4831 Double Down Dr Unit 103 Las Vegas, NV 89122

Estimated Value: $308,000 - $324,000

3

Beds

3

Baths

1,685

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 4831 Double Down Dr Unit 103, Las Vegas, NV 89122 and is currently estimated at $319,154, approximately $189 per square foot. 4831 Double Down Dr Unit 103 is a home located in Clark County with nearby schools including Sister Robert Joseph Bailey Elementary School and Francis H Cortney Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2010

Sold by

Parriera Tina

Bought by

Parriera Richard L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,442

Outstanding Balance

$57,365

Interest Rate

5.25%

Mortgage Type

FHA

Estimated Equity

$261,789

Purchase Details

Closed on

Dec 11, 2009

Sold by

Bac Home Loans Servicing Lp

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

Sep 26, 2007

Sold by

D R Horton Inc

Bought by

Green Dandre M and Green Melanie D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,292

Interest Rate

6.61%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parriera Richard L | -- | Nevada Title Las Vegas | |

| Parriera Nicole Lorraine | $86,000 | Nevada Title Las Vegas | |

| The Secretary Of Housing & Urban Develop | $261,043 | First American National Def | |

| Bac Home Loans Servicing Lp | $261,043 | First American National Def | |

| Green Dandre M | $240,000 | Dhi Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Parriera Nicole Lorraine | $84,442 | |

| Previous Owner | Green Dandre M | $236,292 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,025 | $82,553 | $19,250 | $63,303 |

| 2024 | $996 | $82,553 | $19,250 | $63,303 |

| 2023 | $762 | $78,395 | $20,650 | $57,745 |

| 2022 | $1,060 | $72,437 | $17,850 | $54,587 |

| 2021 | $982 | $60,082 | $15,750 | $44,332 |

| 2020 | $909 | $61,445 | $15,400 | $46,045 |

| 2019 | $852 | $58,550 | $12,950 | $45,600 |

| 2018 | $813 | $52,917 | $9,450 | $43,467 |

| 2017 | $1,529 | $52,063 | $8,750 | $43,313 |

| 2016 | $762 | $46,460 | $7,350 | $39,110 |

| 2015 | $759 | $32,568 | $5,250 | $27,318 |

| 2014 | $736 | $26,800 | $4,200 | $22,600 |

Source: Public Records

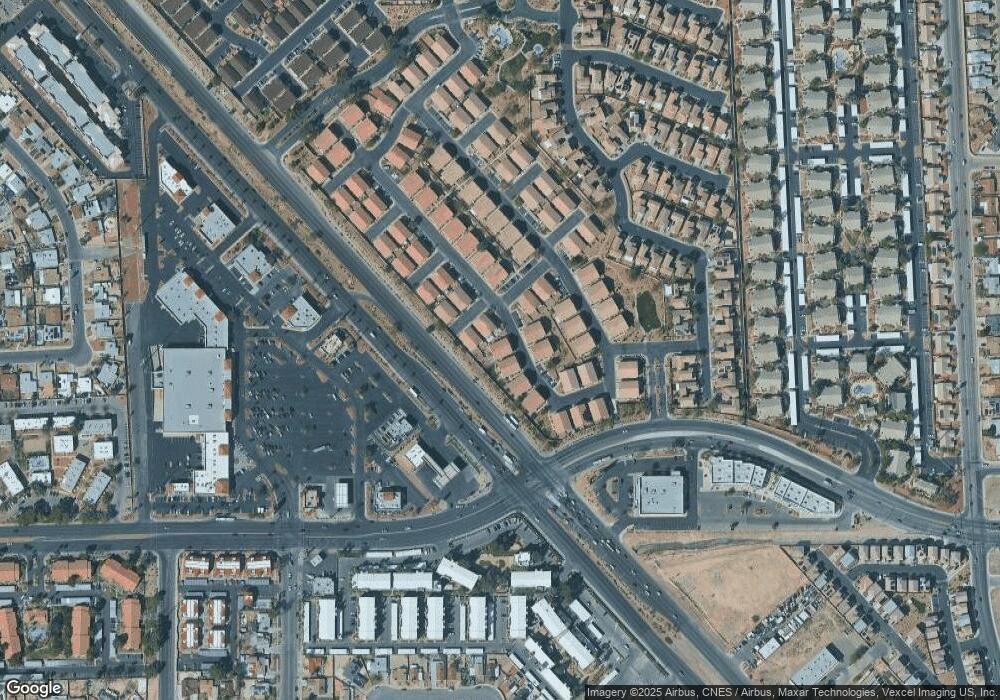

Map

Nearby Homes

- 4788 Double Down Dr Unit 101

- 4847 Double Down Dr Unit 101

- 5536 Baccarat Ave Unit 101

- 5507 Big Red Ct Unit 101

- 4768 Longshot Dr

- 4747 Straight Flush Dr Unit 101

- 5625 Fast Payout Ct

- 5710 E Tropicana Ave Unit 1017

- 5710 E Tropicana Ave Unit 1185

- 5710 E Tropicana Ave Unit 2228

- 5710 E Tropicana Ave Unit 2039

- 5710 E Tropicana Ave Unit 2135

- 5710 E Tropicana Ave Unit 2068

- 5710 E Tropicana Ave Unit 1146

- 5710 E Tropicana Ave Unit 2178

- 5710 E Tropicana Ave Unit 2022

- 5710 E Tropicana Ave Unit 2073

- 5710 E Tropicana Ave Unit 1035

- 5710 E Tropicana Ave Unit 2148

- 5710 E Tropicana Ave Unit 1184

- 4831 Double Down Dr Unit 101

- 4831 Double Down Dr Unit 102

- 4839 Double Down Dr Unit 101

- 4839 Double Down Dr Unit 103

- 4839 Double Down Dr Unit 102

- 4830 Double Down Dr Unit 103

- 4830 Double Down Dr Unit 101

- 4830 Double Down Dr

- 4838 Double Down Dr Unit 101

- 4838 Double Down Dr Unit 102

- 4838 Double Down Dr Unit 103

- 5519 Parlay Way Unit 103

- 5519 Parlay Way Unit 102

- 5519 Parlay Way Unit 101

- 4847 Double Down Dr Unit 103

- 4847 Double Down Dr Unit 102

- 4847 Double Down #101 Dr Unit 101

- 5511 Parlay Way Unit 103

- 5511 Parlay Way Unit 102

- 5511 Parlay Way Unit 101