4779 Ebenezer Rd Cincinnati, OH 45248

Estimated Value: $614,000 - $1,263,317

3

Beds

4

Baths

4,244

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 4779 Ebenezer Rd, Cincinnati, OH 45248 and is currently estimated at $893,772, approximately $210 per square foot. 4779 Ebenezer Rd is a home located in Hamilton County with nearby schools including Charles W Springmyer Elementary School, Bridgetown Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2015

Sold by

Mattlin Robert D and Mattlin Susan D

Bought by

Mattlin Susan D and Susan D Mattlin Trust

Current Estimated Value

Purchase Details

Closed on

Oct 24, 2012

Sold by

Mattlin Susan M

Bought by

Mattlin Robert D and The Susan D Mattlin 2012 Family Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$612,000

Interest Rate

3.31%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Dec 19, 2007

Sold by

Mattlin Robert D and Mattlin Susan D

Bought by

Mattlin Susan D and Susan D Mattlin Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mattlin Susan D | -- | Attorney | |

| Mattlin Robert D | -- | Attorney | |

| Mattlin Susan D | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Mattlin Robert D | $612,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $20,094 | $377,255 | $55,209 | $322,046 |

| 2024 | $20,141 | $377,255 | $55,209 | $322,046 |

| 2023 | $19,796 | $377,255 | $55,209 | $322,046 |

| 2022 | $17,761 | $287,931 | $52,941 | $234,990 |

| 2021 | $16,314 | $287,931 | $52,941 | $234,990 |

| 2020 | $16,122 | $287,931 | $52,941 | $234,990 |

| 2019 | $15,850 | $257,079 | $47,268 | $209,811 |

| 2018 | $15,863 | $257,079 | $47,268 | $209,811 |

| 2017 | $15,152 | $257,079 | $47,268 | $209,811 |

| 2016 | $15,312 | $256,760 | $44,905 | $211,855 |

| 2015 | $15,240 | $256,760 | $44,905 | $211,855 |

| 2014 | $15,237 | $256,760 | $44,905 | $211,855 |

| 2013 | $14,088 | $263,575 | $47,268 | $216,307 |

Source: Public Records

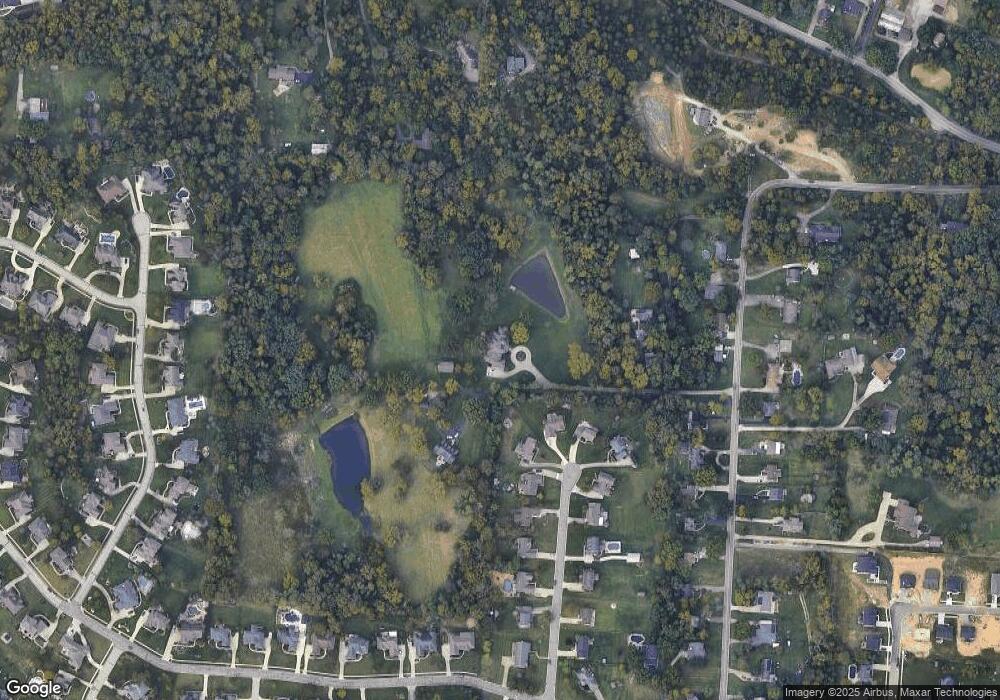

Map

Nearby Homes

- 5703 Irwin Dr

- 5779 Irwin Dr

- 5771 Irwin Dr

- 5767 Irwin Dr

- 6419 Louese Ln

- 6989 Carlinridge Ln

- 5149 Scarsdale Cove Unit 61

- 5161 Carriage Hill

- 6289 Eagles Lake Dr

- 3105 Laurel Hill Ln

- 6646 Hearne Rd

- 6831 Wesselman Rd

- 5207 S Eaglesnest Dr

- 4510 Clearwater Place

- 6586 Hearne Rd Unit 2T

- 4512 Clearwater Place

- 5310 Rybolt Rd

- 10 Priya Place

- 5104 Jonkard Ln

- 5221 Clearlake Dr

- 4749 Greenwald Ct

- 4747 Greenwald Ct

- 4771 Ebenezer Rd

- 4750 Greenwald Ct

- 4739 Greenwald Ct

- 4861 Ebenezer Rd

- 4748 Greenwald Ct

- 4727 Greenwald Ct

- 4740 Greenwald Ct

- 4728 Greenwald Ct

- 4713 Greenwald Ct

- 4791 Ebenezer Rd

- 4805 Ebenezer Rd

- 4763 Ebenezer Rd

- 6553 Wesselman Rd

- 4821 Ebenezer Rd

- 4751 Ebenezer Rd

- 4714 Greenwald Ct

- 4699 Greenwald Ct

- 4833 Ebenezer Rd

Your Personal Tour Guide

Ask me questions while you tour the home.