Estimated Value: $946,100 - $1,255,000

4

Beds

4

Baths

5,874

Sq Ft

$191/Sq Ft

Est. Value

About This Home

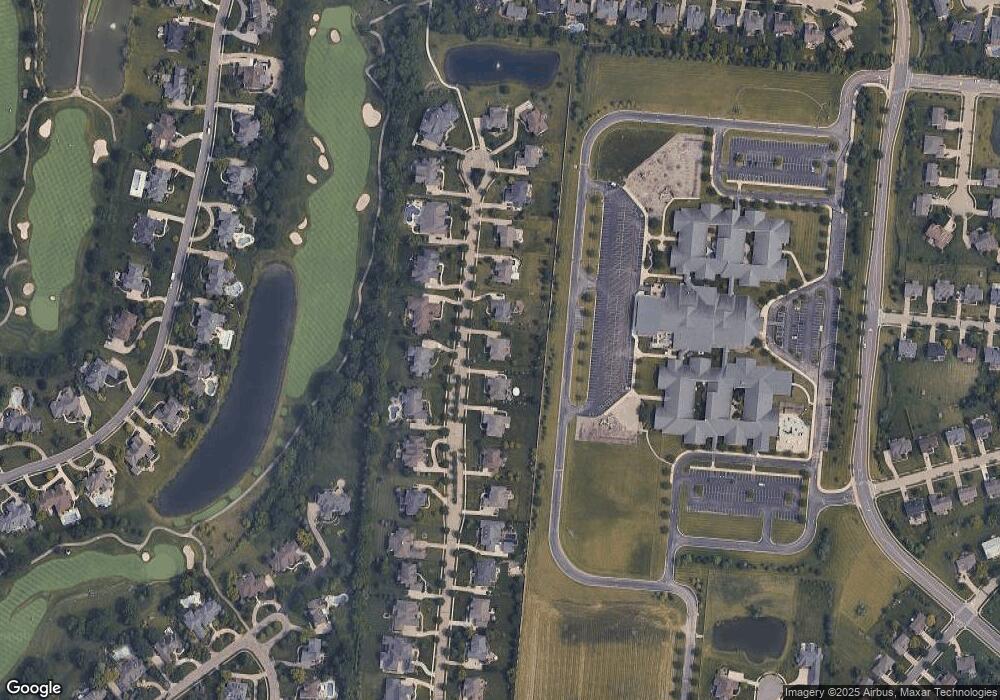

This home is located at 4680 Braid Ln, Mason, OH 45040 and is currently estimated at $1,119,033, approximately $190 per square foot. 4680 Braid Ln is a home located in Warren County with nearby schools including Mason Intermediate Elementary School, Mason Middle School, and William Mason High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2012

Sold by

John Henry Homes Inc

Bought by

Dapore Mark and Dapore Michelle

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Outstanding Balance

$30,720

Interest Rate

4%

Mortgage Type

FHA

Estimated Equity

$1,088,313

Purchase Details

Closed on

Sep 30, 2011

Sold by

Sjl Land Group Llc

Bought by

John Henry Homes Inc

Purchase Details

Closed on

Oct 14, 2010

Sold by

Mccormick 101 Llc

Bought by

Sjl Land Group Llc

Purchase Details

Closed on

Apr 10, 2009

Sold by

Dcb Homes Llc

Bought by

Mccormick 101 Llc

Purchase Details

Closed on

Mar 6, 2006

Sold by

Rhein Properties Llc

Bought by

Dcb Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,342,500

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dapore Mark | $526,400 | J & J Title | |

| John Henry Homes Inc | -- | None Available | |

| Sjl Land Group Llc | $225,000 | Attorney | |

| Mccormick 101 Llc | -- | None Available | |

| Dcb Homes Llc | $1,342,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dapore Mark | $215,000 | |

| Previous Owner | Dcb Homes Llc | $1,342,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,545 | $259,820 | $52,500 | $207,320 |

| 2023 | $10,952 | $227,976 | $59,325 | $168,651 |

| 2022 | $11,063 | $227,976 | $59,325 | $168,651 |

| 2021 | $10,477 | $227,976 | $59,325 | $168,651 |

| 2020 | $10,845 | $201,747 | $52,500 | $149,247 |

| 2019 | $9,995 | $201,747 | $52,500 | $149,247 |

| 2018 | $10,028 | $201,747 | $52,500 | $149,247 |

| 2017 | $9,746 | $183,029 | $45,721 | $137,309 |

| 2016 | $10,038 | $183,029 | $45,721 | $137,309 |

| 2015 | $10,059 | $183,029 | $45,721 | $137,309 |

| 2014 | $10,474 | $177,700 | $44,390 | $133,310 |

| 2013 | $10,496 | $210,170 | $52,500 | $157,670 |

Source: Public Records

Map

Nearby Homes

- 5017 Ainsley Dr

- 5747 Richmond Park Dr

- 4253 Maxwell Dr

- 4109 Maxwell Dr

- 5070 Lexington Ct

- 4521 Springhouse Ct

- 6306 Caddies Way

- 4734 Margaret Ct

- 4089 Ivygrove Ln

- 4782 Bordeaux Ln

- 5160 Hancock Ct

- 4029 Ivygrove Ln

- 4187 Westridge Dr

- 4490 Estate Ct

- 4938 Bordeaux Ln Unit 4938

- 4926 Bordeaux Ln

- 4922 Bordeaux Ln Unit 4922

- 5239 Concord Crossing Dr

- 5791 Running Fox Ln

- 4046 Westridge Dr

- 4700 Braid Ln

- 4660 Braid Ln

- 4638 Braid Ln

- 4722 Braid Ln

- 4665 Braid Ln

- 4744 Braid Ln

- 4723 Braid Ln Unit 248

- 4723 Braid Ln

- 4618 Braid Ln

- 4641 Braid Ln

- 4743 Braid Ln

- 4766 Braid Ln

- 4613 Braid Ln

- 4598 Braid Ln

- 263 Braid Ln Unit 263

- 262 Braid Ln Unit 262

- 242 Braid Ln

- 262 Braid Ln Unit 262

- 263 Braid Ln Unit 263

- 255 Braid Ln