4717 Julian Rd SW Port Orchard, WA 98367

Estimated Value: $781,000 - $1,050,000

4

Beds

3

Baths

3,080

Sq Ft

$286/Sq Ft

Est. Value

About This Home

This home is located at 4717 Julian Rd SW, Port Orchard, WA 98367 and is currently estimated at $880,424, approximately $285 per square foot. 4717 Julian Rd SW is a home located in Kitsap County with nearby schools including Burley Glenwood Elementary School, Cedar Heights Middle School, and South Kitsap High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2010

Sold by

Worley Tracey M and Worley Kemyss W

Bought by

Braun David E and Braun Glenda J F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$353,479

Outstanding Balance

$232,063

Interest Rate

4.87%

Mortgage Type

FHA

Estimated Equity

$648,361

Purchase Details

Closed on

May 25, 2005

Sold by

Whitehead Bill H and Zirkle Lois L

Bought by

Worley Kemyss W and Worley Tracey M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$337,500

Interest Rate

5.84%

Mortgage Type

Construction

Purchase Details

Closed on

Dec 9, 1997

Sold by

Cook Elizabeth and Mainar Elizabeth

Bought by

Whitehead Bill H and Zirkle Lois L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$24,000

Interest Rate

7.19%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Braun David E | $360,280 | Stewart Title | |

| Worley Kemyss W | $55,000 | Transnation Title | |

| Whitehead Bill H | $28,000 | Transnation Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Braun David E | $353,479 | |

| Previous Owner | Worley Kemyss W | $337,500 | |

| Previous Owner | Whitehead Bill H | $24,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $6,338 | $730,500 | $159,230 | $571,270 |

| 2025 | $6,338 | $730,500 | $159,230 | $571,270 |

| 2024 | $6,145 | $730,500 | $159,230 | $571,270 |

| 2023 | $6,106 | $730,500 | $159,230 | $571,270 |

| 2022 | $5,904 | $591,570 | $126,930 | $464,640 |

| 2021 | $5,656 | $535,810 | $115,390 | $420,420 |

| 2020 | $5,662 | $521,310 | $101,610 | $419,700 |

| 2019 | $4,809 | $485,920 | $93,910 | $392,010 |

| 2018 | $5,146 | $398,280 | $80,830 | $317,450 |

| 2017 | $4,346 | $398,280 | $80,830 | $317,450 |

| 2016 | $4,274 | $358,210 | $76,980 | $281,230 |

| 2015 | $4,144 | $351,820 | $76,980 | $274,840 |

| 2014 | -- | $336,770 | $89,750 | $247,020 |

| 2013 | -- | $334,400 | $87,380 | $247,020 |

Source: Public Records

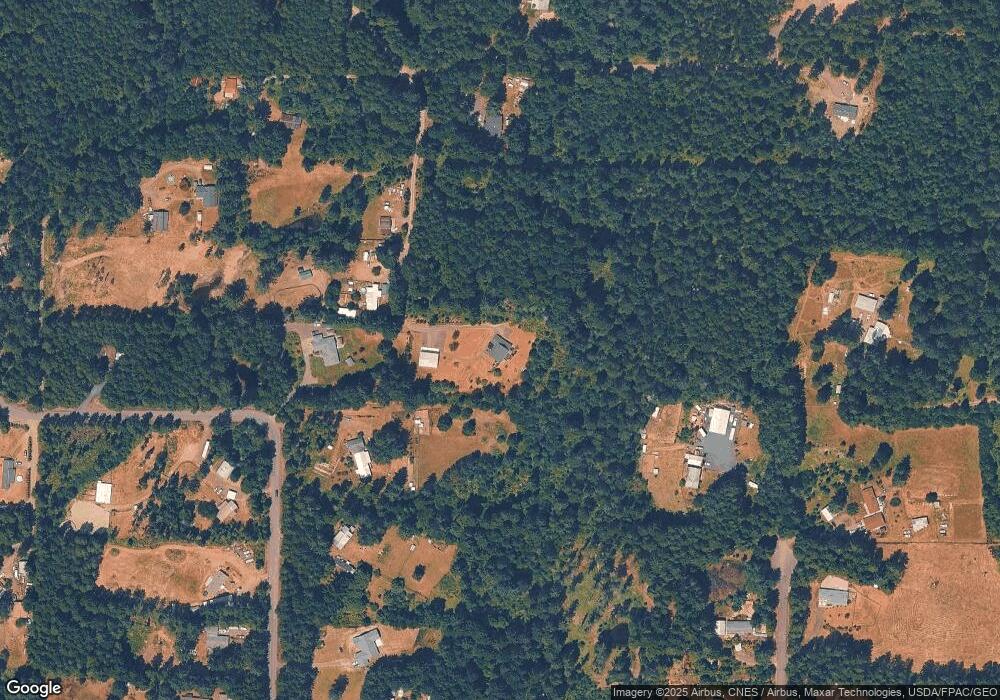

Map

Nearby Homes

- 0 Lake Helena Trail Unit NWM2446806

- 5040 SW Lake Helena Rd

- 12524 Westbrook Dr SW

- 0 Silver Ln SW

- 9970 SW Fairview Lake Rd

- 15721 Fairview Lake Rd SW

- 11910 Alpine Dr SW

- 10185 May Ranch Ln SW

- 6034 Trace Dr SW

- 5884 Trace Dr SW

- 5844 Trace Dr SW

- 5824 Trace Dr SW

- 10569 Glenwood Rd SW

- 13540 Carney Lake Rd SW

- 7891 SW Conifer Ln

- 3379 SW County Line Rd

- 7201 SW Ridgeline Dr

- 10223 Glenwood Rd SW

- 11618 Sidney Rd SW

- 11291 Cooper Ave SW

- 5 Wicks End Ln SW

- 4732 Julian Rd SW

- 4720 Julian Rd SW

- 4977 SW Daisy St

- 12828 Wicks End Ln SW

- 4693 Julian Rd SW

- 5 Acres Off of Julian Rd

- 12856 Wicks End Ln SW

- 5009 SW Daisy St

- 4942 SW Daisy St

- 4937 SW Daisy St

- 4933 SW Daisy St

- 4936 SW Daisy St

- 12857 Wicks End Ln SW

- 12934 Wicks End Ln SW

- 4923 SW Daisy St

- 4680 Julian Rd SW

- 4679 Julian Rd SW