4840 Kings Rd Doylestown, PA 18902

Estimated Value: $576,000 - $851,000

3

Beds

3

Baths

2,318

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 4840 Kings Rd, Doylestown, PA 18902 and is currently estimated at $687,730, approximately $296 per square foot. 4840 Kings Rd is a home located in Bucks County with nearby schools including Cold Spring Elementary School, Holicong Middle School, and Central Bucks High School - East.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 7, 2017

Sold by

Marascio Daniel P and Marascio Kelly

Bought by

Marascio Daniel P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,000

Outstanding Balance

$253,470

Interest Rate

4.02%

Mortgage Type

New Conventional

Estimated Equity

$434,260

Purchase Details

Closed on

Dec 21, 2007

Sold by

Trezise Glen F and Trezise Hillary B

Bought by

Marascio Kelly L and Marascio Daniel P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

6.17%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Dec 8, 1988

Bought by

Trezise Glen F and Trezise Hillary B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marascio Daniel P | -- | None Available | |

| Marascio Kelly L | $365,000 | None Available | |

| Trezise Glen F | $175,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Marascio Daniel P | $328,000 | |

| Closed | Marascio Kelly L | $50,000 | |

| Closed | Marascio Kelly L | $292,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,086 | $31,240 | $8,960 | $22,280 |

| 2024 | $5,086 | $31,240 | $8,960 | $22,280 |

| 2023 | $4,914 | $31,240 | $8,960 | $22,280 |

| 2022 | $4,855 | $31,240 | $8,960 | $22,280 |

| 2021 | $4,797 | $31,240 | $8,960 | $22,280 |

| 2020 | $4,797 | $31,240 | $8,960 | $22,280 |

| 2019 | $4,766 | $31,240 | $8,960 | $22,280 |

| 2018 | $4,766 | $31,240 | $8,960 | $22,280 |

| 2017 | $4,727 | $31,240 | $8,960 | $22,280 |

| 2016 | $4,773 | $31,240 | $8,960 | $22,280 |

| 2015 | -- | $31,240 | $8,960 | $22,280 |

| 2014 | -- | $31,240 | $8,960 | $22,280 |

Source: Public Records

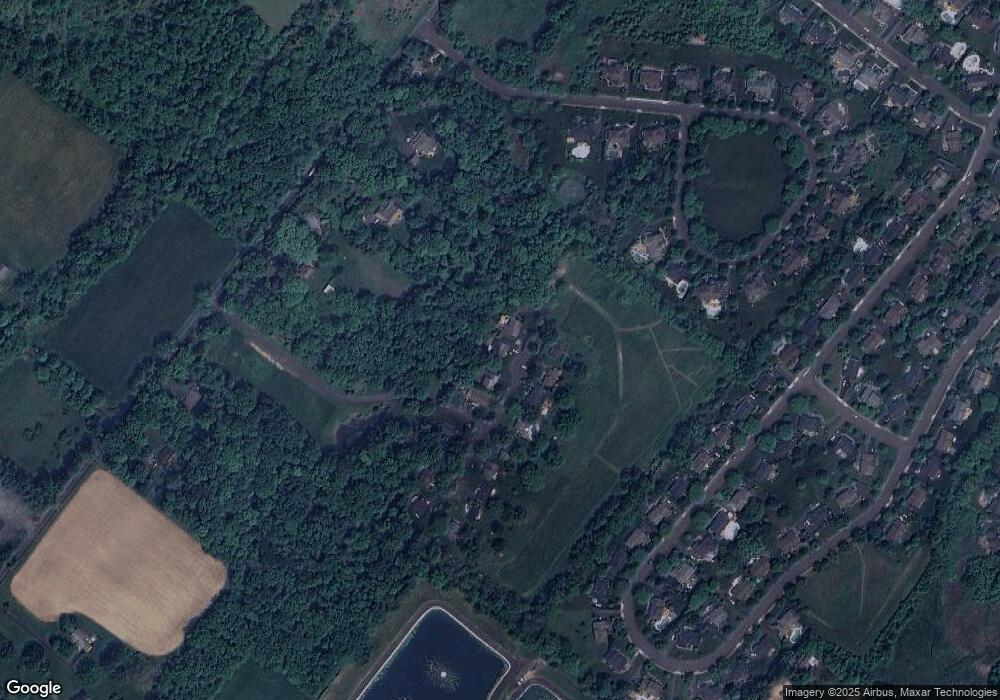

Map

Nearby Homes

- 4925 Redfield Rd

- 4936 Davis Dr

- 4221 Sir Andrew Cir

- 4190 Milords Ln

- 4605 Twinbrook Cir

- 5063 Sagewood Ct

- 3821 Nanlyn Farm Cir

- 5087 Beacon Hill Ct

- 4964 Point Pleasant Pike

- 5115 Sugar Hill Ct

- 3689 Hancock Ln

- 5184 Lovering Dr

- 5182 Point Pleasant Pike

- 6680 Point Pleasant Pike

- 5281 Harrington Ct

- 5491 Long Ln

- 3479 Durham Rd

- 3455 Durham Rd

- 3468 Holicong Rd

- 4928 Edgewood Rd