4883 Fallcrest Cir Sarasota, FL 34233

Estimated Value: $818,000 - $924,000

5

Beds

4

Baths

4,747

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 4883 Fallcrest Cir, Sarasota, FL 34233 and is currently estimated at $852,408, approximately $179 per square foot. 4883 Fallcrest Cir is a home located in Sarasota County with nearby schools including Ashton Elementary School, Riverview High School, and Sarasota Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2014

Sold by

Mnh Sub I Llc

Bought by

Flint Brett Charles and Flint Lori M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,000

Outstanding Balance

$234,536

Interest Rate

4.23%

Mortgage Type

New Conventional

Estimated Equity

$617,872

Purchase Details

Closed on

May 16, 2014

Sold by

Bass Daniel and Bass Maria Angela C

Bought by

Mnh Sub I Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$308,000

Outstanding Balance

$234,536

Interest Rate

4.23%

Mortgage Type

New Conventional

Estimated Equity

$617,872

Purchase Details

Closed on

May 4, 2006

Sold by

Bass Daniel and Bass Rose M

Bought by

Bass Robert L and Bass Maria Angela C

Purchase Details

Closed on

Nov 25, 1997

Sold by

Manny Erwin H and Manny Martha

Bought by

Bass Daniel T and Bass Rose M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$254,400

Interest Rate

7.27%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Flint Brett Charles | $385,000 | Attorney | |

| Mnh Sub I Llc | $351,001 | None Available | |

| Bass Robert L | $102,000 | None Available | |

| Bass Daniel T | $318,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Flint Brett Charles | $308,000 | |

| Previous Owner | Bass Daniel T | $254,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,594 | $461,672 | -- | -- |

| 2023 | $5,594 | $448,225 | $0 | $0 |

| 2022 | $5,420 | $435,170 | $0 | $0 |

| 2021 | $5,338 | $422,495 | $0 | $0 |

| 2020 | $5,355 | $416,662 | $0 | $0 |

| 2019 | $5,183 | $407,294 | $0 | $0 |

| 2018 | $5,071 | $399,700 | $81,900 | $317,800 |

| 2017 | $5,353 | $415,400 | $116,700 | $298,700 |

| 2016 | $5,453 | $415,200 | $85,200 | $330,000 |

| 2015 | $6,157 | $422,800 | $70,400 | $352,400 |

| 2014 | $4,454 | $323,406 | $0 | $0 |

Source: Public Records

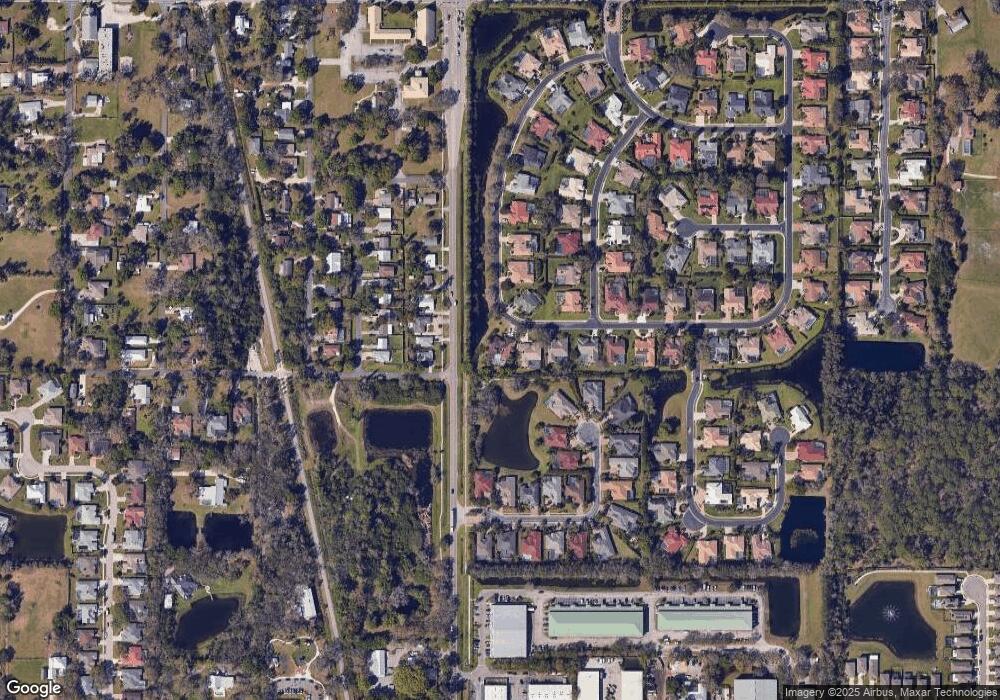

Map

Nearby Homes

- 4888 Winterhaven Dr

- 4725 Harris Ave

- 4702 Woodward Place

- 4861 Silver Topaz St

- 4831 Greenleaf Rd

- 3988 Berlin Dr

- 4908 Bliss Rd

- 4745 Country Manor Dr

- 3985 Proctor Rd

- 0 Bliss Rd

- 5355 Anthony Ln

- 3819 Countryside Ln

- 3957 Proctor Rd

- 4740 Garcia Ave

- 3799 Countryside Rd

- 4424 Meadow Creek Cir

- 4542 Pawnee Trail Unit 196

- 4444 Narraganset Trail Unit 96

- 4546 Pawnee Trail Unit 195

- 4549 Tippecanoe Trail Unit 20

- 4889 Fallcrest Cir

- 4886 Fallcrest Cir

- 4895 Fallcrest Cir

- 4895 Fallcrest Cir

- 5005 Mcintosh Rd

- 4389 Gypsy St

- 4980 Mcintosh Rd

- 4970 Mcintosh Rd

- 4874 Fallcrest Cir

- 4925 Winterhaven Dr

- 5333 Ashton Oaks Ct

- 5333 Ashton Oaks Ct

- 4960 Mcintosh Rd

- 4899 Fallcrest Cir

- 4948 Mcintosh Rd

- 5329 Ashton Oaks Ct

- 4917 Winterhaven Dr

- 5344 Ashton Oaks Ct

- 4862 Fallcrest Cir

- 4980 George Ave