4836 Wilkie Way NW Unit 1 Acworth, GA 30102

Estimated Value: $361,000 - $389,000

4

Beds

3

Baths

1,948

Sq Ft

$193/Sq Ft

Est. Value

About This Home

This home is located at 4836 Wilkie Way NW Unit 1, Acworth, GA 30102 and is currently estimated at $375,260, approximately $192 per square foot. 4836 Wilkie Way NW Unit 1 is a home located in Cobb County with nearby schools including Pitner Elementary School, Palmer Middle School, and North Cobb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2000

Sold by

Whetten Curtis and Whetten Michelle

Bought by

Jackson Michael

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,367

Outstanding Balance

$49,189

Interest Rate

8.24%

Mortgage Type

FHA

Estimated Equity

$326,071

Purchase Details

Closed on

Jun 28, 1996

Sold by

Piejak Steven Debra

Bought by

Whetten Curtis Michelle

Purchase Details

Closed on

Jun 4, 1993

Sold by

Bock David Homes

Bought by

Piejak Steven P and Christopher Debra M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,326

Interest Rate

7.42%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jackson Michael | $138,500 | -- | |

| Whetten Curtis Michelle | $116,000 | -- | |

| Piejak Steven P | $109,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jackson Michael | $137,367 | |

| Previous Owner | Piejak Steven P | $107,326 | |

| Closed | Whetten Curtis Michelle | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,323 | $149,076 | $32,000 | $117,076 |

| 2024 | $3,326 | $149,076 | $32,000 | $117,076 |

| 2023 | $1,978 | $111,976 | $20,000 | $91,976 |

| 2022 | $2,541 | $111,976 | $20,000 | $91,976 |

| 2021 | $1,861 | $80,884 | $20,000 | $60,884 |

| 2020 | $1,861 | $80,884 | $20,000 | $60,884 |

| 2019 | $1,514 | $65,056 | $16,000 | $49,056 |

| 2018 | $1,514 | $65,056 | $16,000 | $49,056 |

| 2017 | $1,465 | $65,056 | $16,000 | $49,056 |

| 2016 | $1,378 | $61,004 | $16,000 | $45,004 |

| 2015 | $1,409 | $61,004 | $16,000 | $45,004 |

| 2014 | $1,037 | $43,956 | $0 | $0 |

Source: Public Records

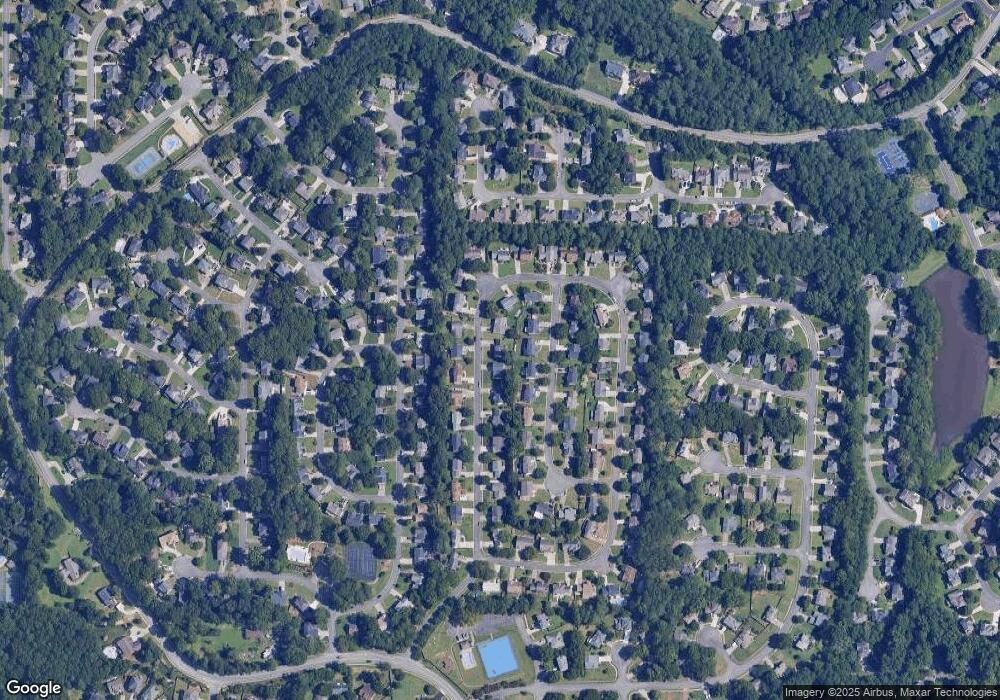

Map

Nearby Homes

- 5018 Amber Way NW Unit 2

- 4903 Wilkie Way NW

- 1800 Baynard Ct NW

- 4912 Lightwood Ct NW

- 1824 Lightwood Ln NW

- 1994 Morning Walk NW

- 1908 Hamby Place Dr NW

- 1996 Morning Walk NW

- 0 Hamby Rd Unit 7686326

- 1964 Tranquil Field Way NW

- 2138 Hamby Cove Dr NW

- 1865 Hickory Creek Ct NW

- 1839 Tranquil Field Dr NW

- 1833 Hickory Creek Ct NW

- 632 Wexford Ct

- 1800 Crescent Hill Dr NW

- 1924 Paddock Path Dr NW

- 4840 Wilkie Way NW

- 4832 Wilkie Way NW

- 5019 Amber Way NW

- 5017 Amber Way NW

- 5017 Amber Way NW Unit II

- 5021 Amber Way NW Unit II

- 4837 Wilkie Way NW Unit 31

- 4837 Wilkie Way NW

- 4841 Wilkie Way NW

- 4844 Wilkie Way NW

- 4828 Wilkie Way NW

- 4833 Wilkie Way NW Unit 1

- 5015 Amber Way NW Unit 2

- 5023 Amber Way NW Unit 1

- 4845 Wilkie Way NW Unit 4845

- 4845 Wilkie Way NW Unit 29

- 4845 Wilkie Way NW

- 4829 Wilkie Way NW

- 4824 Wilkie Way NW

- 5020 Amber Way NW