472 Wingate Place Unit 34 Mount Sterling, OH 43143

Estimated Value: $304,878 - $328,000

4

Beds

3

Baths

1,976

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 472 Wingate Place Unit 34, Mount Sterling, OH 43143 and is currently estimated at $313,220, approximately $158 per square foot. 472 Wingate Place Unit 34 is a home located in Madison County with nearby schools including Madison-Plains Elementary School, Madison-Plains Intermediate School, and Madison-Plains Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2021

Sold by

Courts Marjorie

Bought by

Ntfn Inc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,900

Outstanding Balance

$165,764

Interest Rate

2.99%

Mortgage Type

New Conventional

Estimated Equity

$147,456

Purchase Details

Closed on

Mar 14, 2017

Sold by

Fox Assets Group Llc

Bought by

Lewis Jamie and Courts Marjorie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,884

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 29, 2016

Sold by

Maronda Homes Inc

Bought by

Fox Assets Group Llc

Purchase Details

Closed on

Jan 18, 2007

Sold by

Deer Creek Run Llc

Bought by

Maronda Homes Inc Of Ohio

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ntfn Inc | -- | Monarch Title Svcs Of Oh Llc | |

| Lewis Jamie | $172,000 | Landsel Title | |

| Fox Assets Group Llc | $162,600 | Attorney | |

| Maronda Homes Inc Of Ohio | $1,770,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ntfn Inc | $180,900 | |

| Previous Owner | Lewis Jamie | $168,884 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,726 | $77,880 | $12,870 | $65,010 |

| 2023 | $2,726 | $77,880 | $12,870 | $65,010 |

| 2022 | $2,379 | $64,230 | $10,610 | $53,620 |

| 2021 | $2,318 | $64,230 | $10,610 | $53,620 |

| 2020 | $2,322 | $64,230 | $10,610 | $53,620 |

| 2019 | $1,660 | $47,260 | $9,650 | $37,610 |

| 2018 | $1,627 | $47,260 | $9,650 | $37,610 |

| 2017 | $1,828 | $47,260 | $9,650 | $37,610 |

| 2016 | $1,828 | $55,240 | $9,650 | $45,590 |

| 2015 | $328 | $9,650 | $9,650 | $0 |

| 2014 | $322 | $9,650 | $9,650 | $0 |

| 2013 | -- | $9,080 | $9,080 | $0 |

Source: Public Records

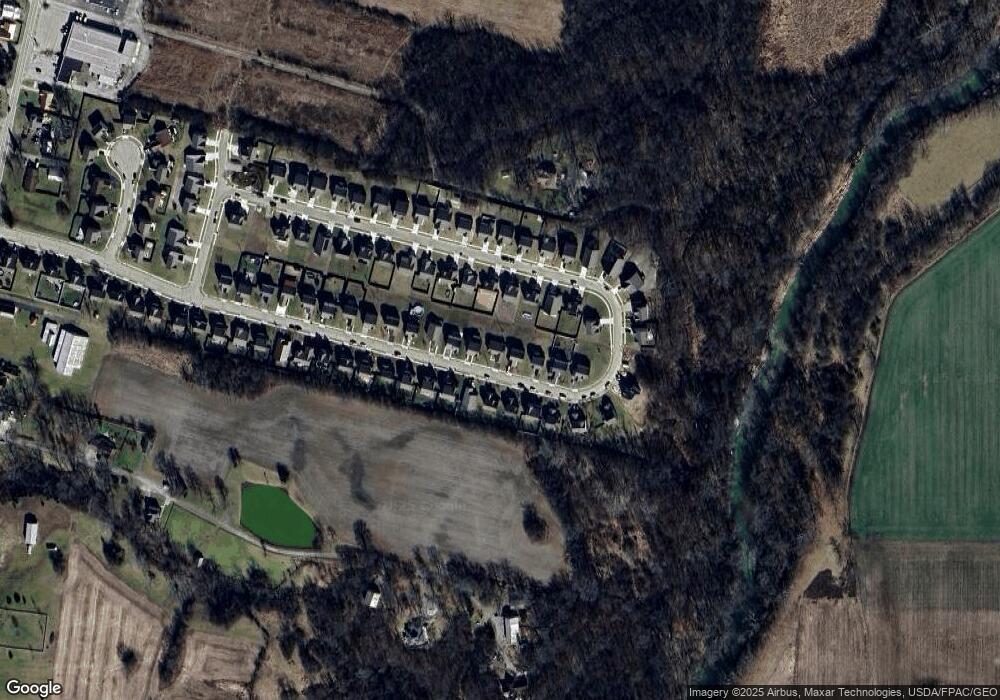

Map

Nearby Homes

- 500 Wingate Place N

- 110 Mountview Ct

- 230 W Columbus St

- 233 W Main St

- 16185 State Route 207

- 67 W Columbus St

- 60 N London St

- 94 Jefferson St

- 178 Poplar St

- 15561 Blain Rd

- 8713 State Route 207

- 16270 Cook Yankeetown Rd NE

- 12265 Woods Opossum Run

- 10586 Baldwin Rd

- 0 Renick Rd

- 0 Rockwell Rd Unit 225016734

- 14008 1st St

- 12343 State Route 316

- 13810 Yankeetown Chenoweth Rd

- 11821 State Route 56 W

- 472 Wingate Place

- 476 Wingate Place S

- 468 Wingate Place Unit 35

- 480 Wingate Place S

- 464 Wingate Place Unit 36

- 464 Wingate Place

- 471 Wingate Place

- 467 Wingate Place S

- 504 Wingate Place N

- 484 Wingate Place

- 463 Wingate Place S

- 460 Wingate Place S

- 512 Wingate Place N

- 479 Wingate Place

- 520 Wingate Place N

- 496 Wingate Place

- 456 Wingate Place S

- 488 Wingate Place

- 455 Wingate Place S

- 452 Wingate Place