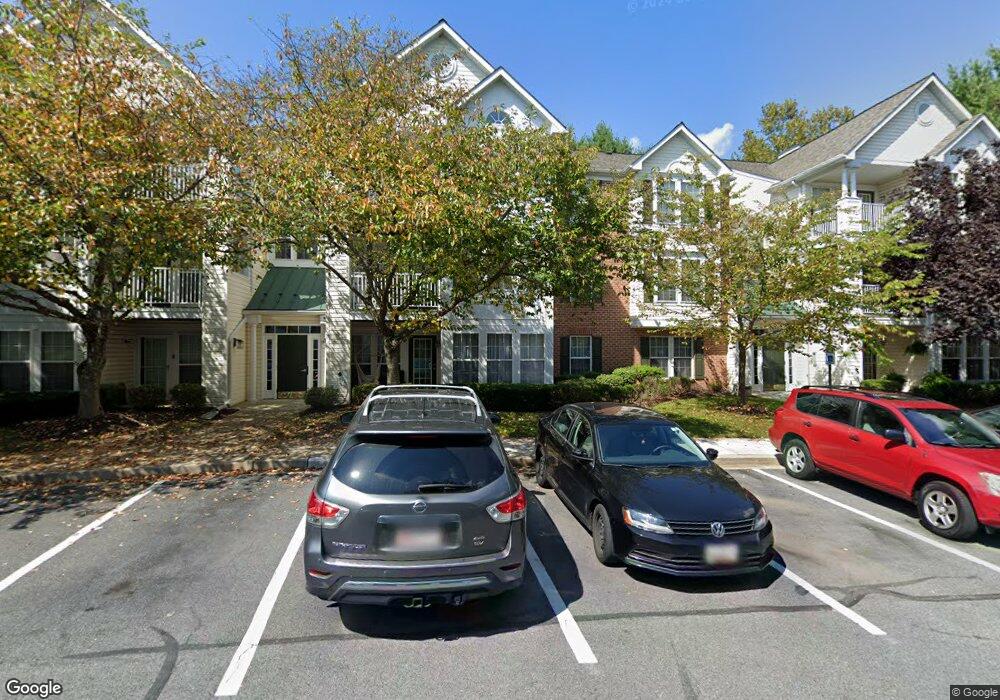

4870 Shellbark Rd Owings Mills, MD 21117

Estimated Value: $230,188 - $239,000

2

Beds

2

Baths

1,123

Sq Ft

$210/Sq Ft

Est. Value

About This Home

This home is located at 4870 Shellbark Rd, Owings Mills, MD 21117 and is currently estimated at $235,547, approximately $209 per square foot. 4870 Shellbark Rd is a home located in Baltimore County with nearby schools including New Town Elementary School, Deer Park Middle Magnet School, and New Town High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 17, 2008

Sold by

Stadd Jerome E

Bought by

Chambers Sandra R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,350

Outstanding Balance

$124,289

Interest Rate

6.14%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$111,258

Purchase Details

Closed on

Jan 29, 2008

Sold by

Stadd Jerome E

Bought by

Chambers Sandra R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,350

Outstanding Balance

$124,289

Interest Rate

6.14%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$111,258

Purchase Details

Closed on

Dec 20, 2001

Sold by

Stadd Jerry E

Bought by

Stadd Jerome E and Stadd Debra

Purchase Details

Closed on

Jan 6, 1998

Sold by

Nvr Homes Inc

Bought by

Stadd Jerry E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chambers Sandra R | $198,500 | -- | |

| Chambers Sandra R | $198,500 | -- | |

| Stadd Jerome E | -- | -- | |

| Stadd Jerry E | $86,685 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chambers Sandra R | $195,350 | |

| Previous Owner | Chambers Sandra R | $195,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,935 | $178,333 | -- | -- |

| 2024 | $2,935 | $160,000 | $35,000 | $125,000 |

| 2023 | $1,411 | $151,667 | $0 | $0 |

| 2022 | $2,691 | $143,333 | $0 | $0 |

| 2021 | $2,406 | $135,000 | $35,000 | $100,000 |

| 2020 | $1,572 | $129,667 | $0 | $0 |

| 2019 | $1,507 | $124,333 | $0 | $0 |

| 2018 | $2,355 | $119,000 | $30,000 | $89,000 |

| 2017 | $2,200 | $119,000 | $0 | $0 |

| 2016 | $2,498 | $119,000 | $0 | $0 |

| 2015 | $2,498 | $120,000 | $0 | $0 |

| 2014 | $2,498 | $120,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 9715 Reese Farm Rd

- 4751 Shellbark Rd

- 5002 Hollington Dr Unit 301

- 5227 Wagon Shed Cir

- 5233 Wagon Shed Cir

- 11 Bank Spring Ct

- 24 Bailey Ln

- 4701 Wainwright Cir

- 5004 Willow Branch Way

- 9943 Middle Mill Dr

- 5114 Wagon Shed Cir

- 5206 Stone Shop Cir

- 9716 Ashlyn Cir

- 5119 Spring Willow Ct

- 9473 Ashlyn Cir

- 9839 Bale Ct

- 900 Red Brook Blvd Unit 101

- 4828 Stone Shop Cir

- 9537 Tessa Ln

- 18 Hawk Rise Ln Unit 205

- 4848 Shellbark Rd

- 4880 Shellbark Rd

- 4850 Shellbark Rd Unit 4850

- 4844 Shellbark Rd

- 4882 Shellbark Rd

- 4890 Shellbark Rd

- 4888 Shellbark Rd

- 4868 Shellbark Rd

- 4886 Shellbark Rd

- 4884 Shellbark Rd

- 4866 Shellbark Rd

- 4864 Shellbark Rd

- 4842 Shellbark Rd

- 4846 Shellbark Rd

- 4862 Shellbark Rd

- 4860 Shellbark Rd

- 4862 Shellbark Rd Unit F

- 9731 Reese Farm Rd

- 9713 Reese Farm Rd

- 9711 Reese Farm Rd