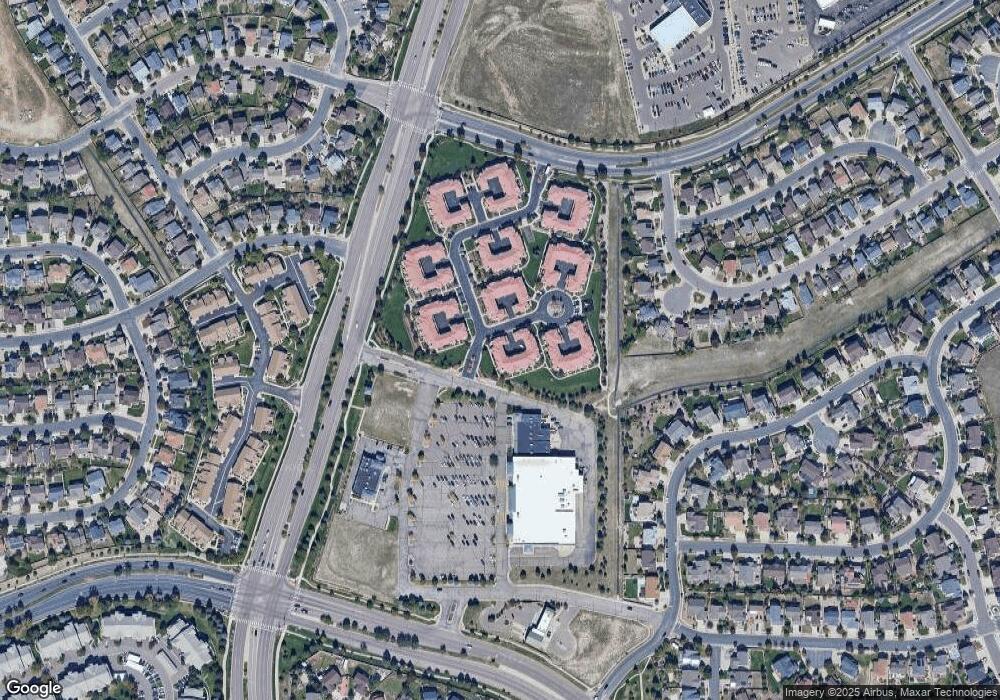

4709 Sand Mountain Point Colorado Springs, CO 80923

Wagon Trails NeighborhoodEstimated Value: $320,000 - $335,000

2

Beds

2

Baths

1,173

Sq Ft

$278/Sq Ft

Est. Value

About This Home

This home is located at 4709 Sand Mountain Point, Colorado Springs, CO 80923 and is currently estimated at $326,253, approximately $278 per square foot. 4709 Sand Mountain Point is a home located in El Paso County with nearby schools including Freedom Elementary School, Jenkins Middle School, and Doherty High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 17, 2020

Sold by

Huber June

Bought by

Nevin Thomas A and Nevin Linda L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,000

Outstanding Balance

$187,089

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$139,164

Purchase Details

Closed on

Nov 29, 2017

Sold by

Larioso Inocente T

Bought by

Larioso Inocente T and Huber June

Purchase Details

Closed on

Sep 10, 2015

Sold by

Sumack Llc

Bought by

Lariosa Inocente T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,500

Interest Rate

3.99%

Mortgage Type

VA

Purchase Details

Closed on

Nov 18, 2005

Sold by

Valentine Susan M

Bought by

Sumack Llc

Purchase Details

Closed on

Nov 22, 2004

Sold by

Elite Properties Of America Inc

Bought by

Valentine Susan M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,620

Interest Rate

5.72%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nevin Thomas A | $265,000 | Legacy Title Group Llc | |

| Larioso Inocente T | -- | None Available | |

| Lariosa Inocente T | $172,500 | Empire Title Co Springs Llc | |

| Sumack Llc | -- | -- | |

| Valentine Susan M | $174,530 | -- | |

| Elite Properties Of America Inc | $174,530 | -- | |

| Valentine Susan M | $174,530 | -- | |

| Elite Properties Of America Inc | $174,530 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nevin Thomas A | $212,000 | |

| Previous Owner | Lariosa Inocente T | $172,500 | |

| Previous Owner | Valentine Susan M | $139,620 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,112 | $23,440 | -- | -- |

| 2024 | $1,002 | $23,040 | $5,090 | $17,950 |

| 2023 | $1,002 | $23,040 | $5,090 | $17,950 |

| 2022 | $1,074 | $17,930 | $3,610 | $14,320 |

| 2021 | $1,161 | $18,450 | $3,720 | $14,730 |

| 2020 | $1,010 | $14,070 | $2,290 | $11,780 |

| 2019 | $1,005 | $14,070 | $2,290 | $11,780 |

| 2018 | $925 | $11,970 | $1,910 | $10,060 |

| 2017 | $879 | $11,970 | $1,910 | $10,060 |

| 2016 | $722 | $11,660 | $1,910 | $9,750 |

| 2015 | $719 | $11,660 | $1,910 | $9,750 |

| 2014 | $714 | $11,140 | $1,670 | $9,470 |

Source: Public Records

Map

Nearby Homes

- 7163 Sand Crest View

- 4721 Rowell Point

- 7127 Vasalias Heights

- 4721 Little London Dr

- 4926 Chariot Dr

- 4886 Little London Dr

- 4902 Cherry Springs Dr

- 6938 Big Timber Dr

- 6877 Adamo Ct

- 6867 Adamo Ct

- 5095 Chaise Dr

- 6706 Dream Weaver Dr

- Ethridge Plan at Trailside at Cottonwood Creek

- Fairview Plan at Trailside at Cottonwood Creek

- Alpine Plan at Trailside at Cottonwood Creek

- Deerfield Plan at Trailside at Cottonwood Creek

- Cherry Oak Plan at Trailside at Cottonwood Creek

- Bryanwood Plan at Trailside at Cottonwood Creek

- 4684 Peak Crest View

- 4595 Peak Crest View

- 4705 Sand Mountain Point

- 4713 Sand Mountain Point

- 4717 Sand Mountain Point

- 4721 Sand Mountain Point

- 4725 Sand Mountain Point

- 4741 Sand Mountain Point

- 4729 Sand Mountain Point

- 4737 Sand Mountain Point

- 4706 Sand Mountain Point

- 4733 Sand Mountain Point

- 7002 Sand Crest View

- 6835 Shimmering Moon Ln

- 6878 Adamo Ct

- 7006 Sand Crest View

- 7010 Sand Crest View

- 4749 Sand Mountain Point

- 4757 Sand Mountain Point

- 4753 Sand Mountain Point

- 4761 Sand Mountain Point

- 4714 Sand Mountain Point