Estimated Value: $907,000

2

Beds

2

Baths

1,752

Sq Ft

$518/Sq Ft

Est. Value

About This Home

This home is located at 478 County Road 3597, Boyd, TX 76023 and is currently estimated at $907,000, approximately $517 per square foot. 478 County Road 3597 is a home located in Wise County with nearby schools including Springtown Elementary School, Springtown Intermediate School, and Springtown Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2019

Sold by

Dantzler Hal Smith

Bought by

Oneal Charles Dayton

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,400

Outstanding Balance

$260,063

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$646,937

Purchase Details

Closed on

Oct 31, 2007

Sold by

Butcher Don R and Butcher Sylvia D

Bought by

Dantzler Hal Smith

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,000

Interest Rate

6.42%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oneal Charles Dayton | -- | Fidelity National Title Azle | |

| Dantzler Hal Smith | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Oneal Charles Dayton | $294,400 | |

| Previous Owner | Dantzler Hal Smith | $171,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,193 | $630,970 | $50,752 | $580,218 |

| 2024 | $2,193 | $567,956 | $50,674 | $517,282 |

| 2023 | $10,691 | $846,479 | $0 | $0 |

| 2022 | $11,408 | $698,587 | $263,996 | $434,591 |

| 2021 | $8,599 | $522,040 | $224,990 | $297,050 |

| 2020 | $5,772 | $347,590 | $194,990 | $152,600 |

| 2019 | $5,794 | $326,910 | $194,990 | $131,920 |

| 2018 | $5,260 | $282,180 | $150,000 | $132,180 |

| 2017 | $4,186 | $224,570 | $123,750 | $100,820 |

| 2016 | $3,726 | $199,910 | $112,500 | $87,410 |

| 2015 | -- | $194,530 | $108,750 | $85,780 |

| 2014 | -- | $188,270 | $101,250 | $87,020 |

Source: Public Records

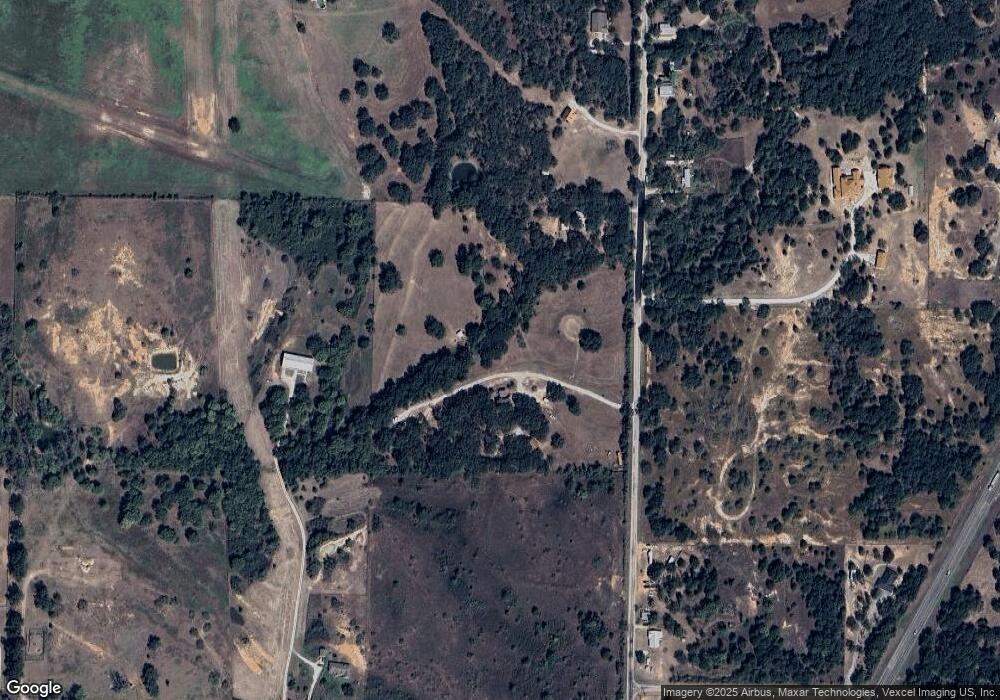

Map

Nearby Homes

- 500 County Road 3597

- 500 County Road 3597

- 702 County Road 3597

- 125 Lucky Ridge Ln

- 110 Daffodil Ln

- 106 Daffodil Ln

- 105 Bermuda Place

- 140 Greengate Dr

- 195 Greenhill Trail

- 144 Running River Dr

- 148 Greengate Dr

- 199 Birch Forest Ln

- 128 Birch Forest Ln

- 117 Bermuda Place

- 133 Hollytree Ln

- 120 Birch Forest Ln

- 137 Daffodil Ln

- 180 Running River Dr

- 105 Daffodil Ln

- 129 Hollytree Ln

- 000 County Road 3597

- 140 County Road 3598

- 436 County Road 3597

- TBD County Road 3597

- 404 County Road 3597

- 427 County Road 3597

- 559 County Road 3597

- TBD - 756 Lucky Ridge

- TBD - 755 Lucky Ridge

- 373 County Road 3597

- 140 Cr 3598

- 500 Cr 3597

- 110 County Road 3599

- 593 County Road 3597

- 9256 S Fm 51

- 9256 apt 300 S Fm 51

- 9256 apt 200 S Fm 51

- 352 County Road 3597

- 0 Tbd Cr 3597

- 243 County Road 3598