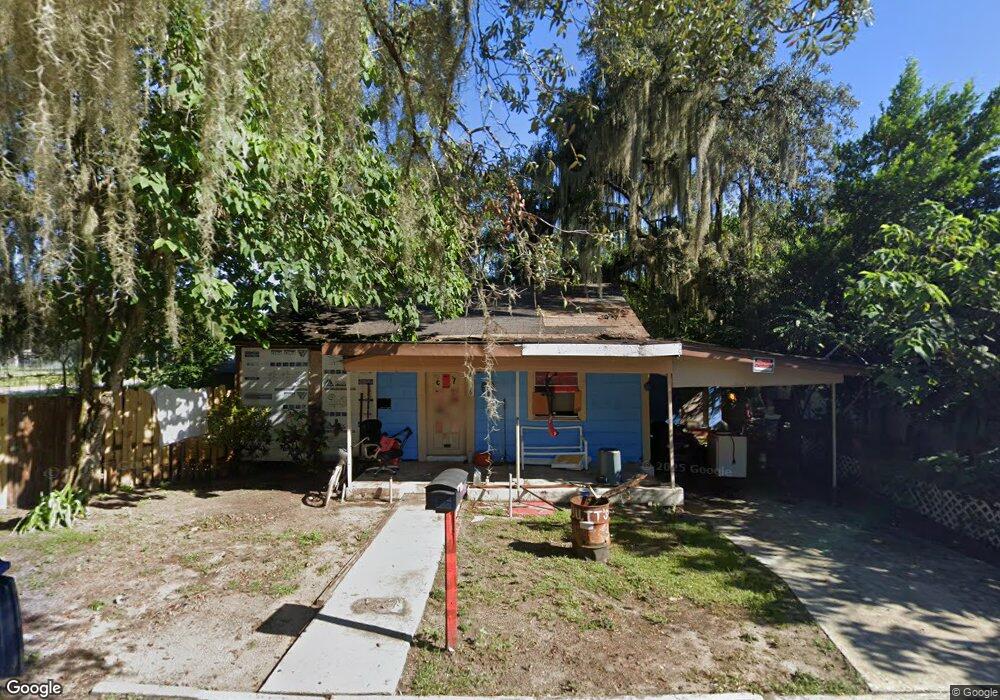

4706 4th St Sebring, FL 33870

Estimated Value: $73,000 - $97,000

2

Beds

1

Bath

725

Sq Ft

$119/Sq Ft

Est. Value

About This Home

This home is located at 4706 4th St, Sebring, FL 33870 and is currently estimated at $85,988, approximately $118 per square foot. 4706 4th St is a home located in Highlands County with nearby schools including Sebring High School, Fred Wild Elementary School, and Sebring Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2025

Sold by

Countrywide Estates Inc

Bought by

Peaceland Estates Inc

Current Estimated Value

Purchase Details

Closed on

Jul 7, 2025

Sold by

Demers Ralph

Bought by

Countrywide Estates Inc

Purchase Details

Closed on

Nov 15, 2019

Sold by

Rasco Lesha and Rosco Lesha

Bought by

Demers Ralph

Purchase Details

Closed on

Dec 18, 2009

Sold by

Worth John W and Worth Tina E

Bought by

Rasco Lesha

Purchase Details

Closed on

Oct 28, 2004

Sold by

Gross Maurice and Gross Anna

Bought by

Worth John W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$18,500

Interest Rate

12%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jan 19, 2001

Sold by

Hud

Bought by

Gross Maurice and Gross Anna

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peaceland Estates Inc | $100 | None Listed On Document | |

| Countrywide Estates Inc | $6,000 | Lakeview Title | |

| Countrywide Estates Inc | $6,000 | Lakeview Title | |

| Demers Ralph | -- | None Available | |

| Rasco Lesha | $21,000 | South Ridge Abstract & Title | |

| Worth John W | $23,500 | -- | |

| Gross Maurice | $14,600 | Island Title Services Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Worth John W | $18,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $945 | $5,747 | $5,747 | -- |

| 2024 | $875 | $28,974 | $3,352 | $25,622 |

| 2023 | $875 | $25,473 | $0 | $0 |

| 2022 | $656 | $18,660 | $3,352 | $15,308 |

| 2021 | $604 | $15,265 | $3,352 | $11,913 |

| 2020 | $535 | $14,348 | $0 | $0 |

| 2019 | $519 | $13,501 | $0 | $0 |

| 2018 | $478 | $12,438 | $0 | $0 |

| 2017 | $521 | $14,855 | $0 | $0 |

| 2016 | $518 | $14,779 | $0 | $0 |

| 2015 | $502 | $14,303 | $0 | $0 |

| 2014 | $484 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1603 Roseland Ave

- 4807 3rd St

- 4816 4th St

- 4810 5th St

- 1418 Palm Blvd

- 1729 Warfield Place

- 4517 Kenilworth Blvd

- 1430 Las Villas Blvd

- 1434 Las Villas Blvd

- 1436 Las Villas Blvd

- 1440 Las Villas Blvd

- 1418 Las Villas Blvd

- 1313 Denise Ave

- 1439 Las Villas Blvd

- 4703 Howard St

- 1000 Alicante Ct

- 1103 Gigon Ct

- 1800 Colmar Ave

- 1820 Colmar Ave

- 1900 Colmar Ave