46W655 Elm St Unit 7 Elburn, IL 60119

Estimated Value: $376,000 - $419,000

3

Beds

2

Baths

1,676

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 46W655 Elm St Unit 7, Elburn, IL 60119 and is currently estimated at $395,698, approximately $236 per square foot. 46W655 Elm St Unit 7 is a home located in Kane County with nearby schools including Kaneland Blackberry Creek Elementary School, Harter Middle School, and Kaneland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 14, 2002

Sold by

Enders Denise M and Harris Denise M

Bought by

Harris Roger E and Harris Denise E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Interest Rate

7.14%

Purchase Details

Closed on

Dec 29, 1998

Sold by

Long Marjorie B and Sigmund Patricia

Bought by

Enders Denise M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,000

Interest Rate

6.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harris Roger E | -- | -- | |

| Enders Denise M | $164,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Harris Roger E | $155,000 | |

| Closed | Enders Denise M | $123,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,090 | $104,403 | $26,129 | $78,274 |

| 2023 | $6,984 | $97,264 | $24,342 | $72,922 |

| 2022 | $6,901 | $89,184 | $22,320 | $66,864 |

| 2021 | $6,664 | $85,467 | $21,390 | $64,077 |

| 2020 | $6,473 | $82,521 | $20,653 | $61,868 |

| 2019 | $6,314 | $79,225 | $19,828 | $59,397 |

| 2018 | $5,845 | $72,213 | $18,073 | $54,140 |

| 2017 | $5,384 | $66,063 | $16,534 | $49,529 |

| 2016 | $4,956 | $60,178 | $15,061 | $45,117 |

| 2015 | -- | $56,189 | $14,063 | $42,126 |

| 2014 | -- | $56,189 | $14,063 | $42,126 |

| 2013 | -- | $60,588 | $15,164 | $45,424 |

Source: Public Records

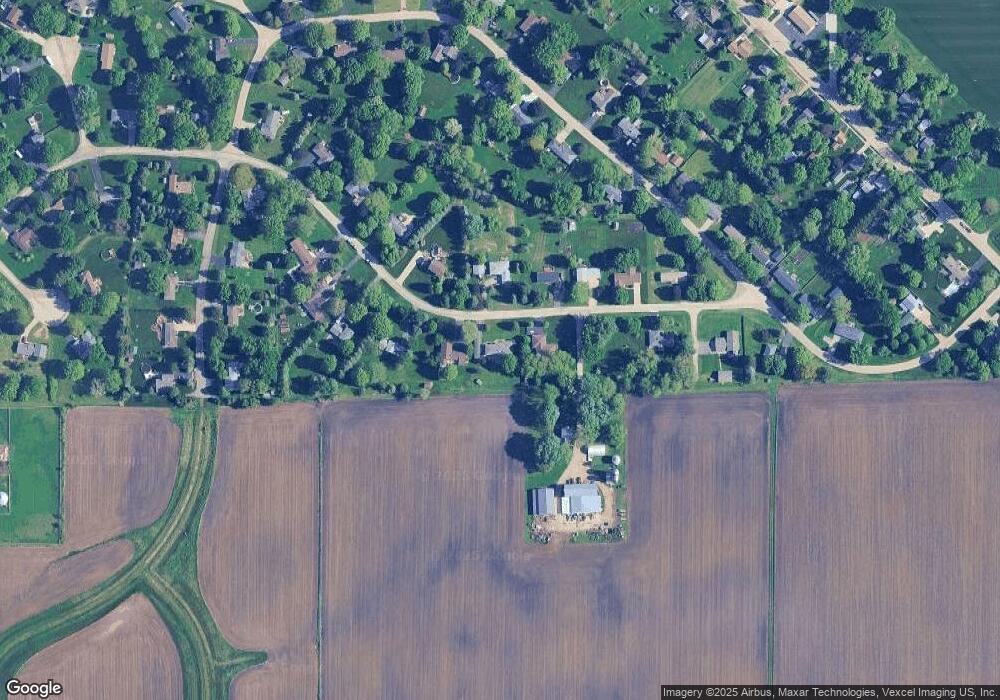

Map

Nearby Homes

- 0N119 Dauberman Rd

- 000 Finley Rd

- 3S520 Marian Ln

- 44W099 Finley Rd

- 43W690 Marian Cir

- 2S227 Green Rd

- 165 Schneider Rd

- 43W493 Thornapple Tree Rd

- LOT 7 Rowe Rd

- 44W700 Rowe Rd

- Lot 9 Rowe Rd

- 00 Rt 38 Rd

- 48W201 Keslinger Rd

- Lot #7 Derek Dr

- 16 Derek Dr

- 12 Derek Dr

- 6 Derek Dr

- 5 Derek Dr

- 4 Derek Dr

- 11 Derek Dr

- 46W681 Elm St

- 46W627 Elm St

- 46W660 Elm St Unit 7

- 46W615 Elm St

- 46W630 Elm St

- 46W703 Elm St Unit 7

- 46W682 Elm St

- 46W608 Elm St

- 46W563 Elm St Unit 2

- 46W578 Elm St

- 46W715 Elm St Unit 7

- 46W720 Elm St

- 46W731 Elm St

- 46W569 Locust St

- 46W554 Elm St

- 46W758 Locust St

- 46W615 Locust St

- 46W751 Elm St

- 46W740 Elm St

- 46W527 Elm St