471 267th St Osceola, WI 54020

Estimated Value: $357,691 - $409,000

2

Beds

1

Bath

--

Sq Ft

3

Acres

About This Home

This home is located at 471 267th St, Osceola, WI 54020 and is currently estimated at $380,173. 471 267th St is a home located in Polk County with nearby schools including Osceola Elementary School, Osceola Intermediate School, and Osceola Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2019

Sold by

Torres Francisco Alfonso and Torres Rebecca Lynne

Bought by

Krupa Melande and Stachowiak Neil

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,557

Outstanding Balance

$208,006

Interest Rate

4%

Mortgage Type

VA

Estimated Equity

$172,167

Purchase Details

Closed on

Mar 15, 2018

Sold by

Equity Trust Co Trsutee

Bought by

Torres Francisco Alfonso and Torres Rebecca Lynne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 29, 2017

Sold by

Kirchoff Scott and Kirchoff Chalane

Bought by

Equity Trust Co

Purchase Details

Closed on

Mar 7, 2009

Sold by

Entrust Midwest Llc Fbo Abigail Jordan G

Bought by

Kirchoff Scott

Purchase Details

Closed on

Feb 21, 2007

Sold by

Buck Carol A Tyler

Bought by

St Croix Valley Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Krupa Melande | $229,000 | Burnet Title | |

| Torres Francisco Alfonso | $225,000 | Polk County Abstract | |

| Equity Trust Co | -- | None Available | |

| Kirchoff Scott | $159,000 | -- | |

| St Croix Valley Trust | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Krupa Melande | $236,557 | |

| Previous Owner | Torres Francisco Alfonso | $205,000 | |

| Closed | St Croix Valley Trust | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,023 | $260,900 | $46,000 | $214,900 |

| 2023 | $2,900 | $260,900 | $46,000 | $214,900 |

| 2022 | $2,499 | $147,100 | $23,500 | $123,600 |

| 2021 | $2,429 | $147,100 | $23,500 | $123,600 |

| 2020 | $2,525 | $147,100 | $23,500 | $123,600 |

| 2019 | $2,708 | $147,100 | $23,500 | $123,600 |

| 2018 | $2,864 | $147,100 | $23,500 | $123,600 |

| 2017 | $2,353 | $147,100 | $23,500 | $123,600 |

| 2016 | $2,372 | $123,400 | $23,100 | $100,300 |

| 2015 | $2,150 | $123,400 | $23,100 | $100,300 |

| 2013 | $2,007 | $123,400 | $23,100 | $100,300 |

| 2012 | $2,078 | $123,400 | $23,100 | $100,300 |

Source: Public Records

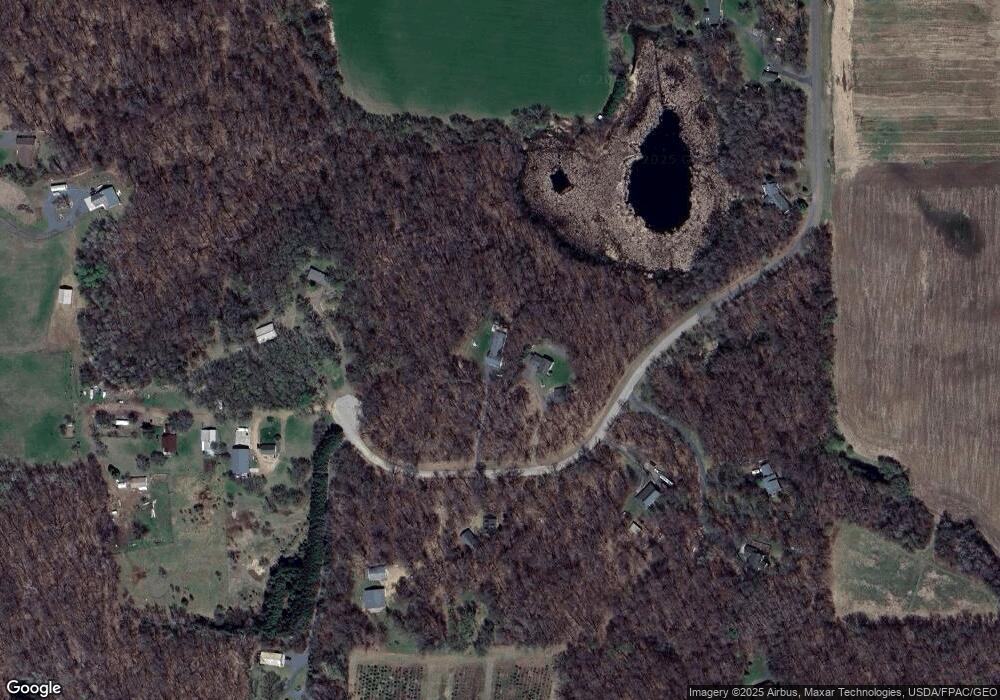

Map

Nearby Homes

- 368 280th St

- xxx 65th Ave

- 628 258th St

- 2523 40th Ave

- 381 Mill St

- 516 Gerald St

- 330 Mill St

- 260 Spring St

- Lot 61 Simmon Dr

- 1220 Corey Ct

- 407 3rd Ave E

- 502 Kreekview Dr

- 442 Tony St

- 24XXX St Croix Trail

- 402 Caroll St

- 701 N Cascade St

- 412 8th Ave E

- Lt1 Happy Hollow Rd

- 728 Mulligan Dr Unit A

- 2486 75th Ave

- 468 267th St

- 470 267th St

- 482 267th St

- 475 267th St

- 460 267th St

- 468 267th St

- 484 267th St

- 484 267th St Unit A

- 484A 267th St

- 484A 267th St

- 465 267th St

- 503 267th St

- 462 267th St

- 462 267th St Unit A

- 462 267th St

- 2691 2691 Viebrock Dr

- 2683 Viebrock Dr

- 2691 Viebrock Dr

- 2682 Viebrock Dr

- 2692 Viebrock Dr