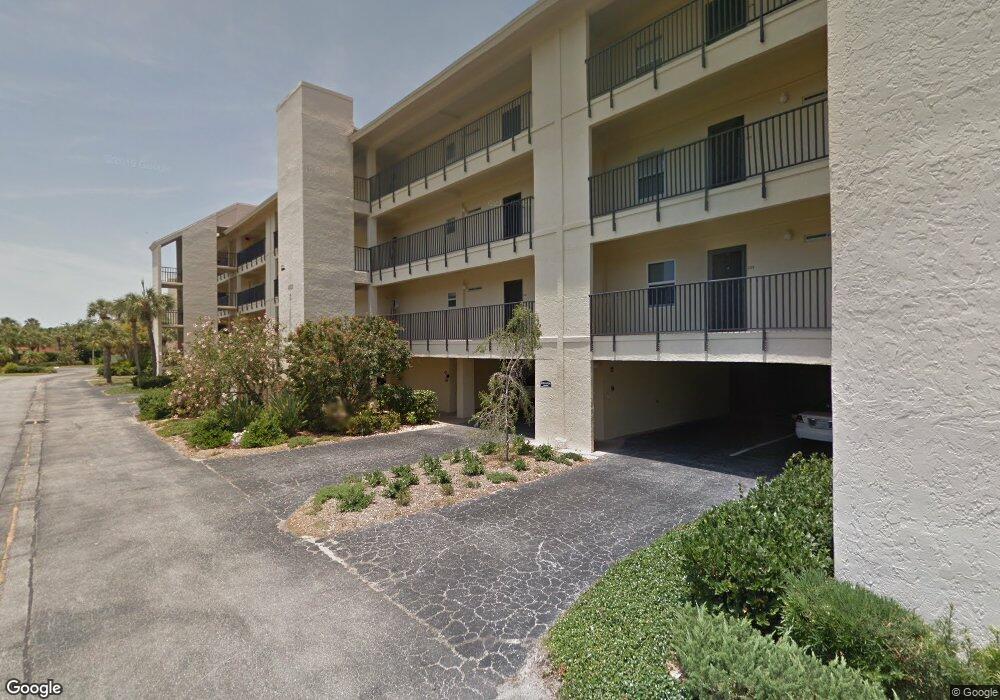

Windward Bay Condos 4800 Gulf of Mexico Dr Unit CPH5 Longboat Key, FL 34228

Estimated Value: $665,488 - $785,000

2

Beds

2

Baths

1,325

Sq Ft

$555/Sq Ft

Est. Value

About This Home

This home is located at 4800 Gulf of Mexico Dr Unit CPH5, Longboat Key, FL 34228 and is currently estimated at $735,872, approximately $555 per square foot. 4800 Gulf of Mexico Dr Unit CPH5 is a home located in Manatee County with nearby schools including Anna Maria Elementary School, Martha B. King Middle School, and Bayshore High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2019

Sold by

French Kenneth R and French Loriann N

Bought by

Neely Michael Joseph and Neely Gwen Michale

Current Estimated Value

Purchase Details

Closed on

Apr 15, 2015

Sold by

Panza Lawrence A

Bought by

Kenneth & Loriann French Revocable Trust

Purchase Details

Closed on

Jan 5, 2015

Sold by

Pfeifer Kelly L

Bought by

Panza Lawrence A

Purchase Details

Closed on

Jun 7, 2011

Sold by

Panza Lawrence A and Panza Palma M

Bought by

Panza Lawrence A and Pfeifer Kelly L

Purchase Details

Closed on

Dec 1, 2008

Sold by

Emmanuele Charles and Emmanuele Concetta

Bought by

Panza Lawrence A and Panza Palma M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.01%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 15, 2003

Sold by

Esposito Alberte Bernier

Bought by

Emmanuele Charles and Emmanuele Concetta

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Neely Michael Joseph | -- | Attorney | |

| Neely Michael Joseph | $515,000 | Attorney | |

| Kenneth & Loriann French Revocable Trust | $390,000 | Msc Title Inc | |

| Panza Lawrence A | $17,900 | None Available | |

| Panza Lawrence A | $30,000 | Attorney | |

| Panza Lawrence A | $405,000 | Attorney | |

| Emmanuele Charles | $300,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Panza Lawrence A | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,786 | $191,888 | -- | $191,888 |

| 2024 | $8,786 | $680,000 | -- | $680,000 |

| 2023 | $8,370 | $646,000 | $0 | $646,000 |

| 2022 | $7,211 | $509,250 | $0 | $509,250 |

| 2021 | $5,982 | $370,000 | $0 | $370,000 |

| 2020 | $6,693 | $395,000 | $0 | $395,000 |

| 2019 | $4,452 | $295,000 | $0 | $295,000 |

| 2018 | $4,695 | $306,217 | $0 | $0 |

| 2017 | $4,350 | $299,919 | $0 | $0 |

| 2016 | $4,346 | $293,750 | $0 | $0 |

| 2015 | $3,150 | $244,800 | $0 | $0 |

| 2014 | $3,150 | $226,696 | $0 | $0 |

| 2013 | $3,179 | $229,164 | $0 | $0 |

Source: Public Records

About Windward Bay Condos

Map

Nearby Homes

- 4500 Gulf of Mexico Dr Unit 202

- 4500 Gulf of Mexico Dr Unit 305

- 4968 Gulf of Mexico Dr Unit Villa 22

- 4540 Gulf of Mexico Dr Unit 204

- 4900 Gulf of Mexico Dr Unit 205

- 4900 Gulf of Mexico Dr Unit 203

- 4725 Gulf of Mexico Dr Unit 212

- 4765 Gulf of Mexico Dr Unit B202

- 4840 Gulf of Mexico Dr Unit Villa 15

- 4805 Gulf of Mexico Dr Unit 105

- 4825 Gulf of Mexico Dr Unit 105

- 4651 Gulf of Mexico Dr Unit 402

- 4835 Gulf of Mexico Dr Unit 302

- 4621 Gulf of Mexico Dr Unit 16B

- 4621 Gulf of Mexico Dr Unit 2F

- 4621 Gulf of Mexico Dr Unit 19B

- 4976 Gulf of Mexico Dr Unit 18

- 5005 Gulf of Mexico Dr Unit 5

- 4545 Gulf of Mexico Dr Unit 408

- 4440 Exeter Dr Unit 204

- 4960 Gulf of Mexico Dr Unit 305

- 4900 Gulf of Mexico Dr Unit B301

- 4700 Gulf of Mexico Dr Unit D206

- 4960 Gulf of Mexico Dr Unit 202

- 4900 Gulf of Mexico Dr Unit B305

- 4960 Gulf of Mexico Dr Unit A206

- 4700 Gulf of Mexico Dr Unit 303

- 4700 Gulf of Mexico Dr Unit 301

- 4900 Gulf of Mexico Dr Unit 206

- 4900 Gulf of Mexico Dr Unit 302

- 4700 Gulf of Mexico Dr Unit 205

- 4540 Gulf of Mexico Dr Unit 302

- 4900 Gulf of Mexico Dr Unit 205

- 4700 Gulf of Mexico Dr Unit 302

- 4700 Gulf of Mexico Dr Unit 203

- 4960 Gulf of Mexico Dr Unit 201

- 4900 Gulf of Mexico Dr Unit 202

- 4540 Gulf of Mexico Dr Unit 206

- 4540 Gulf of Mexico Dr Unit 301

- 4700 Gulf of Mexico Dr Unit D202