash Dr

- 4726 E Woburn Ln

- 4602 E Thorn Tree Dr

- 4814 E Crimson Terrace

- 4510 E Thorn Tree Dr

- 4350 E Smokehouse Trail

- 4349 E Smokehouse Trail

- 544 E Amber Sun Dr

- 4541 E Brilliant Sky Dr

- 0 Black Mountain Pkwy Unit Q

- 1014 E Desert Sky Ct Unit 21174116

- 1022 E Desert Sky Ct

- 4929 E Tumbleweed Cir

- 33808 N Pate Place

- 34105 N 44th Place

- 4243 E Smokehouse Trail

- 33575 N Dove Lakes Dr Unit 2044

- 4645 E Matt Dillon Trail

- 4641 E Matt Dillon Trail

- 4661 E Matt Dillon Trail

- 4637 E Matt Dillon Trail

- 4665 E Matt Dillon Trail

- 33420 N 46th Place

- 4633 E Matt Dillon Trail

- 33417 N 46th Place

- 4669 E Matt Dillon Trail

- 33424 N 46th Place

- 33421 N 46th Place

- 4629 E Matt Dillon Trail

- 4628 E Matt Dillon Trail

- 4703 E Matt Dillon Trail

- 33425 N 46th Place

- 33428 N 46th Place

- 4625 E Matt Dillon Trail

- 4620 E Matt Dill0n Terrace

- 4620 E Matt Dillon Trail

- 4646 E Red Range Way

Your Personal Tour Guide

Ask me questions while you tour the home.