4820 E 236th St Cicero, IN 46034

Estimated Value: $406,000 - $596,000

Studio

2

Baths

2,826

Sq Ft

$167/Sq Ft

Est. Value

About This Home

This home is located at 4820 E 236th St, Cicero, IN 46034 and is currently estimated at $471,135, approximately $166 per square foot. 4820 E 236th St is a home located in Hamilton County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 23, 2018

Sold by

Peterson John H and Peterson Susan L

Bought by

Board Of Commissioners Of Hamilton Count

Current Estimated Value

Purchase Details

Closed on

Apr 19, 2001

Sold by

Lorenzi Anthony J and Lorenzi Kim

Bought by

Peterson John H and Peterson Susan L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,000

Interest Rate

7.03%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Board Of Commissioners Of Hamilton Count | $800 | None Available | |

| Peterson John H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Peterson John H | $133,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,404 | $262,400 | $93,100 | $169,300 |

| 2023 | $2,349 | $251,600 | $93,100 | $158,500 |

| 2022 | $2,300 | $233,300 | $93,100 | $140,200 |

| 2021 | $2,160 | $220,500 | $93,100 | $127,400 |

| 2020 | $1,998 | $210,600 | $93,100 | $117,500 |

| 2019 | $1,668 | $189,300 | $46,500 | $142,800 |

| 2018 | $1,586 | $181,600 | $46,900 | $134,700 |

| 2017 | $1,439 | $169,500 | $46,900 | $122,600 |

| 2016 | $1,417 | $168,400 | $46,900 | $121,500 |

| 2014 | $1,267 | $156,200 | $43,300 | $112,900 |

| 2013 | $1,267 | $146,600 | $43,300 | $103,300 |

Source: Public Records

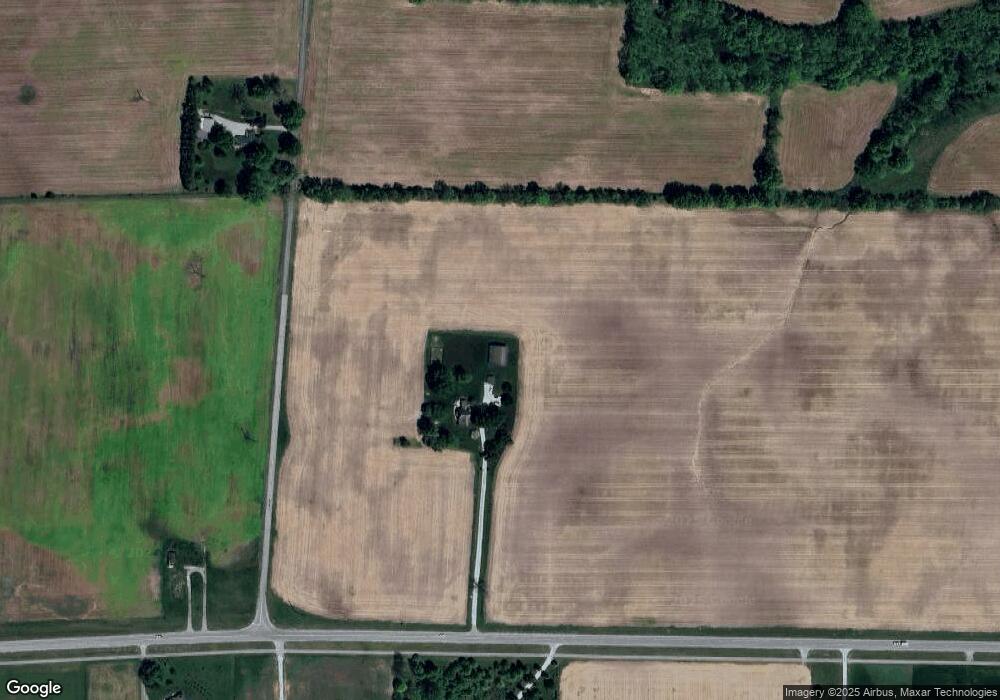

Map

Nearby Homes

- 4215 E 236th St

- 5029 E 246th St

- 24995 Anthony Rd

- 6680 Napa Ct

- 1592 E 236th St

- 5674 Doe Way

- 30 Lively Place

- 5777 Skipton Ct

- 27 Karner Blue Ct

- 47 Karner Blue Ct

- 24 Karner Blue Ct

- 25 Karner Blue Ct

- 32 Karner Blue Ct

- 38 Karner Blue Ct

- 23 Karner Blue Ct

- 104 Perlican Dr

- 16303 Magnolia Ln

- 6011 Selby Ct

- 131 Batteese Dr

- 146 Verdant Dr

- 4785 E 236th St

- 0 Cal Carson Rd Unit 21487203

- 0 Cal Carson Rd Unit 21486829

- 23949 Cal Carson Rd

- 5001 E 236th St

- 5001 E 236th St

- 4775 E 236th St

- 23975 Cal Carson Rd

- 24001 Cal Carson Rd

- 5345 E 236th St

- 24041 Cal Carson Rd

- 0 E 236th St Unit 21542439

- 0 E 236th St Unit 21541127

- 0 E 236th St Unit 21505592

- 0 E 236th St Unit 21207823

- 0 E 236th St Unit MBR2406000

- 0 E 236th St Unit MBR2338761

- 0 E 236th St Unit MBR2300352

- 0 E 236th St Unit 21773174

- 0 E 236th St Unit 21695080

Your Personal Tour Guide

Ask me questions while you tour the home.