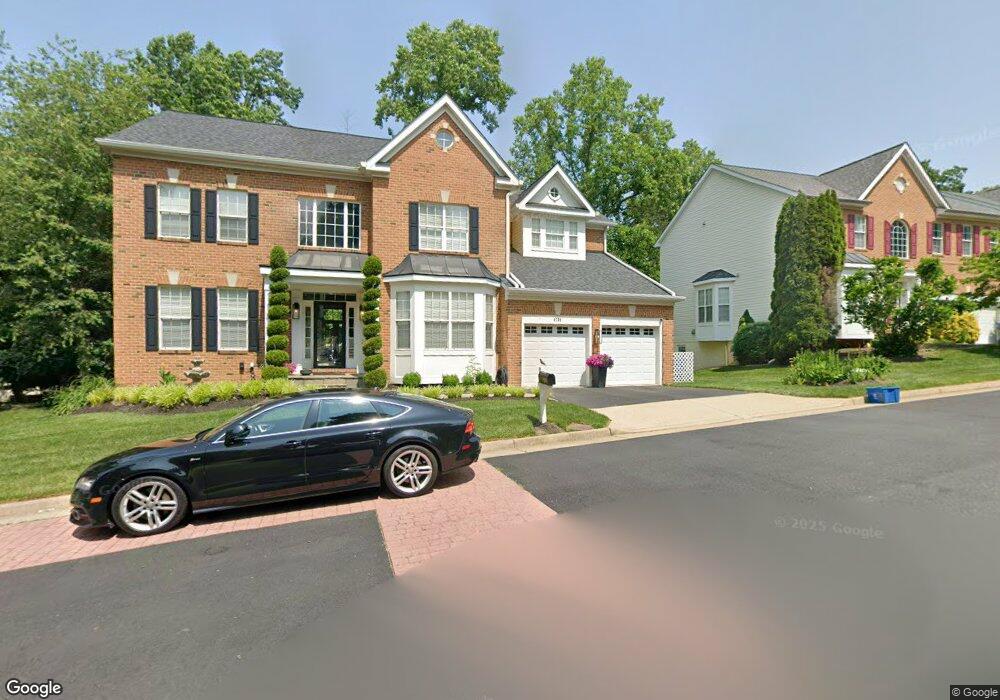

4728 Feature Oak Way Fairfax, VA 22032

Estimated Value: $1,149,816 - $1,354,000

5

Beds

5

Baths

3,504

Sq Ft

$352/Sq Ft

Est. Value

About This Home

This home is located at 4728 Feature Oak Way, Fairfax, VA 22032 and is currently estimated at $1,233,704, approximately $352 per square foot. 4728 Feature Oak Way is a home located in Fairfax County with nearby schools including Laurel Ridge Elementary School, James W Robinson, Jr. Secondary School, and Holy Spirit School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 8, 2024

Sold by

Sands Manuel A and Sands Ruth

Bought by

Sands Family Living Trust and Sands

Current Estimated Value

Purchase Details

Closed on

Jan 11, 2021

Sold by

Sands Manuel A and Sands Ruth

Bought by

Sands Manuel A and Sands Ruth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$394,000

Interest Rate

2.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 23, 2015

Sold by

Sands Manuel A and Sands Ruth

Bought by

Sands Family Living Trust

Purchase Details

Closed on

Apr 26, 2001

Sold by

Courtland Ct Powell Rd Ll

Bought by

Sands Manuel A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$425,000

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sands Family Living Trust | -- | None Listed On Document | |

| Sands Manuel A | -- | Westcor Land Title Ins Co | |

| Sands Family Living Trust | -- | None Available | |

| Sands Manuel A | $567,557 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sands Manuel A | $394,000 | |

| Previous Owner | Sands Manuel A | $425,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,882 | $1,180,510 | $363,000 | $817,510 |

| 2024 | $12,882 | $1,111,930 | $363,000 | $748,930 |

| 2023 | $12,600 | $1,116,540 | $363,000 | $753,540 |

| 2022 | $10,830 | $947,070 | $303,000 | $644,070 |

| 2021 | $10,016 | $853,510 | $278,000 | $575,510 |

| 2020 | $9,478 | $800,860 | $263,000 | $537,860 |

| 2019 | $9,356 | $790,530 | $258,000 | $532,530 |

| 2018 | $9,091 | $790,530 | $258,000 | $532,530 |

| 2017 | $8,769 | $755,320 | $238,000 | $517,320 |

| 2016 | $8,479 | $731,920 | $228,000 | $503,920 |

| 2015 | $8,168 | $731,920 | $228,000 | $503,920 |

| 2014 | $8,384 | $752,920 | $228,000 | $524,920 |

Source: Public Records

Map

Nearby Homes

- 9640 Park Preserve Dr

- 4906 Mcfarland Dr

- 9604 Braddock Rd

- 4716 Pickett Rd

- 4869 Nash Dr

- 4947 Mcfarland Ct

- 4522 Pickett Rd

- 4618 Twinbrook Rd

- 5006 Lone Oak Place

- 5019 Powell Rd

- 9883 Becket Ct

- 4601 Tara Dr

- 9717 Commonwealth Blvd

- 4401 Pickett Rd

- 4303 Branchview Way

- 5135 Richardson Dr

- 5122 Pommeroy Dr

- 5137 Richardson Dr

- 10134 Red Spruce Rd

- 4629 Briar Patch Ct

- 4726 Feature Oak Way

- 4730 Feature Oak Way

- 9646 Park Preserve Dr

- 4985 Dequincey Dr

- 4724 Feature Oak Way

- 4983 Dequincey Dr

- 4732 Feature Oak Way

- 9645 Park Preserve Dr

- 4725 Feature Oak Way

- 4981 Dequincey Dr

- 4989 Dequincey Dr

- 4722 Feature Oak Way

- 9644 Park Preserve Dr

- 4734 Feature Oak Way

- 4733 Feature Oak Way

- 4979 Dequincey Dr

- 4991 Dequincey Dr

- 9642 Park Preserve Dr

- 4721 Feature Oak Way

- 4720 Feature Oak Way