4826 SW 45th St Gainesville, FL 32608

Estimated Value: $205,000 - $286,082

2

Beds

2

Baths

1,188

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 4826 SW 45th St, Gainesville, FL 32608 and is currently estimated at $244,771, approximately $206 per square foot. 4826 SW 45th St is a home located in Alachua County with nearby schools including Idylwild Elementary School, Kanapaha Middle School, and Gainesville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2025

Sold by

Morgenstern Henry Lee

Bought by

Morgenstern Henry Lee and Rotolo Patrice Suze

Current Estimated Value

Purchase Details

Closed on

Jul 29, 2020

Sold by

Morgenstern Henry Lee and Covington Nancy Lynn

Bought by

Morgenstern Henry Lee

Purchase Details

Closed on

Mar 26, 2019

Sold by

Morgenstern Henry Lee and Covington Nancy Lynn

Bought by

Morgenstern Henry Lee and Covington Nancy Lynn

Purchase Details

Closed on

Oct 10, 2017

Sold by

Morgenstern Henry Lee and Lahart Marcy

Bought by

Morgenstern Henry Lee and Covington Nancy Lynn

Purchase Details

Closed on

May 26, 2017

Sold by

Jones Calvin R

Bought by

Morgenstern Henry Lee and Lahart Marcy L

Purchase Details

Closed on

May 22, 2017

Bought by

Lahart and Lahart Morgenstern

Purchase Details

Closed on

Jun 21, 2004

Bought by

Lahart and Lahart Morgenstern

Purchase Details

Closed on

Jun 9, 2004

Bought by

Lahart and Lahart Morgenstern

Purchase Details

Closed on

Aug 1, 1986

Bought by

Lahart and Lahart Morgenstern

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morgenstern Henry Lee | -- | None Listed On Document | |

| Morgenstern Henry Lee | -- | None Listed On Document | |

| Morgenstern Henry Lee | $60,000 | Attorney | |

| Morgenstern Henry Lee | -- | Attorney | |

| Morgenstern Henry Lee | -- | None Available | |

| Morgenstern Henry Lee | $125,000 | Attorney | |

| Lahart | $100 | -- | |

| Morgenstern Henry Lee | -- | Attorney | |

| Lahart | $100 | -- | |

| Dees Charles O | -- | -- | |

| Lahart | $100 | -- | |

| Dees Charles O | -- | -- | |

| Lahart | $100 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,786 | $195,233 | $75,000 | $120,233 |

| 2024 | $3,360 | $195,425 | $75,000 | $120,425 |

| 2023 | $3,360 | $183,820 | $90,000 | $93,820 |

| 2022 | $2,945 | $144,075 | $60,000 | $84,075 |

| 2021 | $2,721 | $119,449 | $34,000 | $85,449 |

| 2020 | $2,394 | $92,469 | $13,000 | $79,469 |

| 2019 | $2,432 | $93,932 | $13,000 | $80,932 |

| 2018 | $2,399 | $96,800 | $13,000 | $83,800 |

| 2017 | $948 | $57,600 | $0 | $0 |

| 2016 | $778 | $56,420 | $0 | $0 |

| 2015 | $781 | $56,030 | $0 | $0 |

| 2014 | $795 | $55,590 | $0 | $0 |

| 2013 | -- | $65,300 | $13,000 | $52,300 |

Source: Public Records

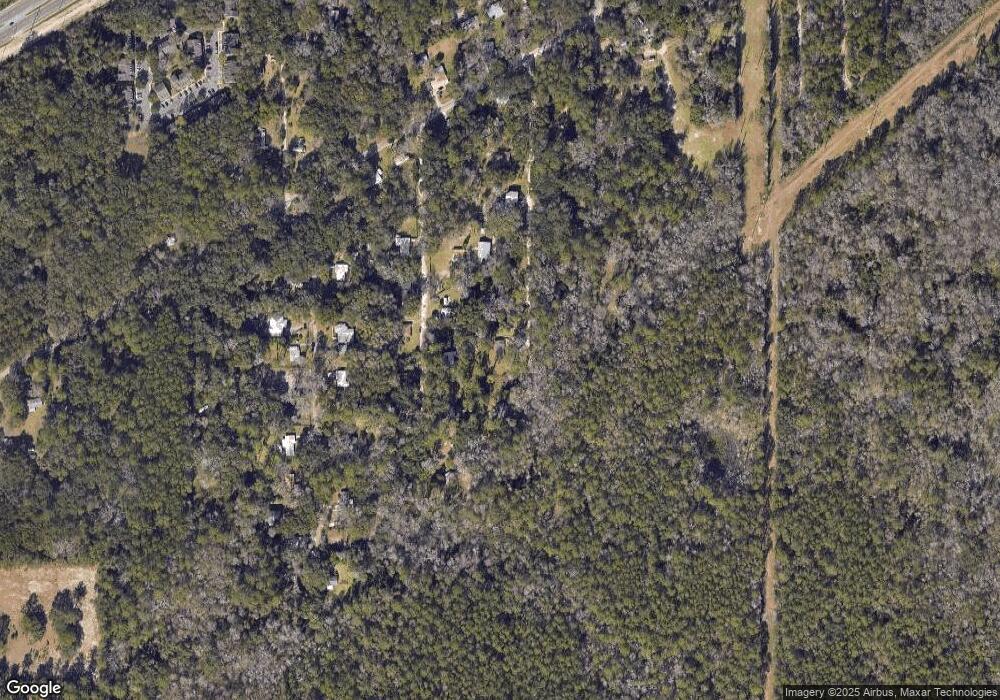

Map

Nearby Homes

- 4663 SW 48th Dr Unit 137

- 4663 SW 48th Dr Unit 138

- 4639 SW 48th Dr Unit 151

- 4506 SW 46th Dr

- 4301 SW 47th Way

- 4622 SW 45th Ln

- 4905 SW 51st Rd

- CALI Plan at Oaks Preserve

- Holden Plan at Oaks Preserve

- HAYDEN Plan at Oaks Preserve

- 4921 SW 51st Rd

- ARIA Plan at Oaks Preserve

- Elston Plan at Oaks Preserve

- Coral Plan at Oaks Preserve

- DARWIN Plan at Oaks Preserve

- Hemingway Plan at Oaks Preserve

- ROBIE Plan at Oaks Preserve

- 0 SW 50 Terrace

- 5155 SW 52nd Terrace

- 5191 SW 52nd Terrace

- 4826 SW 45 St

- 4908 SW 45th St

- 4908 SW 45 St

- 4919 SW 46th St

- 4804 SW 45th St

- 4815 SW 46th St

- 4902 SW 46th St

- 4820 SW 46th St

- 4801 SW 46th St

- 4802 SW 46th St

- 5065 SW 46th St Unit 106

- 4905 SW 47th St

- 4815 SW 44th St

- 4821 SW 47th St

- 4700 SW 46th St

- 4720 SW 46th St

- 4714 SW 45th St

- 5010 SW 46th St

- 4925 SW 47th St

- 4805 SW 45th St