48 David Dr Augusta, NJ 07822

Estimated Value: $559,000 - $662,000

Studio

--

Bath

2,419

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 48 David Dr, Augusta, NJ 07822 and is currently estimated at $626,303, approximately $258 per square foot. 48 David Dr is a home located in Sussex County with nearby schools including Frankford Township School and High Point Regional High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 28, 2008

Sold by

Hark Daniel J and Hark Jennifer D

Bought by

Kozlowski Neil and Kozlowski Suzanne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,000

Interest Rate

5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 29, 1999

Sold by

Heil James P and Heil Sandra J

Bought by

Hark Daniel J and Hark Jennifer D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,300

Interest Rate

8.24%

Mortgage Type

Balloon

Purchase Details

Closed on

Feb 22, 1995

Sold by

Bailey Green Corp

Bought by

Heil James P and Heil Sandra J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kozlowski Neil | $350,000 | None Available | |

| Hark Daniel J | $227,900 | Fidelity National Title Ins | |

| Heil James P | $218,502 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kozlowski Neil | $255,000 | |

| Previous Owner | Hark Daniel J | $182,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,871 | $331,900 | $129,900 | $202,000 |

| 2024 | $9,575 | $331,900 | $129,900 | $202,000 |

| 2023 | $9,575 | $331,900 | $129,900 | $202,000 |

| 2022 | $9,343 | $331,900 | $129,900 | $202,000 |

| 2021 | $9,061 | $331,900 | $129,900 | $202,000 |

| 2020 | $8,802 | $331,900 | $129,900 | $202,000 |

| 2019 | $8,553 | $331,900 | $129,900 | $202,000 |

| 2018 | $8,473 | $331,900 | $129,900 | $202,000 |

| 2017 | $8,444 | $331,900 | $129,900 | $202,000 |

| 2016 | $8,550 | $331,900 | $129,900 | $202,000 |

| 2015 | $8,507 | $331,900 | $129,900 | $202,000 |

| 2014 | $8,702 | $331,900 | $129,900 | $202,000 |

Source: Public Records

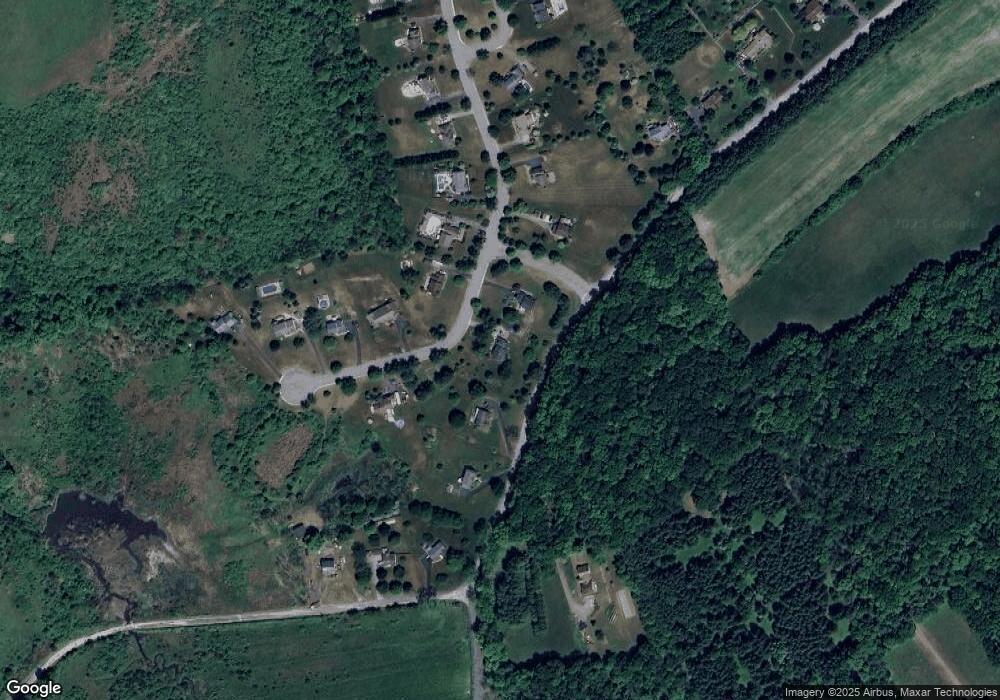

Map

Nearby Homes

- 118 Statesville Quarry Rd

- 26 Dickerson Rd

- 134 Meadows Rd

- 80, 82 George Hill Rd

- 12 Patricia Ln

- 5 Butternut Rd

- 29 Plains Rd

- 216 New Jersey 15

- 23 Plains Rd

- 76 Monroe Rd

- 10 Pidgeon Hill Rd

- 19 Dalrymple Rd

- 20 Pines Rd

- 0 Old Beaver Run Rd

- 3 Kimble Ln

- 83 Hyatt Rd

- 51 Pidgeon Hill Rd

- 3194 Route 94

- 59 Newton Ave

- 17 Longview Rd