47-730 Hui Kelu St Unit 4403 Kaneohe, HI 96744

Estimated Value: $796,519 - $926,000

3

Beds

2

Baths

1,489

Sq Ft

$571/Sq Ft

Est. Value

About This Home

This home is located at 47-730 Hui Kelu St Unit 4403, Kaneohe, HI 96744 and is currently estimated at $850,130, approximately $570 per square foot. 47-730 Hui Kelu St Unit 4403 is a home located in Honolulu County with nearby schools including Ahuimanu Elementary School, Governor Samuel Wilder King Intermediate School, and Castle High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 17, 2010

Sold by

Weible Timothy Scott and Weible Diane Lynn

Bought by

Mcclure Bradley Dean and Dulay Lani Kuulei Aloha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$422,211

Outstanding Balance

$280,112

Interest Rate

5%

Mortgage Type

FHA

Estimated Equity

$570,018

Purchase Details

Closed on

Jul 16, 2004

Sold by

Meyer Danny Le Roy and Meyer Marian Alice

Bought by

Weible Timothy Scott and Weible Diane Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

6.27%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 28, 2002

Sold by

Roska David Christopher and Roska Lisa Ann

Bought by

Meyer Danny Le Roy and Meyer Marian Alice

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,500

Interest Rate

6.89%

Purchase Details

Closed on

Jun 15, 1999

Sold by

Jackson Malcolm John and Jackson Charlotte Puck

Bought by

Roska David Christopher and Roska Lisa Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,250

Interest Rate

7.24%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcclure Bradley Dean | $430,000 | Fam | |

| Weible Timothy Scott | $390,000 | -- | |

| Meyer Danny Le Roy | $216,000 | -- | |

| Roska David Christopher | $167,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcclure Bradley Dean | $422,211 | |

| Previous Owner | Weible Timothy Scott | $300,000 | |

| Previous Owner | Meyer Danny Le Roy | $209,500 | |

| Previous Owner | Roska David Christopher | $167,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,329 | $811,700 | $477,500 | $334,200 |

| 2024 | $2,329 | $785,500 | $449,400 | $336,100 |

| 2023 | $2,101 | $800,200 | $449,400 | $350,800 |

| 2022 | $2,014 | $675,500 | $426,900 | $248,600 |

| 2021 | $1,907 | $644,900 | $615,500 | $29,400 |

| 2020 | $1,801 | $614,600 | $590,900 | $23,700 |

| 2019 | $1,926 | $630,400 | $545,900 | $84,500 |

| 2018 | $1,909 | $625,400 | $501,400 | $124,000 |

| 2017 | $1,848 | $608,100 | $473,500 | $134,600 |

| 2016 | $1,773 | $586,700 | $445,700 | $141,000 |

| 2015 | $1,608 | $539,300 | $478,400 | $60,900 |

| 2014 | $1,506 | $528,300 | $458,800 | $69,500 |

Source: Public Records

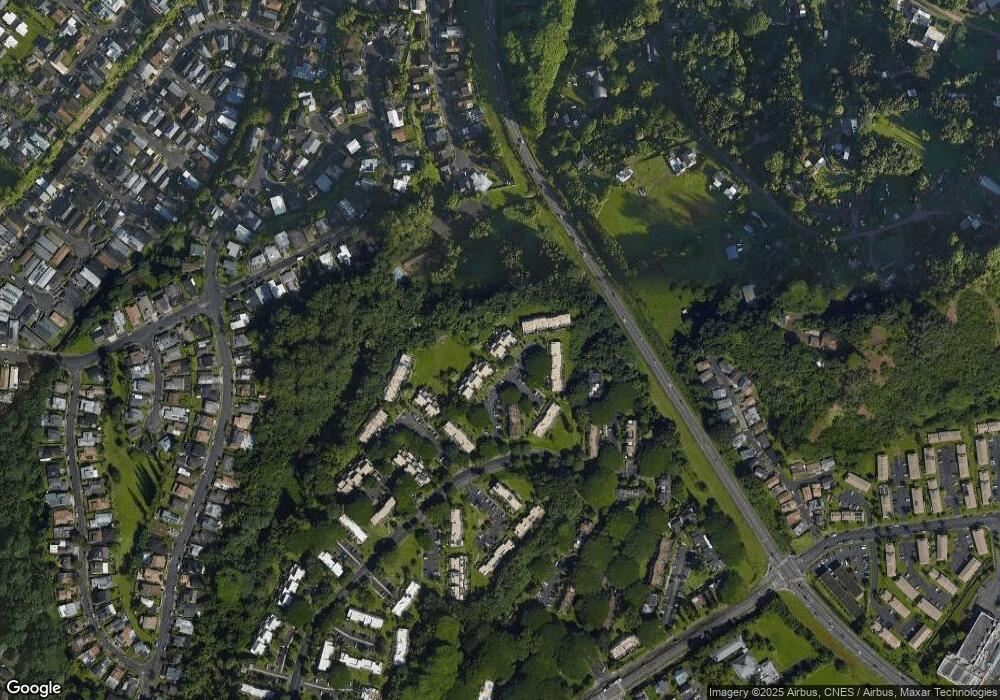

Map

Nearby Homes

- 47-724 Hui Kelu St Unit 1

- 47-718 Hui Kelu St Unit 1504

- 47-681 Hui Kelu St Unit 7106

- 47-685 Hui Ulili St

- 47-405 Hui Iwa St Unit 6-6

- 47-654 Hui Kelu St Unit 7601

- 47-62 Okana Place

- 47-564 Alawiki St

- 47-535 Alawiki St

- 47-541 Alawiki St

- 47-427 Ahuimanu Place

- 47-449 Aiai Place

- 47-508 Hui Iwa St

- 47-227 Okana Rd

- 47-039 Okana Place

- 47-388 Keohapa Place

- 47-544 Hakuhale St

- 47-129 Heno Place

- 47-270 Ahuimanu Rd

- 47-646 Melekula Rd

- 47-730 Hui Kelu St Unit 4406

- 47-730 Hui Kelu St Unit 4402

- 47-730 Hui Kelu St Unit 4405

- 47-730 Hui Kelu St Unit 404

- 47-730 Hui Kelu St Unit 1

- 47-732 Hui Kelu St Unit 3303

- 47-732 Hui Kelu St Unit 3301

- 47-732 Hui Kelu St Unit 6306

- 47-732 Hui Kelu St Unit 3302

- 47-732 Hui Kelu St Unit 3305

- 47-732 Hui Kelu St Unit 3304

- 47-732 Hui Kelu St Unit 4

- 47-732 Hui Kelu St Unit 5

- 47-734B Hui Kelu St Unit 3

- 47-738 Hui Kelu St Unit 6606

- 47-738 Hui Kelu St Unit 2

- 47-722 Hui Kelu St Unit 131304

- 47-722 Hui Kelu St Unit 131303

- 47-722 Hui Kelu St Unit 131306

- 47-722 Hui Kelu St Unit 131305