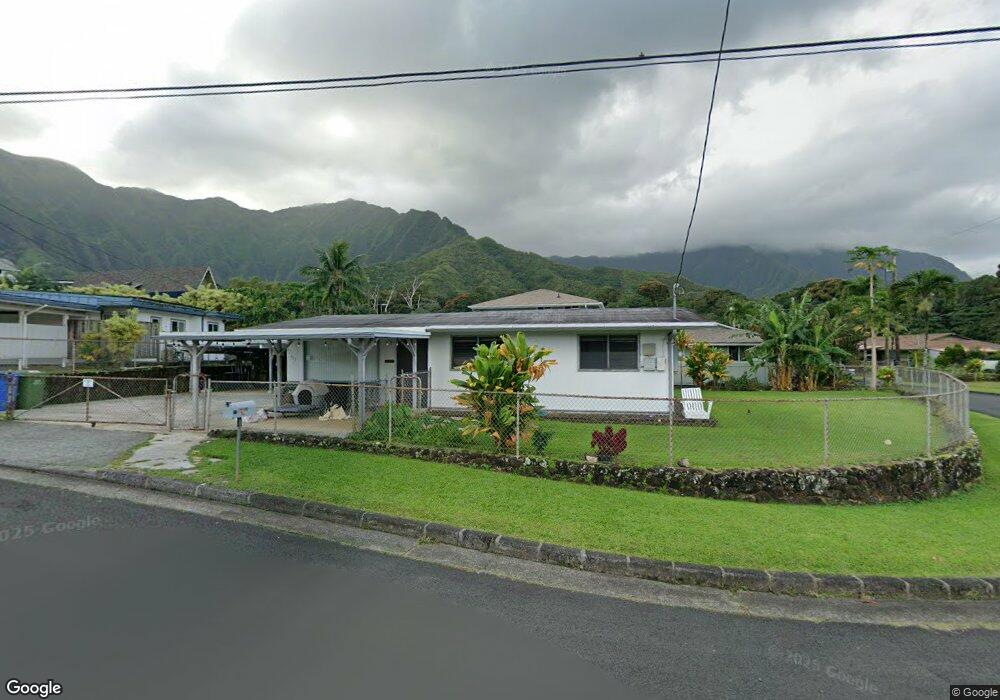

47-493 Apau Loop Kaneohe, HI 96744

Estimated Value: $918,000 - $1,036,000

3

Beds

2

Baths

912

Sq Ft

$1,049/Sq Ft

Est. Value

About This Home

This home is located at 47-493 Apau Loop, Kaneohe, HI 96744 and is currently estimated at $956,632, approximately $1,048 per square foot. 47-493 Apau Loop is a home located in Honolulu County with nearby schools including Kahaluu Elementary School, Governor Samuel Wilder King Intermediate School, and Castle High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 30, 2019

Sold by

Mahelona Patrick Jason Hina I and Mahelona Jennifer Ann

Bought by

Mahelona Patrick J H and Mahelona Jennifer A

Current Estimated Value

Purchase Details

Closed on

Oct 24, 2001

Sold by

Martin George William and Martin Faith Kanoohokahi

Bought by

Mahelona Patrick Jason Hinai and Mahelona Jennifer Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,644

Outstanding Balance

$76,692

Interest Rate

6.84%

Estimated Equity

$879,940

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mahelona Patrick J H | -- | None Available | |

| Mahelona Patrick J H | -- | None Available | |

| Mahelona Patrick J H | -- | None Available | |

| Mahelona Patrick Jason Hinai | $214,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mahelona Patrick Jason Hinai | $196,644 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,670 | $876,900 | $779,300 | $97,600 |

| 2024 | $2,670 | $882,800 | $779,300 | $103,500 |

| 2023 | $2,383 | $880,900 | $726,700 | $154,200 |

| 2022 | $2,262 | $746,200 | $631,900 | $114,300 |

| 2021 | $2,226 | $736,000 | $631,900 | $104,100 |

| 2020 | $2,142 | $712,100 | $574,000 | $138,100 |

| 2019 | $2,240 | $720,000 | $605,600 | $114,400 |

| 2018 | $2,097 | $679,100 | $505,500 | $173,600 |

| 2017 | $1,905 | $624,200 | $489,700 | $134,500 |

| 2016 | $1,758 | $582,300 | $468,700 | $113,600 |

| 2015 | $1,897 | $622,100 | $484,500 | $137,600 |

| 2014 | -- | $585,200 | $421,300 | $163,900 |

Source: Public Records

Map

Nearby Homes

- 47-544 Hakuhale St

- 47-481 Ahulimanu Place Unit 1902

- 47-449 Aiai Place

- 47-427 Ahuimanu Place

- Lot 14 Ahaolelo Rd

- 47-254 Ahaolelo Rd

- 47-646 Melekula Rd

- 47-325 Ahuimanu Rd

- 47-718 Hui Kelu St Unit 1504

- 47-712 Hui Kelu St Unit 181807

- 47-546 Mapele Place Unit B

- 47-654 Hui Kelu St Unit 7601

- 47-681 Hui Kelu St Unit 7106

- 47-546-E Mapele Place Unit A

- 47-62 Okana Place

- 47-270 Ahuimanu Rd

- 47-508 Hui Iwa St

- 47-403 Hui Iwa St Unit 4

- 47-401 Hui Iwa St Unit 3

- 47-316C Hui Iwa St Unit 603

- 47-504 Hio Place

- 47-495 Apau Loop

- 47-506 Hio Place

- 47-503 Hio Place

- 47-494 Apau Loop

- 47-488 Apau Loop

- 47-487 Apau Loop

- 47-499 Apau Loop

- 47-512 Hio Place

- 47-507 Hio Place

- 47-502 Apau Loop Unit 2207

- 47-510 Hio Place

- 47-484 Apau Loop

- 47-503 Apau Loop

- 47-508 Hio Place

- 47-511 Hio Place

- 47-483 Apau Loop

- 47-482 Apau Loop

- 47-516 Hio Place

- 47-506 Apau Loop