4758 Ledgewood Dr Unit A3 Medina, OH 44256

Estimated Value: $171,053 - $178,000

2

Beds

2

Baths

1,014

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 4758 Ledgewood Dr Unit A3, Medina, OH 44256 and is currently estimated at $175,763, approximately $173 per square foot. 4758 Ledgewood Dr Unit A3 is a home located in Medina County with nearby schools including Eliza Northrop Elementary School, Claggett Middle School, and Medina High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 29, 2024

Sold by

Hunt Barbara J

Bought by

Barbara J Hunt Family Trust and Lampshire

Current Estimated Value

Purchase Details

Closed on

Jun 19, 2014

Sold by

Luttner Raymond M and Luttner Amanda

Bought by

Hunt Barbara J

Purchase Details

Closed on

Jul 8, 2003

Sold by

Baldwin David A and Baldwin Gretchen N

Bought by

Luttner Raymond M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,000

Interest Rate

5.36%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 29, 1996

Sold by

Saro Carmen L

Bought by

Baldwin David A and Baldwin Gretchen N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,000

Interest Rate

6.38%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barbara J Hunt Family Trust | -- | None Listed On Document | |

| Hunt Barbara J | $83,000 | None Available | |

| Luttner Raymond M | $87,000 | -- | |

| Baldwin David A | $80,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Luttner Raymond M | $77,000 | |

| Previous Owner | Baldwin David A | $76,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $955 | $42,920 | $9,980 | $32,940 |

| 2023 | $955 | $42,920 | $9,980 | $32,940 |

| 2022 | $1,505 | $42,920 | $9,980 | $32,940 |

| 2021 | $1,350 | $34,610 | $8,050 | $26,560 |

| 2020 | $1,361 | $34,610 | $8,050 | $26,560 |

| 2019 | $1,364 | $34,610 | $8,050 | $26,560 |

| 2018 | $1,258 | $30,890 | $5,340 | $25,550 |

| 2017 | $1,275 | $30,890 | $5,340 | $25,550 |

| 2016 | $1,304 | $30,890 | $5,340 | $25,550 |

| 2015 | $1,244 | $28,870 | $4,990 | $23,880 |

| 2014 | $1,781 | $28,870 | $4,990 | $23,880 |

| 2013 | $1,783 | $28,870 | $4,990 | $23,880 |

Source: Public Records

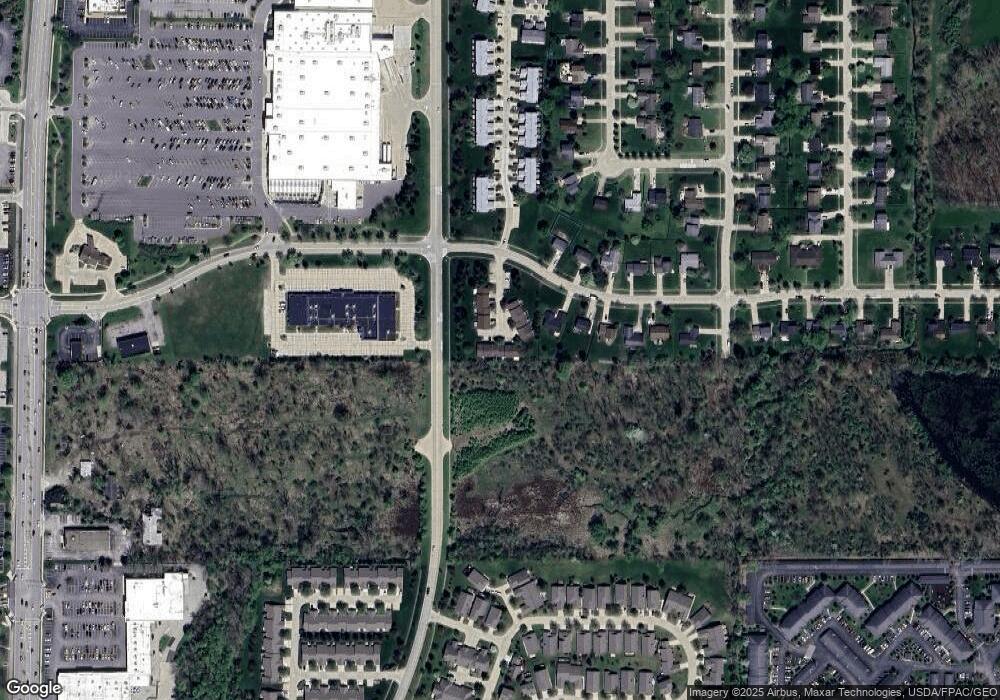

Map

Nearby Homes

- 1168 N Jefferson St Unit U18

- 1073 N Jefferson St Unit B

- 1054 Cedarwood Ln

- 4105 Sacramento Blvd

- 3997 Stonegate Dr

- 990 Shorewood Dr

- S/L 26 Devon Path

- S/L 27 Devon Path

- 800 Wildwood Ct

- 1150 Chapman Ln Unit 23

- 5035 Red Maple Ct

- 560 Ridge Dr

- 4525 Fenn Rd

- 232 Howard St

- 754 N Huntington St

- 4015 Marks Rd Unit 2D

- 4575 Rocky Mountain Dr

- 3722 Watkins Rd

- 5315 Genny Dr

- 4550 Weymouth Rd

- 4758 Ledgewood Dr Unit B8

- 4758 Ledgewood Dr Unit B7

- 4758 Ledgewood Dr Unit B6

- 4758 Ledgewood Dr Unit B5

- 4758 Ledgewood Dr Unit C12

- 4758 Ledgewood Dr Unit C11

- 4758 Ledgewood Dr Unit C10

- 4758 Ledgewood Dr Unit C9

- 4758 Ledgewood Dr Unit A4

- 4758 Ledgewood Dr Unit A2

- 4758 Ledgewood Dr Unit A1

- 4758 Ledgewood Dr Unit 10C

- 4758 Ledgewood Dr Unit 3-A

- 4758 Ledgewood Dr Unit 5-B

- 4758 Ledgewood Dr Unit 9-C

- 4742 Ledgewood Dr

- 4734 Ledgewood Dr

- 4726 Ledgewood Dr

- 4745 Ledgewood Dr

- 4737 Ledgewood Dr