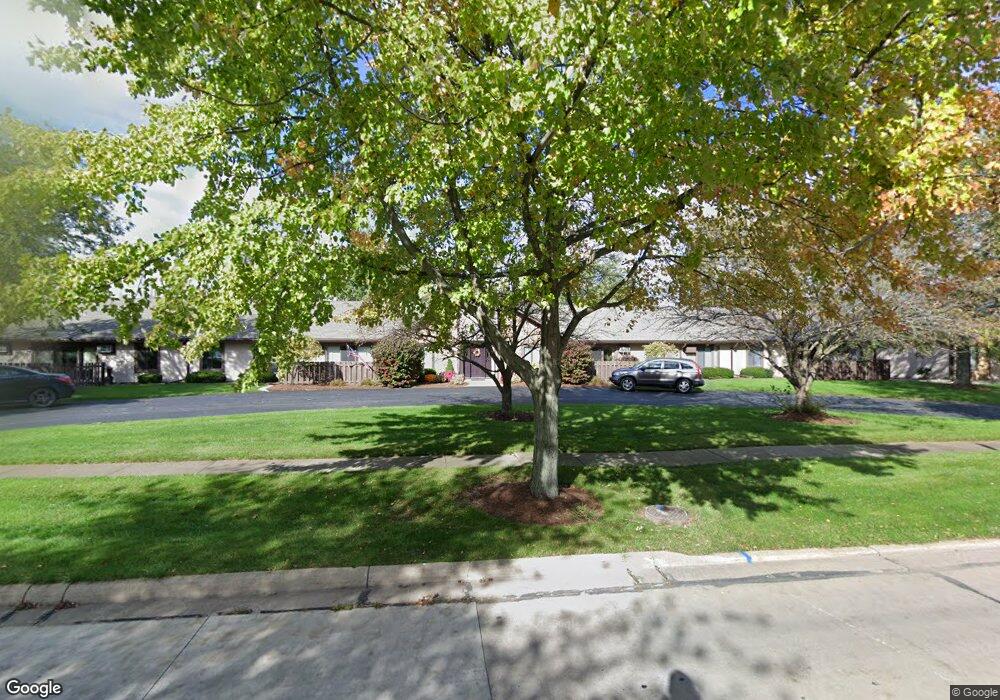

4709 Venice Heights Blvd Unit BLVD Sandusky, OH 44870

Estimated Value: $121,000 - $127,900

2

Beds

1

Bath

1,188

Sq Ft

$105/Sq Ft

Est. Value

About This Home

This home is located at 4709 Venice Heights Blvd Unit BLVD, Sandusky, OH 44870 and is currently estimated at $124,475, approximately $104 per square foot. 4709 Venice Heights Blvd Unit BLVD is a home located in Erie County with nearby schools including Sandusky High School, Sandusky Central Catholic School, and Firelands Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2025

Sold by

Fronizer Mitzi G

Bought by

Slyker Vivian

Current Estimated Value

Purchase Details

Closed on

Sep 26, 2016

Sold by

Fitzgerald Edward A

Bought by

Fronizer Mitzi G

Purchase Details

Closed on

Feb 26, 2015

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Fitzgerald Edward A

Purchase Details

Closed on

Oct 6, 2014

Sold by

Windsor Robert

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Jun 7, 2010

Sold by

Souter Constance Marie and Souter Robert A

Bought by

Windsor Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,000

Interest Rate

5.14%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Slyker Vivian | $120,000 | First American Title | |

| Fronizer Mitzi G | $67,000 | None Available | |

| Fitzgerald Edward A | -- | Intitle Agency Inc | |

| Federal Home Loan Mortgage Corporation | $37,000 | None Available | |

| Windsor Robert | $67,500 | Hartung Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Windsor Robert | $54,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,568 | $38,927 | $5,250 | $33,677 |

| 2023 | $1,499 | $24,576 | $2,520 | $22,056 |

| 2022 | $1,220 | $24,584 | $2,520 | $22,064 |

| 2021 | $1,232 | $24,580 | $2,520 | $22,060 |

| 2020 | $1,252 | $22,960 | $2,520 | $20,440 |

| 2019 | $1,287 | $22,960 | $2,520 | $20,440 |

| 2018 | $1,289 | $22,960 | $2,520 | $20,440 |

| 2017 | $1,454 | $25,830 | $2,520 | $23,310 |

| 2016 | $963 | $25,830 | $2,520 | $23,310 |

| 2015 | $1,312 | $25,830 | $2,520 | $23,310 |

| 2014 | $1,249 | $24,140 | $2,520 | $21,620 |

| 2013 | $1,203 | $24,140 | $2,520 | $21,620 |

Source: Public Records

Map

Nearby Homes

- 4708 Venice Heights Blvd

- 4708 Venice Heights Blvd Unit 204

- 4708 Venice Heights Blvd Unit 101

- 4809 Venice Rd

- 802 S Meadow Dr

- 719 Cold Creek Blvd

- 0 Venice Rd

- 1 Venice Rd

- 5704 Mccartney Rd

- 3710 Venice Rd

- 4514 Homegardner Rd

- 0 Mccartney Rd

- 2614 Tiffin Ave

- 2614 Tiffin Ave Unit 103

- 0 Ohio 101

- 2234 Wilbert St

- 2002 Wilson St

- 0 Lakeside Unit 20253835

- 1 Perkins Ave

- 1319 Tiffin Ave

- 4709 Venice Heights Blvd Unit 125

- 4709 Venice Heights Blvd Unit 121

- 4709 Venice Heights Blvd

- 4709 Venice Heights Blvd Unit 120

- 4709 Venice Heights Blvd Unit 119

- 4709 Venice Heights Blvd Unit 118

- 4709 Venice Heights Blvd Unit 123

- 4709 Venice Heights Blvd Unit 117

- 4705 Venice Heights Blvd Unit 139

- 4705 Venice Heights Blvd Unit 129

- 4705 Venice Heights Blvd Unit 140

- 4705 Venice Heights Blvd

- 4705 Venice Heights Blvd Unit 135

- 4705 Venice Heights Blvd Unit 137

- 4705 Venice Heights Blvd Unit 127

- 4705 Venice Heights Blvd Unit 132

- 4705 Venice Heights Blvd Unit 136

- 518 Bardshar Rd Unit A

- 518 Bardshar Rd

- 518 Bardshar Rd Unit F