4743 Wilderness Ln Unit 6 Harshaw, WI 54529

Estimated Value: $500,984

8

Beds

5

Baths

6,035

Sq Ft

$83/Sq Ft

Est. Value

About This Home

This home is located at 4743 Wilderness Ln Unit 6, Harshaw, WI 54529 and is currently estimated at $500,984, approximately $83 per square foot. 4743 Wilderness Ln Unit 6 is a home located in Oneida County with nearby schools including Northwoods Community Elementary School, James Williams Middle School, and Rhinelander High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 6, 2024

Sold by

Cortez Jeff M and Cortez Dana R

Bought by

Mgm Wilderness Llc

Current Estimated Value

Purchase Details

Closed on

Nov 16, 2021

Sold by

Pol Holdings Llc

Bought by

Cortez Jeff M and Cortez Dana R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,500

Interest Rate

3.09%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 19, 2020

Sold by

Pol Holdings Llc

Bought by

Cortez Jeff M and Cortez Dana R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,500

Interest Rate

2.8%

Mortgage Type

Land Contract Argmt. Of Sale

Purchase Details

Closed on

Aug 29, 2013

Sold by

Mid Wisconsin Bank

Bought by

Pol Holdings Llc

Purchase Details

Closed on

Jan 28, 2013

Sold by

Mid-Wisconsin Bank

Bought by

Johnson William D and Johnson Misa M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mgm Wilderness Llc | $440,000 | Gowey Abstract & Title | |

| Cortez Jeff M | $282,500 | None Available | |

| Cortez Jeff M | $282,500 | None Available | |

| Pol Holdings Llc | $155,000 | Oneida Title And Abstract In | |

| Johnson William D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cortez Jeff M | $251,500 | |

| Previous Owner | Cortez Jeff M | $252,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,381 | $386,000 | $19,700 | $366,300 |

| 2023 | $5,757 | $386,000 | $19,700 | $366,300 |

| 2022 | $4,581 | $386,000 | $19,700 | $366,300 |

| 2021 | $3,199 | $212,100 | $19,700 | $192,400 |

| 2020 | $2,679 | $212,100 | $19,700 | $192,400 |

| 2019 | $2,581 | $212,100 | $19,700 | $192,400 |

| 2018 | $2,744 | $212,100 | $19,700 | $192,400 |

| 2017 | $2,695 | $212,100 | $19,700 | $192,400 |

| 2016 | $2,965 | $212,100 | $19,700 | $192,400 |

| 2015 | $2,938 | $212,100 | $19,700 | $192,400 |

| 2014 | $2,938 | $212,100 | $19,700 | $192,400 |

| 2011 | $4,135 | $379,800 | $28,000 | $351,800 |

Source: Public Records

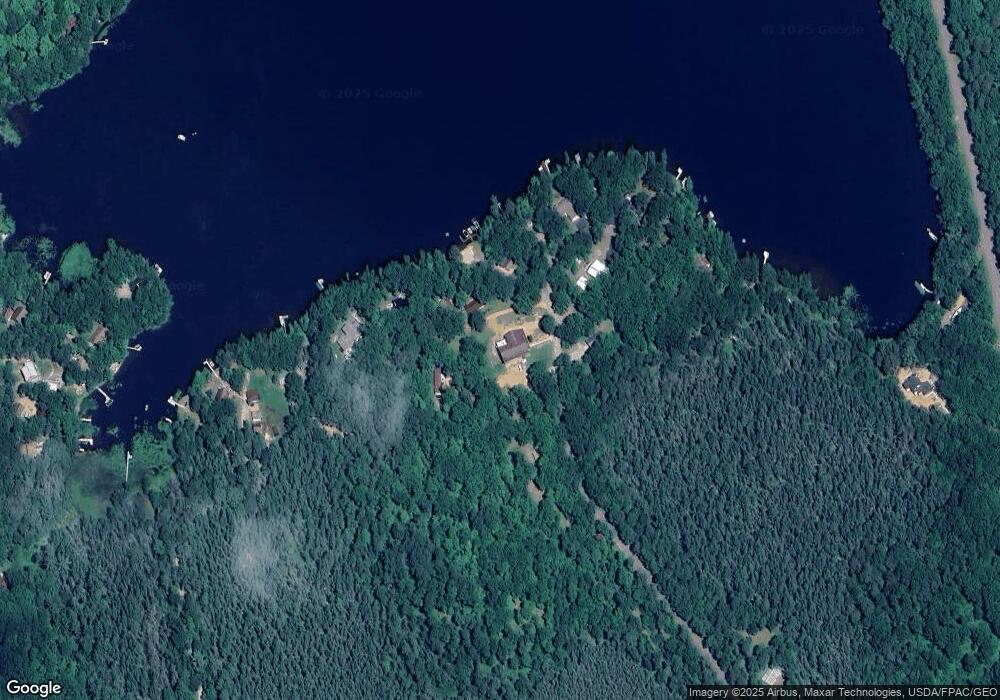

Map

Nearby Homes

- 7938 S Alva Rd

- CA-875-5 Sheep Ranch Rd

- ON Sheep Ranch Rd

- 9335 Little Bearskin Creek Rd

- 3541 Campfire Ln

- 8444 N Oneida Lake Dr

- 9063 Burnham Lake Rd S

- 9355 Musky Bay Ln

- Lt1 U S Highway 51

- Lt0 - Lt1 U S Highway 51

- Lt2 - Lt3 U S Highway 51

- 6069 Windpudding Dr N

- 3775 Sleepy Hollow Rd

- 3991 Vets Memorial Dr

- 4243 Back Country Ln

- 4017 U S 51

- On W Bluebird Rd

- NEAR Rocky Run Rd

- 8654 American Eagle Ct

- 6775 Bluejay Ln

- 4767 Wilderness Ln

- 4765 Wilderness Ln

- 4650 Wilderness Ln

- 4743 Wilderness Ln Unit 5

- 4743 Wilderness Ln

- 4742 Wilderness Ln

- 4742 Wilderness Ln Unit 4751 &

- 4739 Wilderness Ln Unit 5

- 4777 Wilderness Ln

- 4761 Wilderness Ln

- 4745 Wilderness Ln

- 4745 Wilderness Ln Unit Wilderne

- 4771 Wilderness Ln

- 4751 Wilderness Ln Unit 1

- 4751 Wilderness Ln

- 8220 Kickshoe Ln

- 8214 Kickshoe Ln

- 8204 Kickshoe Ln

- 8242 Kickshoe Ln

- 8313 Kickshoe Ln