4701 County Road 1017 Joshua, TX 76058

Estimated Value: $181,000 - $541,000

3

Beds

2

Baths

1,250

Sq Ft

$274/Sq Ft

Est. Value

About This Home

This home is located at 4701 County Road 1017, Joshua, TX 76058 and is currently estimated at $342,000, approximately $273 per square foot. 4701 County Road 1017 is a home located in Johnson County with nearby schools including Marti Elementary School, A.D. Wheat Middle School, and Cleburne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2017

Sold by

Alcantara Juan and Alcantara Bibiana

Bought by

Asuncion Jose and Sigala Olmos

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$550,000

Outstanding Balance

$460,028

Interest Rate

3.96%

Estimated Equity

-$118,028

Purchase Details

Closed on

Sep 15, 2015

Sold by

Shipman Enterprises Llc

Bought by

Apex Of Texas Lp

Purchase Details

Closed on

Aug 28, 2013

Sold by

Burleson Hidden Vistas Lp

Bought by

Stonegate Ventures Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,100

Interest Rate

4.42%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Asuncion Jose | -- | None Available | |

| Apex Of Texas Lp | -- | Fwt | |

| Stonegate Ventures Llc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Asuncion Jose | $550,000 | |

| Previous Owner | Stonegate Ventures Llc | $219,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $597 | $108,075 | $18,000 | $90,075 |

| 2024 | $1,836 | $108,075 | $18,000 | $90,075 |

| 2023 | $1,596 | $166,875 | $18,000 | $148,875 |

| 2022 | $3,092 | $160,875 | $12,000 | $148,875 |

| 2021 | $3,183 | $0 | $0 | $0 |

| 2020 | $3,238 | $0 | $0 | $0 |

| 2019 | $3,479 | $0 | $0 | $0 |

| 2018 | $3,278 | $0 | $0 | $0 |

| 2017 | $2,314 | $0 | $0 | $0 |

| 2016 | $2,104 | $0 | $0 | $0 |

| 2015 | $1,285 | $0 | $0 | $0 |

| 2014 | $1,285 | $0 | $0 | $0 |

Source: Public Records

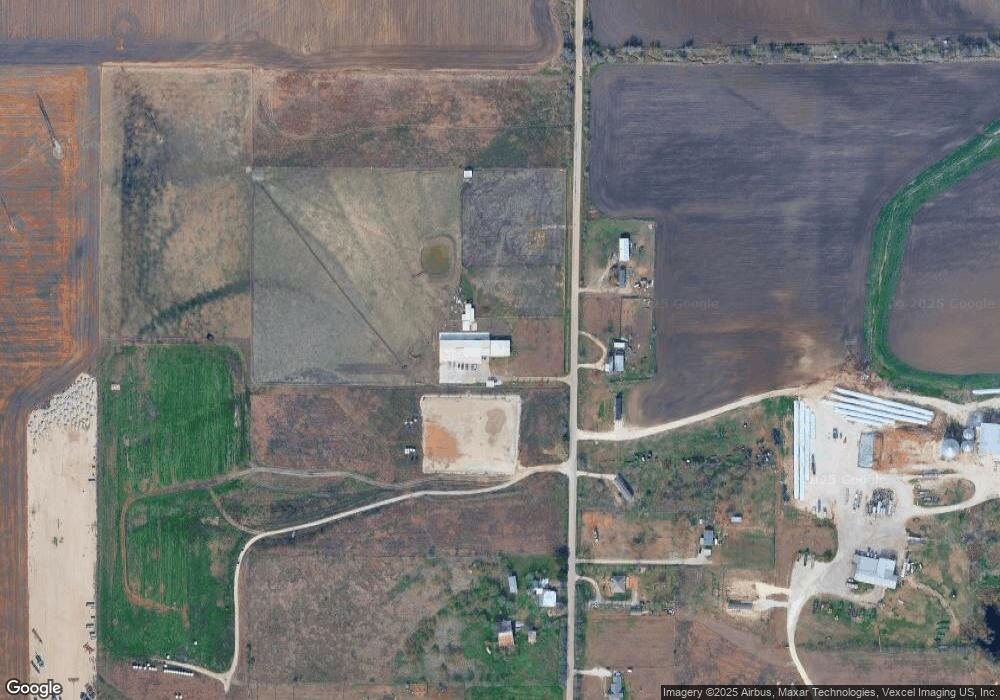

Map

Nearby Homes

- 4400 County Road 1017

- 3617 County Road 902

- 5736 Blackburn Dr

- 4005 Windmill Rd

- 7211 County Road 1017

- 5712 Andy N

- 5728 County Road 1017

- 2117 Jordan Ct

- 4708 Coyote Ct

- 6061 County Road 1010

- 1481 Saguaro Trail

- Retreat Plan at Cactus Ridge

- Canyon Plan at Cactus Ridge

- Stockyard Plan at Cactus Ridge

- 5900 County Road 1017

- 1473 Saguaro Trail

- 1449 Saguaro Trail

- 1458 Saguaro Trail

- 1501 Saguaro Trail

- 1728 County Road 904

- 4704 County Road 1017

- 4569 County Road 1017

- 4548 County Road 1017

- 4570 County Road 1017

- 4524 County Road 1017

- 4524 County Road 1017

- 4500 County Road 1017

- 3076 County Road 902

- 3056 County Road 902

- 3232 Wildflower Rd

- 3401 County Road 902

- 3621 County Road 902

- 3500 County Road 902

- 4320 Windmill Rd

- 3528 County Road 902

- 3401 County Road 902

- 3335 County Road 902

- 3349 County Road 902

- 3409 County Road 902

- 3601 County Road 902